FOMC Preview: Do Stock Markets Want More Than the Fed Can Give?

FOMC Preview: Do Stock Markets Want More Than the Fed Can Give?

By:Ilya Spivak

Can the Fed spook stock markets by doing nothing?

- All eyes turn the Federal Reserve for its first policy announcement of 2025

- No rate change is eyed, and the FOMC seems to favor “wait-and-see” mode

- Shaken markets may want loud dovish intent however, putting stocks at risk

At first glance, the first monetary policy announcement of the year from the Federal Reserve seems likely to be a quiet affair. The markets are overwhelmingly convinced that the steering Federal Open Market Committee (FOMC) will keep its interest rate target unchanged. They price in a 99.5% probability of that outcome.

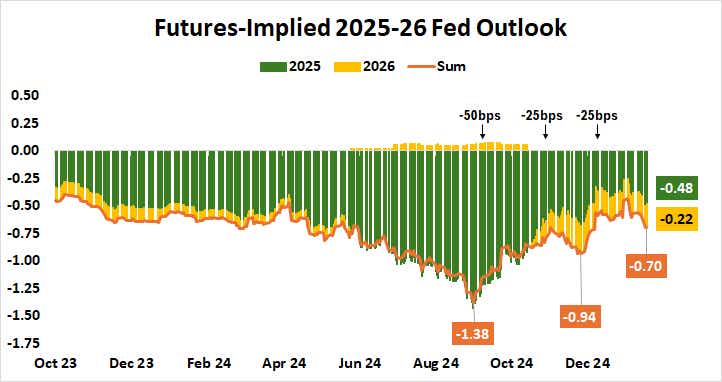

Moreover, January’s conclave will not feature an update of the central bank’s Summary of Economic Projections (SEP), where officials offer a glimpse into their thinking about how the economy and monetary policy are expected to evolve. The last update in December called for 50 basis points (bps) in rate cuts this year and the same in 2026.

Recent pronouncements from FOMC members – both in official policy statements and in their many speaking engagements every month – point to a gradualist bent. The central bank seemingly wants to spend most of its time this year pondering the evolution of economic indicators rather than jumping to change course.

Why should markets care about the Fed rate decision?

On balance, this seems to imply that the Fed is unlikely to unhinge markets when the FOMC delivers its verdict after a two-day gathering. Nevertheless, a shaky backdrop for risk sentiment and ongoing uncertainty about the Fed’s relationship with the new administration in Washington, DC might make for fireworks.

First, the markets’ nerves are probably still raw after a brutal selloff that handed the bellwether S&P 500 its worst one-day performance in seven weeks yesterday. At one point intraday, the benchmark was down more than 3%. That came amid the unveiling of an AI model from China’s DeepSeek that appears to rival leading U.S. offerings.

Second, President Donald Trump has returned to the kind of goading of the Fed that seemed common during his first term in office, following what looked like a more conciliatory tone during last year's campaign. He recently said that he knows more about what to do than the central bank does, and implied that he should be consulted on policy.

Stocks may wobble if the FOMC resists dovish commitment

Taken together, this probably means that the markets are especially reactive to anything they don’t like in the Fed’s pronouncements, and that their preference would be for a dovish tilt. That might reassure battered investors with hopes for cheaper money even as it puts off a clash with Mr. Trump, who has favored lower rates.

A gradualism-minded Fed might disappoint such hopes, even if the substance of its guidance is no more than a restatement of the status quo. This may hurt stocks once after FOMC news passes. Monday’s price action suggests that bonds might find a haven bid in this scenario, and that the parallel fall in yields could hurt the U.S. dollar.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.