Stocks Cheered Low U.S. PPI Data. The Story May Be Different If CPI Misses Too.

Stocks Cheered Low U.S. PPI Data. The Story May Be Different If CPI Misses Too.

By:Ilya Spivak

The producer price index rose 2.2% year-on-year in July, undershooting expectations

Stocks and bonds rose while the dollar fell as the U.S. PPI undershot expectations.

BLS flagged squeezed margins as the main source of wholesale disinflation in July.

U.S. CPI is now in focus, with a downside surprise threatening to upset Wall Street.

Stock and bond markets cheered together while the dollar fell after wholesale inflation in the U.S. slowed more than economists expected. The producer price index (PPI) rose 2.2% year-on-year in July, undershooting the 2.3% penciled in by market watchers ahead of the release.

The core reading that strips out volatile food and energy prices was also on the soft side at 2.4% year-on-year vs. 2.7% expected. Interestingly, a further stripping away of trade services—where the Bureau of Labor Statistics (BLS) tracks changes in margins for wholesalers and retailers—produced an increase from 3.2% to 3.3% year-on-year.

U.S. PPI data: a devil in the details?

According to a BLS statement accompanying the release, for the goods side of the ledger, “nearly 60% of the [price increase] in July can be traced to [energy].” Prices fell on the services side, and the “decline can be traced to [trade services].” This makes for a curious backdrop ahead of the punchier consumer price index (CPI) data due tomorrow.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

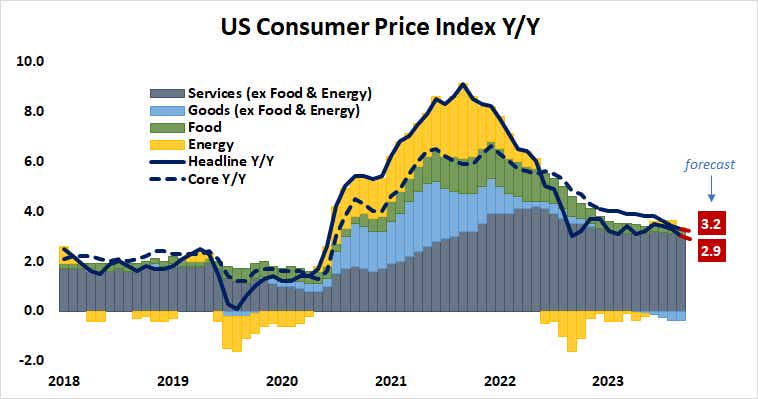

Consumer prices are seen rising 2.9% year-on-year to mark the lowest reading since March 2021. The core CPI measure is penciled in at 3.2%. This too would be a three-year low. A closely watched “nowcast” estimating inflation trends from the Cleveland Federal Reserve anticipates slightly higher figures, pointing to 3% at the headline and 3.3% on the core print.

However, the trend in U.S. economic data outcomes continues to point toward disappointment relative to forecasts, according to analytics Citigroup. In fact, realized results have trailed the Cleveland Fed’s model since April. The internals of the PPI report appear to set the stage for more of the same.

Stocks may fall if U.S. CPI is cooler than expected

The BLS has made it clear that squeezing margins were the main source of wholesale disinflation in July. That seems to imply firms were unable to pass on rising energy costs—the biggest inflationary impetus—downstream to consumers. This speaks to weak end-demand, which might appear more clearly in tomorrow’s numbers.

With that in mind, a soft CPI result may be interpreted to mean the engine driving U.S. output—household consumption—is misfiring. Stock markets may swoon if this renews recession fears, driving capital to bonds and the U.S. dollar. The Japanese yen may also strengthen as the unwinding of the carry trade resumes.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.