Stock Markets May Struggle If Fed Chair Powell Dials Up Hawkish Rhetoric

Stock Markets May Struggle If Fed Chair Powell Dials Up Hawkish Rhetoric

By:Ilya Spivak

If he turns in another forceful performance, that could dilute the rate cut outlook further

- Stock markets shrugged off in-line U.S. CPI data, but higher rates still loom.

- All eyes now turn to a U.S. economic outlook update from Fed Chair Powell.

- This time, appetite for risk may prove less resilient to tightening credit than it was a year ago.

Jittery financial markets seemed to position themselves for an unwelcome surprise before October’s closely watched U.S. inflation data crossed the wires. As it happened, the release passed with a whimper. The core consumer price index (CPI) rose 3.3% year-on-year, putting price growth squarely in line with consensus forecasts.

Wall Street breathed a brief sigh of relief after the numbers were announced, with the bellwether S&P 500 index popping to the top of its two-day range. Treasury yields spiked lower in tandem, as if to highlight traders’ approval of results that pass without diminishing Federal Reserve interest rate cut expectations.

Key U.S. inflation data leaves stock markets undisturbed

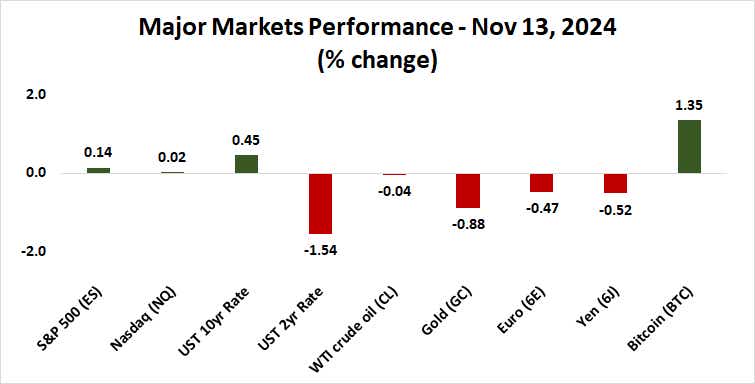

However, these moves proved short-lived. Within a mere two hours, yields had erased intraday losses and moved to explore new intraday highs. Stocks seesawed lower and now look set to finish the day little-changed. Gold prices sank to a two-month low, and the U.S. dollar hit a five-month high against an average of major currencies.

In all, this leaves a familiar status quo in place. The markets seem to have little doubt about the direction of travel for monetary policy bets. The two- to 10-year Treasury yield curve has steepened this week, with long rates outperforming while the short side lags. That points to a shallower rate cut cycle next year.

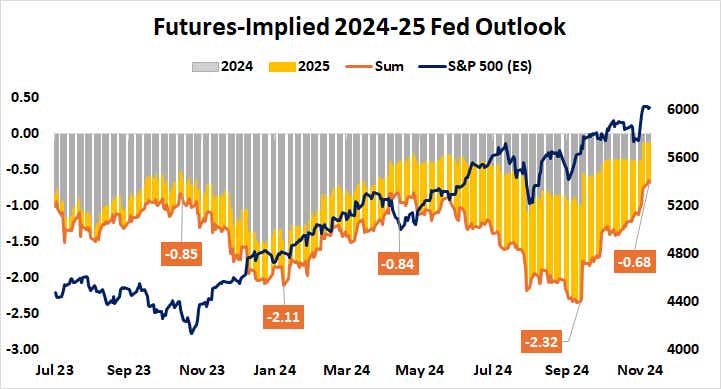

Fed Funds futures are pricing in just two 25-basis-point (bps) reductions in 2025, half of the total the U.S. central bank projected when it updated official forecasts mid-September. That’s even as the priced-in probability of a cut at this year’s final meeting in December has rebounded to 82.3%, the highest in a month. It was just 58.7% yesterday.

Markets vs. Fed rate cut expectations: Smooth sailing?

The hawkish rethink has understandably supported yields and the dollar while punishing gold, the natural foil for interest-bearing and fiat assets. The bit that still confounds investors is whether higher borrowing costs present a problem for risk appetite at large, and thereby for stock markets.

The optimists would argue that current conditions represent a repeat of what happened in the first half of 2024, when a bout of strong U.S. economic data slashed rate cut expectations in half between January and April. Stock markets rose for most of this period, with the S&P 500 adding just over 5% despite a three-week selloff at the period’s end.

Now, too, signs of a strengthening U.S. economy are seemingly reducing scope for easing for ostensibly “good” reasons. The pessimists might counter that the whole of the global economy was growing at an accelerating pace at the start of 2024, whereas it has been slowing since mid-year even as the U.S. gorges on domestic demand.

A speech from Fed Chair Jerome Powell can push global yields still higher

Purchasing managers’ index (PMI) data from S&P Global and JPMorgan showed the pace of worldwide growth in economic activity inched up marginally in October after hitting an eight-month low in September. By contrast, it was on its way to a 12-month high in the first half of the year.

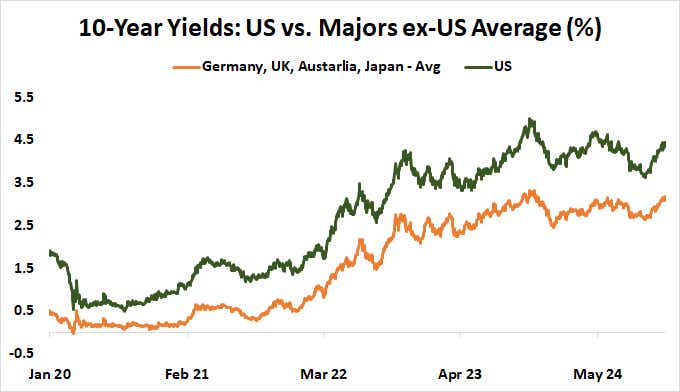

The spotlight turns to a speech from Federal Reserve Chair Jerome Powell, who is due to give an update about the outlook for the U.S. economy. He forcefully insisted that the central bank is not on dovish autopilot at the press conference following last week’s policy meeting. Another forceful performance can dilute the rate cut outlook further.

The steady rise in U.S. yields since September has bid up global rates thanks to the ubiquity of the dollar in worldwide commerce. Another push higher in the wake of Mr. Powell’s remarks would compound credit cost pressure on a global economy that is meaningfully more vulnerable. Stock markets may not swallow that as readily as before.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.