Stocks and Bonds Jump then Fade After May FOMC Meeting

Stocks and Bonds Jump then Fade After May FOMC Meeting

The S&P 500 us up 1.12% for the month so far

- In line with expectations, the Federal Reserve did not change its main rate, but the policy statement signaled more concern about recent inflation data.

- Fed Chair Jerome Powell suggested that it’s likely that the FOMC will keep rates on hold for the near future as it needs additional confidence to start the cut cycle.

- Powell also made clear that a rate hike is not under consideration at present time.

The Federal Reserve surprised no one today when it kept its main rate on hold at 5.25-5.50%,

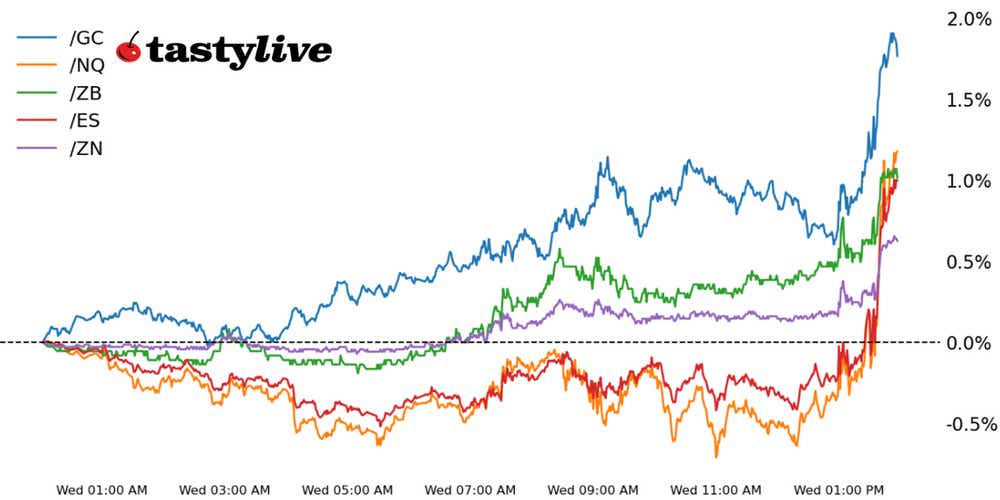

The lack of any hawkish surprise beyond what was anticipated is allowing markets to breathe a sigh of relief, with stocks and bonds rallying sharply during the press conference (although gains were fading rapidly as cash equities headed toward the close).

The May Federal Open Market Committee (FOMC) policy statement showed meaningful changes from March that acknowledged the lack of recent progress on inflation. However, neither the policy statement, nor Fed Chair Jerome Powell at his press conference, offered any signal that a rate hike is likely this year. On several occasions, Fed Chair Powell said that he and the FOMC believed that policy was “sufficiently restrictive,” a dovish silver lining.

In effect, the May FOMC meeting can be summarized as the Fed reconciling its view on rate cuts with that of the market. Powell said that it’s already been priced-in, as rates markets are discounting just 27 basis points worth of cuts through the end of the year.

As of now, it’s too soon to say that a December rate cut is off the table, although the depth of the rate cut cycle may be shallower than previously expected.

Quantitative tightening to be less tight

Furthermore, the FOMC announced a reduction in quantitative tightening from $60 billion per month to $25 billion per month (a reduction of $35 billion per month, slightly more than anticipated $30 billion per month reduction).

While the overall market impact on bonds from the QT change may be limited, the reduction in balance sheet runoff could translate into a reduced need for Treasury issuance over the coming months, which in turn may help take some pressure off the long end of the yield curve, which has seen a string of weaker auctions.

/ZQ Fed funds futures forward curve (May 2024 to November 2026)

Rates markets are starting to calcify around the idea that no rate cuts are coming in June, July, or September this year, which have continued to see cut odds bleed out in recent weeks.

Only one cut is fully discounted when looking at the /ZQ (Fed funds) term structure, which is where the FOMC seems to be anchoring the conversation as it prepares a new round of forecasts for its Summary of Economic Projections in June.

As long as one rate cut for 2024 isn’t eliminated, we may be looking at a floor of sorts forming in bonds.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.