Stocks and the U.S. Dollar Face More Trouble Ahead on U.S. CPI and Sentiment Data: Macro Week Ahead

Stocks and the U.S. Dollar Face More Trouble Ahead on U.S. CPI and Sentiment Data: Macro Week Ahead

By:Ilya Spivak

Stocks face deeper losses as recession fears continue to preoccupy the markets.

- U.S. CPI data is unlikely to cheer the markets despite cooling inflation.

- The Canadian dollar may rise if the BOC holds back on dovish signaling.

- Stock markets face deeper losses if U.S. consumer confidence unravels.

Stock markets continued to bleed out last week as recession fears kept swirling. Treasury yields managed a meager uptick but the broader trend lower since the beginning of the year remained firmly intact. Crude oil prices fell amid cooling demand expectations while gold idled in familiar territory.

The U.S. dollar traded broadly lower against its major counterparts. The euro saw outsized support, adding a meaty 4.6% against the greenback as Eurozone bond yields surged amid speculation about a large-scale military buildout ahead. That sharply shifted interest rate spreads in favor of the single currency.

Against this backdrop, here are the key macro waypoints to consider in the days ahead.

U.S. consumer price index (CPI) data

Inflation is expected to have cooled in the U.S. last month. The headline rate is seen ticking down to 2.9% year-on-year, returning to December’s setting after edging up to 3.0% in January. Similarly, the core rate excluding volatile food and energy prices is seen coming back to 3.2% from 3.3%.

Citigroup analytics warn that U.S. economic news-flow has increasingly disappointed relative to baseline forecasts recently, which may tilt surprise risk in favor of another miss. That is unlikely to be encouraging for markets consumed with recession fears. They might see a soft result as reinforcing growth fears, which may hurt stocks further.

A lack of urgency on interest rate cuts at the Federal Reserve might mean that downbeat CPI results dial up speculation about harder-hitting stimulus further ahead. This could push Treasury bonds higher as yields come down. The U.S. dollar may weaken as interest rate differentials turn further against the currency.

.png?format=pjpg&auto=webp&quality=50&width=762&disable=upscale)

