Stock Markets at Risk If ISM Data Comes Out as Expected

Stock Markets at Risk If ISM Data Comes Out as Expected

By:Ilya Spivak

The likeliest outcome for this U.S. service sector data is also the scariest

Stock markets have had a change of heart about Fed rate cuts as U.S. economic data has soured.

Traders now fear the central bank has already missed the window to avoid recession.

For ISM service sector data, an as-expected outcome may be the scariest for Wall Street.

A vigorous debate about what Federal Reserve interest rate cuts mean for stock markets has been raging for nearly a year—ever since the U.S. central bank signaled its hiking cycle ended in November 2023. The resolution is imminent as officials gear up to begin lowering rates this month and promises to be defining for asset prices.

One side of the argument sees cuts as benign maintenance of credit costs after their rapid rise amid the Fed’s battle with inflation following the COVID-19 pandemic. As rate hikes bear down on price growth expectations, the “real” cost of capital goes up. This means the Fed needs cuts to avoid squeezing creditors too hard and harming the economy.

Stock markets are changing their mind about interest rate cuts

This paints a benign picture, where rate cuts are the path to keep borrowing costs on an even keel while inflation cools and help to engineer the proverbial “soft landing.” Inspired by this vision, Wall Street roared higher. The bellwether S&P 500 stock index added an eye-watering 63.4% from the low in October 2023 to the high in July 2024.

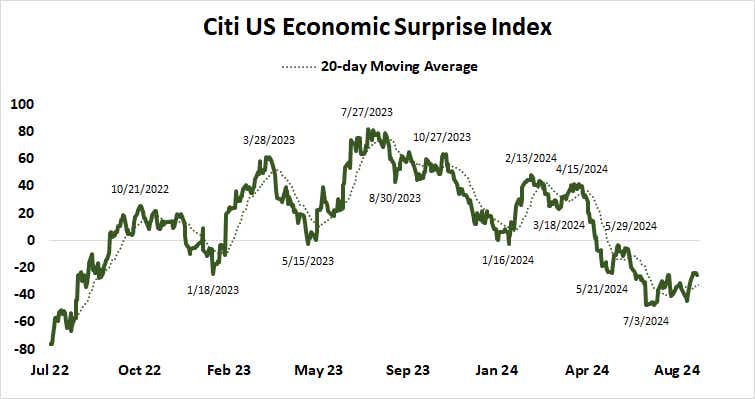

A counter-narrative began to emerge in April as U.S. economic data flow began to take on an increasingly downbeat tone. In this version of the story, the Fed has already allowed real rates to rise too high and missed the window of opportunity to lower them before an unwelcome downturn is inevitable.

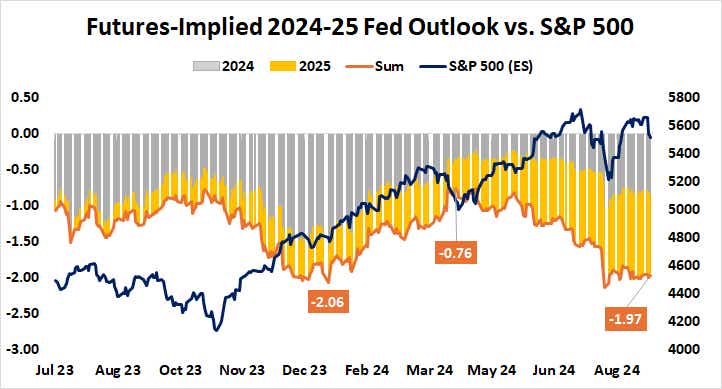

This world view came as central bank officials bemoaned slow-going disinflation and signaled a reluctance to cut rates in the second quarter. The priced-in outlook reflected in interest rate futures showed swelling 2025 stimulus bets, implying the central bank’s tardiness this year would demand a catch-up sprint amid some sort of growth debacle.

Markets fear the Fed has already missed the “soft landing” window

By the time Fed Chair Jerome Powell began to signal in early July that a rate cut cycle was about to begin, financial markets had witnessed nearly three months of deteriorating economic news and almost doubled the tally of expected rate cuts through next year. It rose from 76 basis points (bps) in mid-April to 133 bps by the end of June.

It seems hardly surprising that against this backdrop, the long-awaited arrival of stimulus was interpreted to mean the Fed has finally recognized something untoward enough in the economy’s trajectory that it was compelled to act. Stocks topped, then rapidly lurched lower as still more disappointing data appeared to confirm traders’ concerns.

A rebound from the panic lows set in early August amid this wave of heavy selling has failed to reclaim July peaks, while September’s opening session brought the biggest one-day downturn in a month and erased nearly two weeks of grinding gains. Another round of top-tier economic data is now poised to define the next steps.

For U.S. service sector data, the likeliest outcome is also the scariest

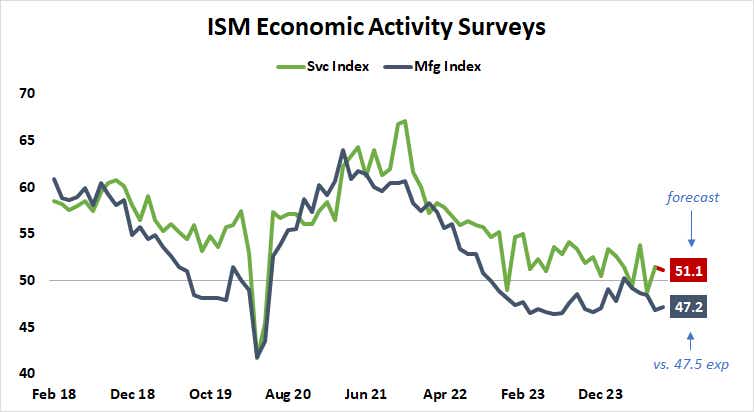

First up this week, the latest service sector survey from the Institute of Supply Management (ISM) is expected to show the pace of activity growth held broadly steady in August. A shock contraction in June was followed by a rebound in July, and last month’s performance is seen broadly keeping pace.

The markets might welcome a downside surprise, figuring such a result would nudge the Fed toward a jumbo 50bps rate cut when it makes its move on Sept. 18. They may likewise endorse a beat, hoping the economy is strong enough that a 25bps cut will suffice.

A set of figures that registers broadly in line with expectations—by definition, the most likely outcome—may be the most negative scenario for stock markets. That would endorse the status quo, where traders are already dispirited by cyclical dynamics and worried about the Fed’s laggy response to recession risk.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.