Stocks May Fall as the U.S. Dollar Gains on Services ISM Data

Stocks May Fall as the U.S. Dollar Gains on Services ISM Data

By:Ilya Spivak

The stock market may suffer as the U.S. Dollar gains on June’s service-sector ISM report.

- Cooling “core services” key for Fed inflation-fighting efforts.

- June ISM service-sector survey in focus amid conflicting cues.

- Balance of risks makes stocks vulnerable, U.S. dollar may rise.

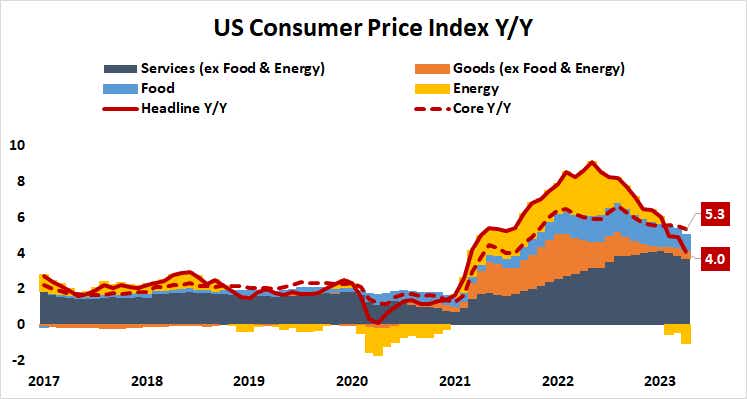

Federal Reserve officials are laser-focused on the service sector, and with good reason. To get inflation back to the U.S. central bank’s target 2%, policymakers must figure out how to let the air out of the so-called “core services” component of the benchmark consumer price index (CPI).

Service sector key for meeting Fed U.S. inflation goals

The “goods” part of the equation has been worked down dramatically from where it was at the start of 2022 when the Fed began its rate-hike cycle. That is owed to the combination of the dampening effect of higher borrowing costs on trade flows and a complimentary healing of pandemic-damaged supply chains.

Food costs made up a sticky bit of the pie but a significant improvement (that is, a smaller CPI contribution) seems likely to show up in incoming months’ data. That’s because sugar prices have turned back lower after a trend-bucking rally that diverged from broader weakness in commodities. Export caps in India are being offset by oversupply in Brazil.

Energy prices are now a disinflationary force, despite supposed efforts to cut output by Saudi Arabia and Russia. Crude oil is down nearly 22% year on year at the start of July. Natural gas is down almost 62%. Tellingly, the Bloomberg Commodity Index – a catch-all measure of raw materials prices – is off by a far-more modest 8%.

Stocks may slip as the U.S. dollar gains on service-sector ISM data

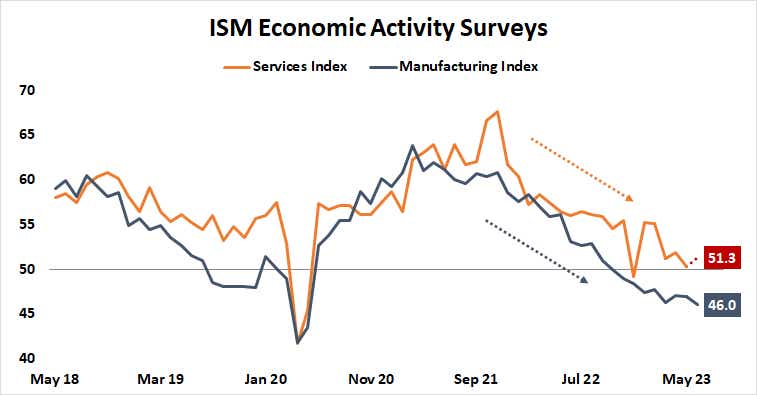

This makes the service-sector Institute for Service Manufacturing (ISM) survey a key input for markets and Fed officials alike. The index is expected to inch up from 50.3 in May to 51.3 in June, implying a slight pickup in the pace of activity growth following a month at near standstill. Traders will be keen to see component gauges tracking prices and employment too.

Data from Citigroup suggests U.S. economic news-flow has increasingly outperformed relative to baseline forecasts since mid-May. This implies that market-watchers’ models are overly pessimistic and may set the stage for upbeat ISM results that spur on Fed rate hike speculation. That might bode ill for stocks and gold prices but benefit the U.S. dollar.

The manufacturing ISM survey released earlier this week offers something of a counterpoint. That survey undershot relative to economists’ projections, showing the sector shrank at the fastest pace since May 2020. That’s quite the reference point, implying conditions as dire as the first few panicked months of the COVID-19 outbreak.

Traders’ response to a similarly grim result on the services side may be telling. If it is celebrated as reducing scope for monetary tightening, stocks and other risk-sensitive assets may find room on the upside. If such thinking is overwhelmed by recession fears however, a market-wide retreat to cash may be inescapable.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Image generated with Midjourney.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.