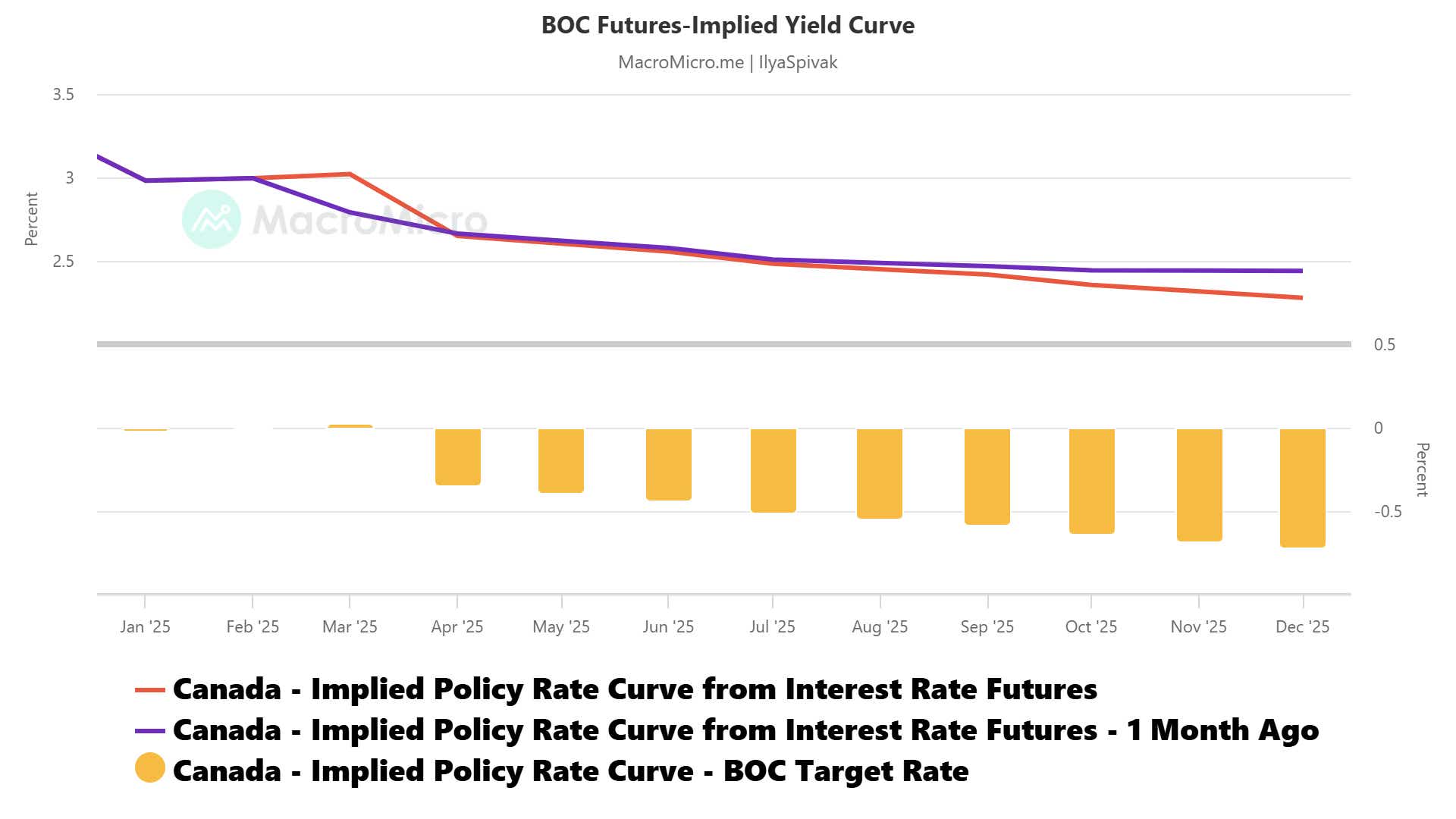

Bank of Canada (BOC) monetary policy meeting

Canada’s central bank is widely expected to lower its target interest rate by another 25 basis points (bps), arriving at 2.75%. The larger question for the markets will be whether officials are prepared to dial up stimulus expectations further as the economy remains in the doldrums. As it stands, the markets have priced 72bps in cuts for this year.

Inflation has settled near the 2% year-on-year mark. Leading purchasing managers index (PMI) data still points to contracting economic activity, but the pace of deterioration may be anchoring. Citigroup data suggests Canadian economic news has improved relative to median forecasts over recent weeks.

This might mean that the BOC resists more dovish posturing for now. The proximity of a general election now that Mark Carney has taken over as Prime Minister may be another reason to move slowly. Carney will face Pierre Poilievre to defend his new job in the coming months. On balance, this may help lift the Canadian dollar.

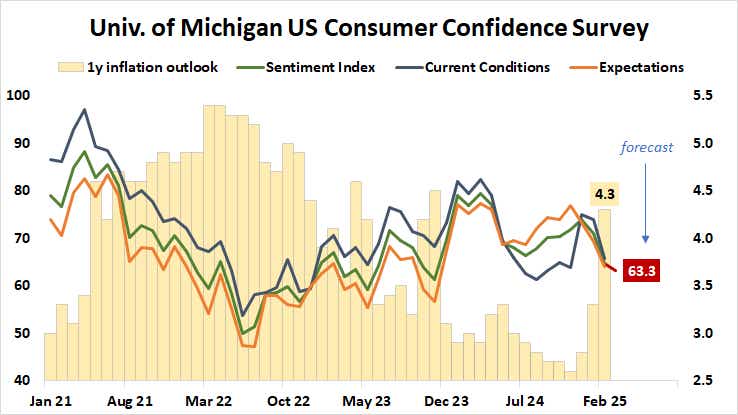

University of Michigan (UofM) consumer confidence data

February brought a sharp decline in U.S. consumer sentiment as uncertainty about tariffs and other elements of fiscal policy pushed one-year inflation expectations sharply higher. Survey respondents polled by the University of Michigan (UofM) were the gloomiest since November 2023 as the one-year price growth outlook jumped to 4.3%.

More of the same is expected as preliminary figures for this month cross the wires. Economists are penciling in a move down to 63.3 on the headline sentiment index, a new 16-month low. Household consumption accounts for close to 70% of overall U.S. gross domestic product (GDP) growth. If the mood darkens, recession fears are likely to build.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.