Stocks and Bonds May Fall Together on Cautious FOMC Meeting Minutes

Stocks and Bonds May Fall Together on Cautious FOMC Meeting Minutes

By:Ilya Spivak

Fed Chair Jerome Powell said the central bank is not in a hurry to cut rates, adding that economic risks are ‘two-sided’

- Federal Reserve officials are not as aligned on the scope for rate cuts as it seems.

- Even a modest repricing of market consensus can trigger a strong price reaction.

- Stocks and bonds may fall if September FOMC minutes are less dovish than expected.

Did the Federal Reserve really mean to signal a dramatically dovish shift in policymakers’ thinking when it began its long-awaited interest rate cut cycle last month? That’s the question on the minds of investors as they prepare for the release of minutes from September’s meeting of the central bank’s steering Federal Open Market Committee (FOMC).

At face value, the answer seems self-evident. Officials opted for a jumbo 50-basis-point (bps) interest rate cut instead of the standard-sized 25bps move. What’s more, their updated summary of economic projections (SEP) seemed to endorse the markets’ dovish myth-making, pointing to 100bps in easing this year and in 2025.

Fed officials disagree on how many rate cuts are ahead

At the press conference following the policy announcement, central bank Chair Jerome Powell was asked about how to forecast the Fed’s likely moves going forward. He quipped that a look at the SEP would be a start. In fact, there seems to be quite a bit of diversity of thought among Fed lever-pullers about how to proceed.

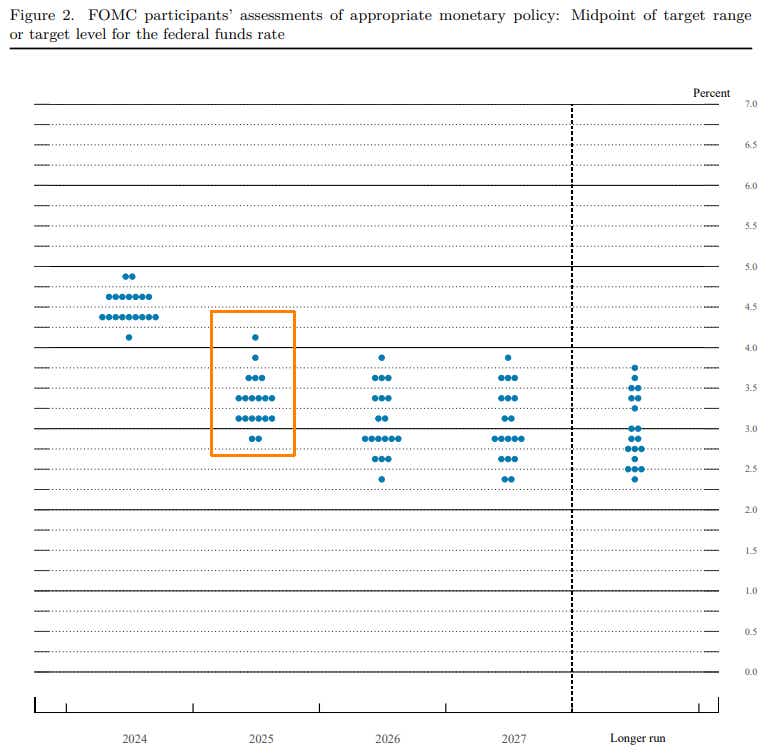

Last month’s decision inspired the first dissent by a Fed governor in nearly two decades when Michelle Bowman voted for a smaller 25bps cut. The often-maligned “dot plot” chart goes further, showing only six of 19 FOMC members—about 32%—saw the Fed Funds rate in the 3.25%-3.50% range by year-end 2025 as the distilled forecast implies.

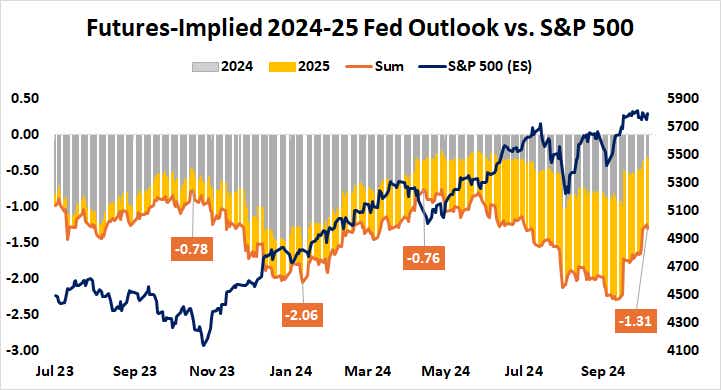

Allowing for more leeway, a stronger majority of 12 of 19 officials (63%) expected rates to land somewhere between 3% and 3.5%. That seems more convincing, but a difference of 25bps can be significant for market outcomes. Last week, losing about one cut from the priced in forecast through 2025 triggered the biggest bonds rout in two years.

September FOMC minutes put stocks and bonds at risk

For his part, Powell has switched to a more cautious tone. Speaking early last week, he said the U.S. central bank is not in a hurry to cut rates, adding that risks to the economic outlook are “two-sided.” Other officials have echoed similar sentiments in subsequent comments, especially after a batch of impressively strong economic data.

This imbues the latest FOMC meeting minutes publication with market-moving potential. If the central bank uses the narrative document to signal that it is not on dovish autopilot and stands ready to pivot, traders could trim interest rate cut expectations further. That might bode ill for stock and bond markets, while lifting the dollar.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.