Stocks at Risk if Fed Chair Powell Leaves Markets Guessing

Stocks at Risk if Fed Chair Powell Leaves Markets Guessing

By:Ilya Spivak

If Fed Chair Powell leaves markets uncertain about where interest rates are headed, stock markets may suffer as the U.S. dollar gains

- Markets are struggling to define a baseline for Fed policy expectations.

- Fear of “higher-for-longer” rates remains despite softer Fed-speak.

- Sentiment may sour if Fed Chair Jerome Powell leaves traders guessing.

The markets are struggling to settle on an outlook for Federal Reserve monetary policy, driving seesaw volatility across stock and bond markets as traders' focus jumps from one data point to another. A much-anticipated speech from Chair Jerome Powell will be closely watched in hopes of clarity.

Defining the length of time the U.S. central bank intends to hold interest rates at elevated levels before it begins to lower them seems to be central.

Stocks and bonds gyrate as markets struggle with Fed outlook

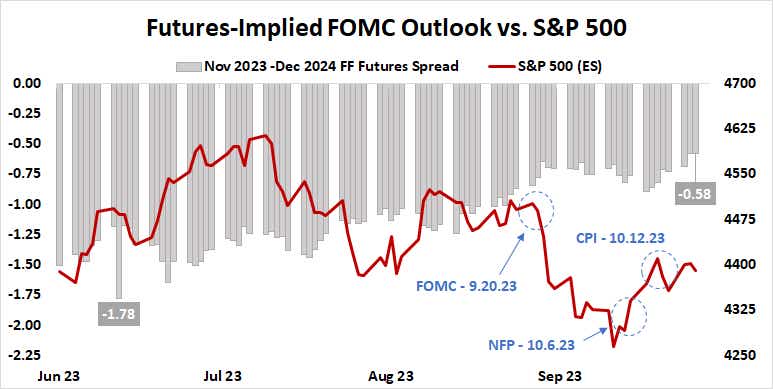

Traders walked away from the latest meeting of the policy-setting Federal Open Markets Committee (FOMC) on Sept. 20 with the feeling policymakers favored keeping rates “higher for longer,” delaying hoped-for stimulus amid a slide toward global recession. Spooked stock markets declined declined as bond markets pointed to rising uncertainty.

Investors’ response to the release of unexpectedly strong U.S. employment statistics on Oct. 6 seemed to mark a turning point in this narrative. An initial “good is bad” response saw sentiment deteriorate amid fears that the buoyant result would encourage a more hawkish Fed. A demonstrative intraday reversal then handed the S&P 500 its best one-day rally in a month. That appeared to bookend the post-FOMC recalibration of policy expectations.

Consumer price index (CPI) data published on Oct. 12 added another twist. Traders seized on a narrowly higher-than-expected headline inflation reading even as the more Fed-relevant core price growth measure ticked lower. “Higher-for-longer” fears resurfaced, bond yields swung higher and stocks swooned.

More of the same followed as consumers’ inflation expectations jumped in a survey by the University of Michigan (U-M), and after retail sales data showed an impressively strong pickup in September.

Financial markets to Fed Chair Powell: “Tell us where to go”

In the meantime, the message from Federal Reserve officials seems to have turned less combative. A raft of speeches from FOMC officials in the weeks following the Sept. 20 conclave flagged an emerging consensus around the idea that rate hikes have concluded, at least for now.

Transitioning to ‘wait-and-see’ mode is not the same as signaling an approaching round of rate cuts, but it is the usual prerequisite. That seems to put the message from policy officials somewhat at odds with the markets’ most recent re-positioning.

Enter Jerome Powell.

The Fed chair is due to speak at the Economic Club of New York. He will deliver prepared remarks, then sit for a moderated Q&A session. Such outings can be potent opportunities to communicate with markets and frame policy expectations. Investors will listen with great interest.

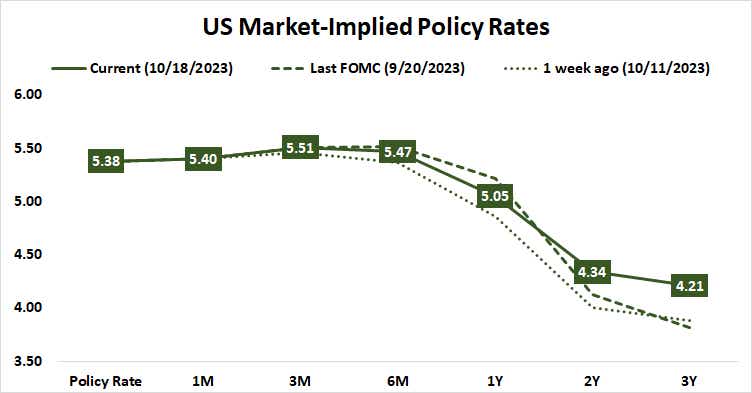

The policy path implied in interest rate futures markets has pointedly steepened over the past week. Traders have pushed out the expected start of next year’s easing cycle from July to September and the priced-in probability of another 25-basis-point (bps) interest rate hike before the end of 2023 has increased from 30%% to 55%.

The cumulative move in interest rates between now and the end of 2024 is now a decline of about 58 bps. That’s less than a third of the 178 bps in easing that was penciled in for the same period in late July, when the start of the “higher-for-longer” repricing process put an interim top in stock markets.

Sentiment might steady if Powell appears to endorse stopping interest rate hikes, scattering resurgent worries about still-more tightening this year. Signaling strict neutrality and data dependence on what happens next might keep risk appetite curtailed however as traders envision more seesaw volatility ahead. That might distill into a defensive posture, weighing on Wall Street and underpinning the U.S. dollar.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.