Strong U.S. Consumers Invite a More Hawkish Fed

Strong U.S. Consumers Invite a More Hawkish Fed

By:Ilya Spivak

July FOMC minutes may spook stocks, boost dollar and Japanese Yen

- U.S. retail sales dwarf forecasts, endorse “higher for longer” Fed rates outlook.

- Hawkish FOMC minutes may follow, putting U.S. consumers in the crosshair.

- Global recession fears may flatten yield curve, driving the Japanese yen higher.

July’s U.S. retail sales report endorsed the markets’ repricing of expectations to a “higher for longer” Federal Reserve interest rate path driving financial markets since last week. Receipts rose 0.7% from the prior month, dwarfing forecasts calling for a rise of 0.4%. Sales increased 3.2% from July 2022, marking the largest year-on-year since February.

Resilient appetite from U.S. consumers is a welcome sign for a global economy hoping against hope to avoid broad-based recession. The Eurozone—collectively about 15% of the global economy—is flirting with recession, if not already in one. China—the world’s second-largest economy at close to 18% of the worldwide whole—is still struggling to recover after reopening from “zero-COVID” restrictions in December.

Household consumption is close to 70% of U.S. economic growth, and the North American behemoth is the largest piece of the worldwide total at about 24%. This means that the fate of the global economy now rests squarely on U.S. consumers’ shoulders.

Fed inflation fight takes aim at U.S. consumers

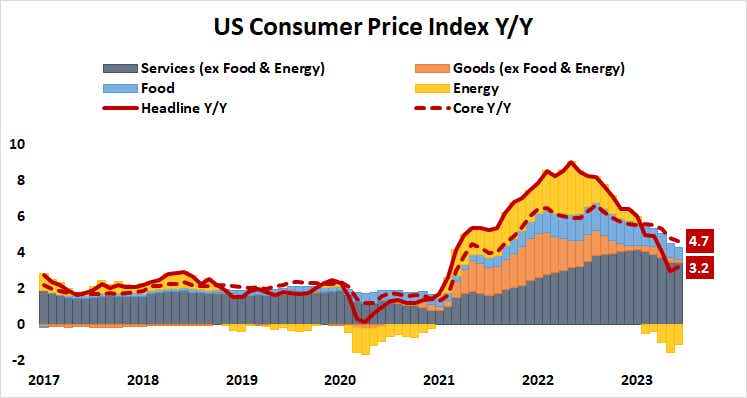

That is a precarious setup. To hear them tell it, Fed officials are singularly focused on pulling inflation back to the target of 2%, even at the cost of a recession. With price growth on the goods side of the equation having been crushed by rising rates and the mending of post-COVID supply chain ruptures, the service sector is firmly in the central bank’s crosshairs. This means consumers have a proverbial target on their back.

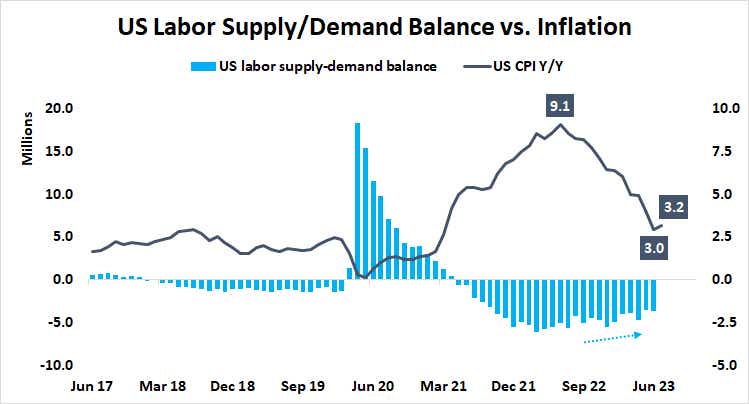

The .U.S labor market has held up remarkably well through the Fed’s blistering rate hike cycle, at least so far. The unemployment rate fell to 3.5%n July, a four-month low. While job openings fell to 9.6 million in June–the lowest since April 2021–they remain much higher than the pre-pandemic average of about 7 million.

Considering the current size of the labor force and the share of it that is in work, this translates to a mismatch whereby labor supply falls short of demand by about 3.6 million workers. That’s down from the March 2022 peak at 6 million, but more than double the worst gaps appearing when deficits emerged mid-2018, where they amounted to no more than 1.5 million until COVID struck. That has underpinned wage growth, stalling disinflation.

Stocks may fall as yen joins dollar rally on hawkish FOMC minutes

This puts minutes from July’s meeting of the policy-setting FOMC committee in focus. Deflating the labor market will not come from increasing supply – an all-but impossible feat on the timeline that officials are working with – so the only way to bring down prices is to hurt demand.

If this translates to hawkish rhetoric that forces markets to push the “higher for longer” readjustment further, stock markets may fall further while the U.S. dollar gains ground against its major counterparts. With U.S. consumers the last line of defense for the global economy however, such a stance might also amplify fears of an all-encompassing recession.

That might weigh on longer-term bond yields–a reflection of the need for easing down the road–even as shorter-term rates are well supported. That could be a recipe for the defensively minded Japanese yen to join the greenback on the upside against most other major currencies.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.