Stocks and Bonds Shrug Off Widely Anticipated Fed Hike

Stocks and Bonds Shrug Off Widely Anticipated Fed Hike

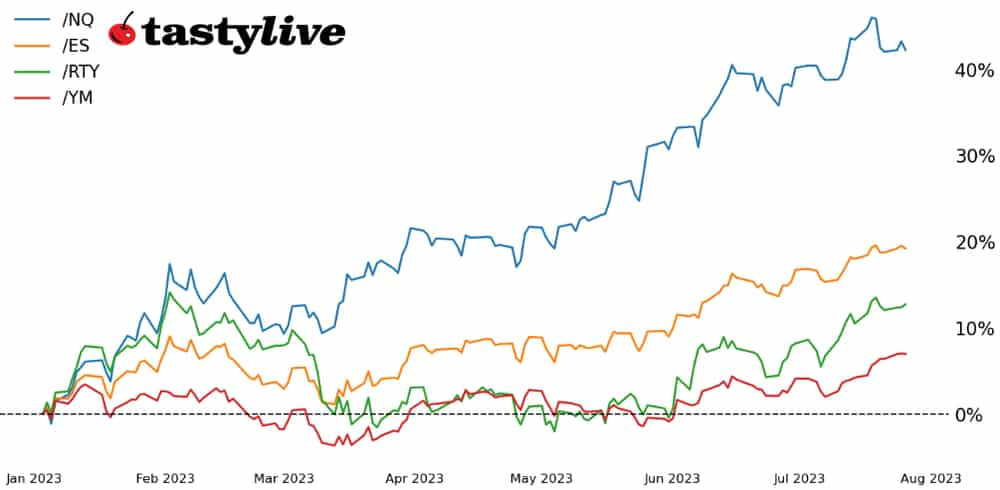

S&P 500 up +2.17% month-to-date

- The Federal Reserve hiked their main rate by 25-bps to 5.25-5.5%, as expected (100% chance, per CME’s FedWatch tool).

- What happens next? That depends entirely on the data.

- Markets haven’t been offered any compelling reason to change their current trajectory.

The Federal Reserve did what was widely anticipated, raising rates by 25-basis points (bps) to bring their main rate to 5.25%-5.5%. What happens next, however, is entirely data dependent, which is why it's too soon to officially announce that the rate hike cycle is finished.

While headline U.S. inflation has come down sharply over the past year, the easy part of the fight is finished. Base effects in the data will make further declines more difficult to achieve, while a turn higher in soft agriculture and energy commodities' prices will likely produce a bump in inflation rates in August and September.

Given the hit to the Fed's credibility in the wake of keeping rates too low for too long ("transitory"), it's likely that the Fed keeps rates higher for a sustained period, absent a recession, to avoid another inflation surge akin to the late-1970s. "Generals are always fighting the last war," as they say: we had excessive easing in the pandemic after not doing enough stimulus early on in the global financial crisis; now, we may see excessive tightening post-pandemic to offset excessive easing.

And yet, these aren't compelling reasons for U.S. equity markets to stop rallying or for the bond market to exit inversion territory. Much of Fed policy is simply a confidence game, insofar as markets don't care about incremental interest rate moves as long as it appears that the Fed has a sober, clear-eyed view of the economy.

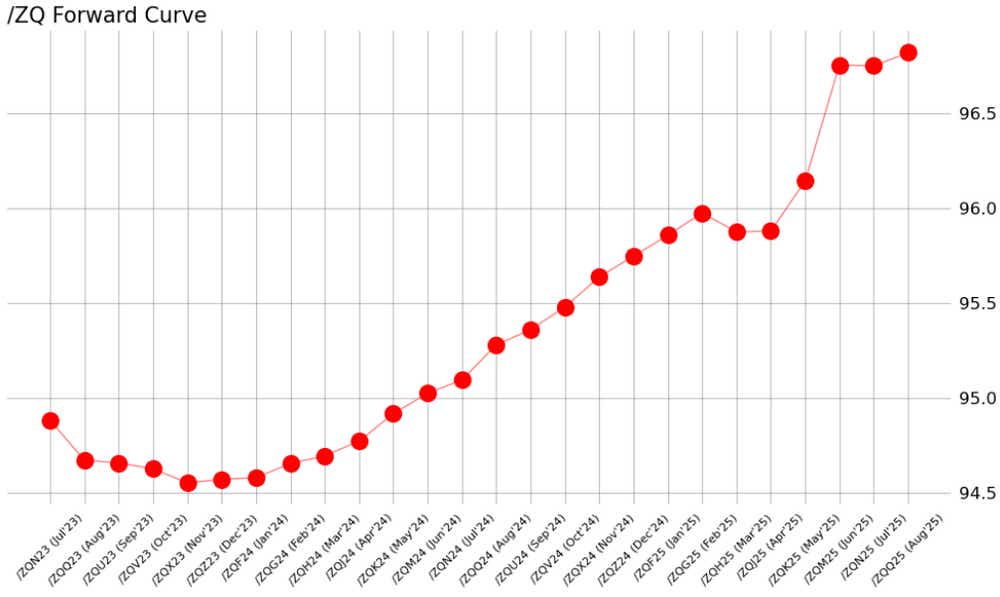

/ZQ Fed Funds Futures Forward Curve (August 2023 to December 2025)

The /ZQ (Fed funds) term structure shows an expectation that the Fed may not raise rates again this year: there is effectively a 50-50 chance that another hike is levied by November. A lot can change between now and then; indeed, there are another 55 days until the September FOMC meeting.

For now, markets believe that the Fed has done a good job engineering a soft landing, so the latest rate hike - and another 25-bps rate hike later this year - will not dramatically alter traders' near-term outlook; only a dramatic fall off in U.S. economic data will provoke a reassessment. The trends in stocks and bonds remain your friends, for now.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multi-national firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.