Consumer Spending Under Scrutiny with Target and Best Buy Earnings Reports

Consumer Spending Under Scrutiny with Target and Best Buy Earnings Reports

The retailers are announcing results amid concern about tariffs and fear of an economic slowdown

- Target and Best Buy are set to report earnings tomorrow.

- Insight into consumer spending is expected to provide some clarity amid concern about growth.

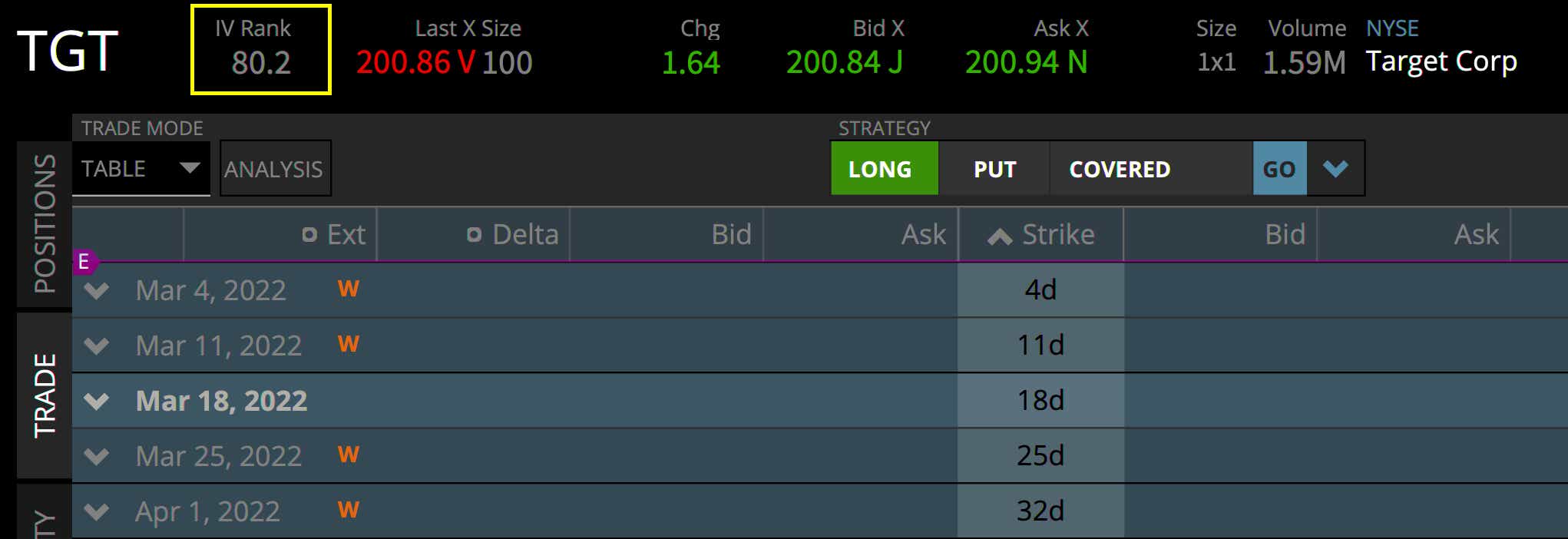

- Both stocks are trading with an elevated implied volatility rank (IVR).

Target (TGT) and Best Buy (BBY) are scheduled to report quarterly earnings on before the market opens tomorrow morning. Earnings reports from two major U.S. retailers come amid concern about the economy as a risk-off tone drives equity prices lower.

The Trump administration’s tariffs and trade measures, along with a slowdown in China, have put stagflation back into the picture. The trade measures are also expected to put pressure on margins for retailers who import goods. That could be bad news for Target and Best Buy, and traders are focused on the retailers’ guidance.

Target stock fell to fresh 52-week lows today ahead of its earnings report, extending a sell-off from the previous few weeks that was driven primarily by trade concerns. Best Buy stock has held up relatively well, with prices holding about 7% above its low traded back in early February.

Analysts are expecting slower growth from both retailers because both companies rely on imported goods. Broader concerns about discretionary spending in the U.S. economy have also driven prices lower, with analysts expecting slower growth of sales as consumers look to save money.

What do analysts expect?

Analysts see Target posting earnings per share (EPS) of $2.26 and revenue of $30.8 billion, according to TradingView. Last year, Target reported EPS of $2.98 on $31.92 billion in revenue. Same-store sales growth is expected to cross the wires at +1.2%, according to Bloomberg data.

The 2025 outlook from management will be key to the price reaction, with risk remaining to the downside because of tariffs. The extent of the impact expected by leadership is in focus.

Best Buy is expected to report EPS of $2.40 on $13.7 billion in revenue. That would be down from an EPS of $2.72 and revenue of $14.65 billion a year ago. The fourth quarter is typically Best Buy’s strongest of the year because it factors in holiday spending.

The decline in earnings and revenue is cause for concern , but analysts are more focused on the guidance that executives will provide and what they’re saying about tariffs. The recent drop-offs in consumer sentiment and other economic measures point to trouble for retailers, and a miss could affect the stock and send it lower despite the recent losses.

Trading Target earnings

Target trades with an implied volatility rank (IVR) of 80.7, meaning volatility is elevated compared to the past 12 months. Prices briefly dipped below the November swing low before trimming some losses in today’s trading session. Still, the technical structure is at risk and a break lower would likely open the stock up to more selling.

Trading Best Buy earnings

Best Buy’s IVR is also elevated at 81.7, reflecting elevated volatility over the past year. BBY’s has a stronger price structure than TGT, but it still reflects more downside risk, especially following today’s sell-off. The early February swing low at 81.11 marks the lowest level since August. A disappointing report could send prices near that level. Otherwise, traders on the long side would likely target the February swing high at 91.68, which is the highest level since November.

.png?format=pjpg&auto=webp&quality=50&width=1336&disable=upscale)

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.