Stocks May Fall with the British Pound as the Bank of England Cuts Rates

Stocks May Fall with the British Pound as the Bank of England Cuts Rates

By:Ilya Spivak

Stock markets may join the British pound in a move lower if the Bank of England strikes a dovish tone

The Japanese yen rally continues as the Bank of Japan issues a surprise rate hike.

Fed messaging reinforces the case for the start of rate cuts in September.

The British pound is vulnerable if the Bank of England dials up dovish guidance.

The Bank of Japan (BOJ) opted for a surprise interest rate hike at this week’s monetary policy meeting. Officials raised the target policy lending rate by 15 basis points (bps) to 0.25% from 0.1%. Governor Kazuo Ueda said the dramatic depreciation of the Japanese yen this year was “one of the reasons” for the move, saying it was an “important risk.”

At the start of this month, the yen touched the lowest level since December 1986 before turning briskly higher. It added close to 6% against the U.S. dollar in the three weeks preceding the BOJ meeting, powered by potent risk aversion. Wall Street suffered dramatic losses in the same period, and yields fell amid global slowdown fears, as expected.

Yen extends rise on a surprise Bank of Japan rate hike

For the yen, this defensive mood translated into the unwinding of so-called “carry trades,” where market participants borrow cheaply in the perennially low-yielding currency to finance purchases of higher-returning assets. Exiting such exposure amid the liquidation sweep of the past three weeks meant covering yen shorts, driving up the currency.

The rally continued after the BOJ rate hike, with the yen touching the highest level in over four months and tracking on pace to add a further 1.8% on the day against the greenback. For its part, the Federal Reserve did little to arrest the move as it issued a monetary policy announcement mere hours later.

The U.S. central bank kept its target range for the Federal funds rate unchanged in the 5.25%-5.50% range but signaled a cut is almost certainly on the menu when officials reconvene in September. The policy statement made official the shift in the Fed’s thinking away from a singular focus on inflation, marking greater sensitivity to slowing growth.

Fed Chair Jerome Powell reiterated as much at the press conference following the policy decision. He called long-term inflation expectations “well anchored,” adding that while the job of reducing price growth is not finished, the central bank can afford to dial back restrictive borrowing costs.

Dovish Bank of England threatens British pound and stock markets

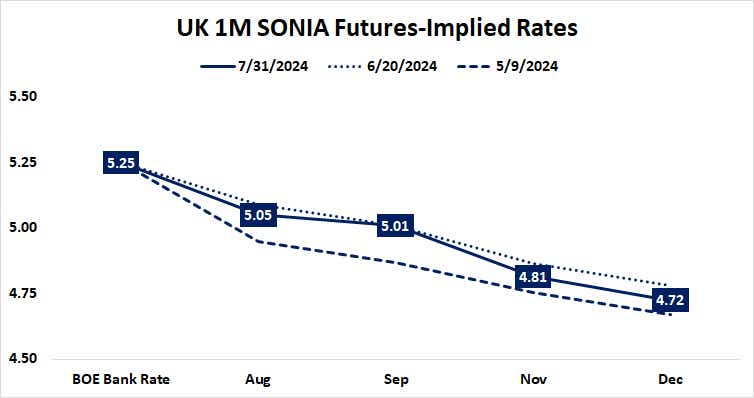

The spotlight now turns to the Bank of England (BOE). It is expected to lower its target interest rate by 25bps to 5.00% from 5.25%. Market watchers anticipate a split decision, with a narrow majority of five policymakers on the nine-member Monetary Policy Committee (MPC) opting for the reduction while four vote for a stay.

The cut is priced into benchmark one-month SONIA interest rate futures with a commanding probability of 80%. This implies the move itself is unlikely to stir much of a response from the markets, putting the onus on the forward guidance delivered in tandem.

Analytics from Citigroup suggest U.K. economic data has softened recently relative to baseline forecasts. Meanwhile, the last bastions of sticky inflation apparent in June’s consumer price index (CPI) inflation data sit within discretionary spending categories—recreation and hospitality_which ought to be responsive if growth cools.

If the BOE opts for a dovish tilt with that in mind, the British pound may fall. The defensive tone might also extend more broadly and put the brakes on this week’s recovery in stock markets if the U.K. central bank dials up concerns about the onset of global downturn.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.