Trading Higher for Longer

Trading Higher for Longer

The Federal Reserve held its main rate at 5.25-5.5%, as expected

- The Federal Reserve held its main rate at 5.25-5.5%, as expected.

- Is another rate hike guaranteed? Not necessarily, though the FOMC is still penciling one in.

- As anticipated, markets haven’t seen a meaningful reason to breakout one way or the other.

The Federal Reserve surprised no one today when it left its main rate on hold at 5.25% to 5.5%. As many Federal Open Market Committee (FOMC) officials have suggested in recent months, including Fed Chair Jerome Powell, any further monetary policy tightening is entirely data dependent. In other words, it is still too soon to officially announce that the rate-hike cycle is finished.

A stronger U.S. economy through the summer months, a resilient U.S. labor market, and stickier inflation provoked hawkish upgrades to the FOMC’s Summary of Economic Projections. Even though the United Auto Workers (UAW) strikes and a potential federal government shutdown could weigh on economic activity in the coming weeks, the Fed believes that a prolonged period of interest rates staying high(er) for longer is necessary. The year-end main rate was projected at 5.625% as it was in June; but the year-end 2024 main rate was revised higher to 5.125% from 4.625%, indicating that two rate cuts were eliminated for next year.

In a sense, little has changed for the Fed, and thus, little has changed in our expectations either. The Fed took a serious hit to its credibility with talk of “transitory” inflation in 2021 and early-2022, so it's likely that the Fed keeps rates higher for a sustained period. Or, as we said after the July FOMC meeting, “generals are always fighting the last war.”

Markets continue napping

Even so, these aren’t meaningful reasons for markets to wake up from their summer slumber: U.S. equity markets have traded within the expected moves as discounted by the options market ahead of the meeting, nor has the bond market moved to exit inversion territory.

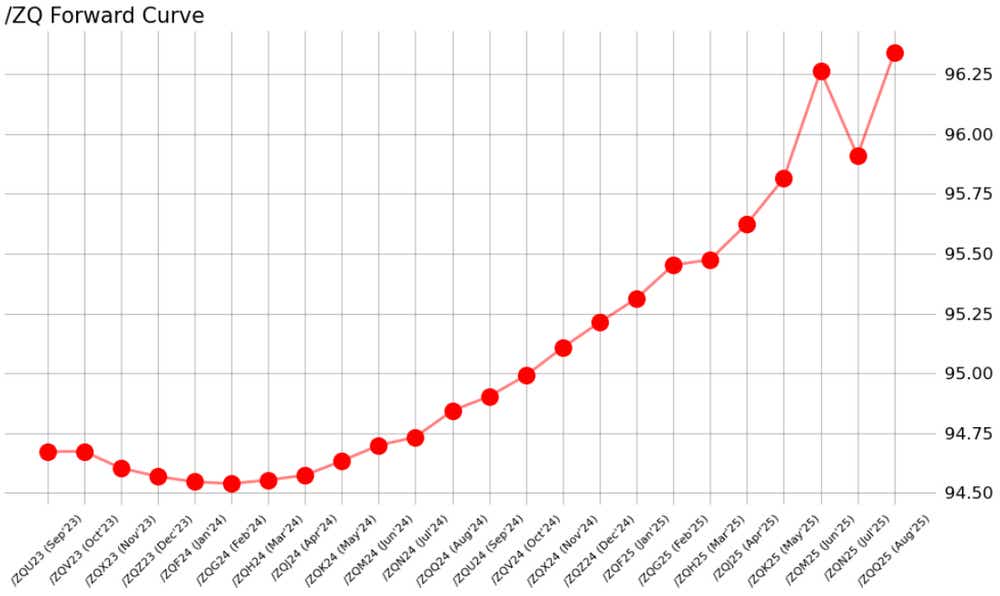

/ZQ Fed funds futures forward curve (September 2023 to August 2025)

The /ZQ (Fed funds) term structure shows an expectation that the Fed may not raise rates again this year: there is just under a 50-50 chance that another hike is delivered before the end of the year. The next FOMC meeting doesn’t arrive until November 1, so there is a lot of time for the data landscape to evolve, and thus change the minds and hearts of traders.

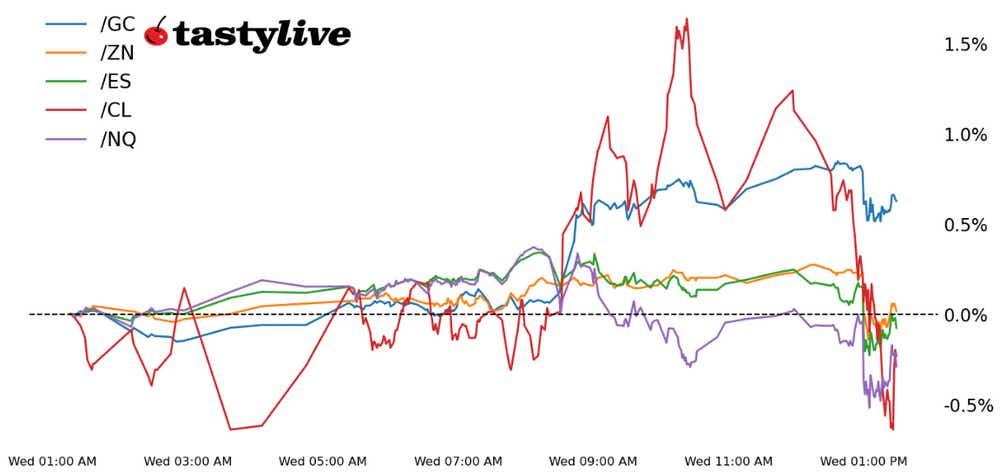

On today’s Futures Power Hour, we asked “if the Fed holds, do markets make a sound?” The answer is “no, not really,” even as U.S. equity markets and U.S. Treasury bonds weakened around the announcement.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.