Nasdaq 100 Treads Water as Silver and Yields Drop

Nasdaq 100 Treads Water as Silver and Yields Drop

Also five-year T-note, silver, crude oil and Australian dollar futures

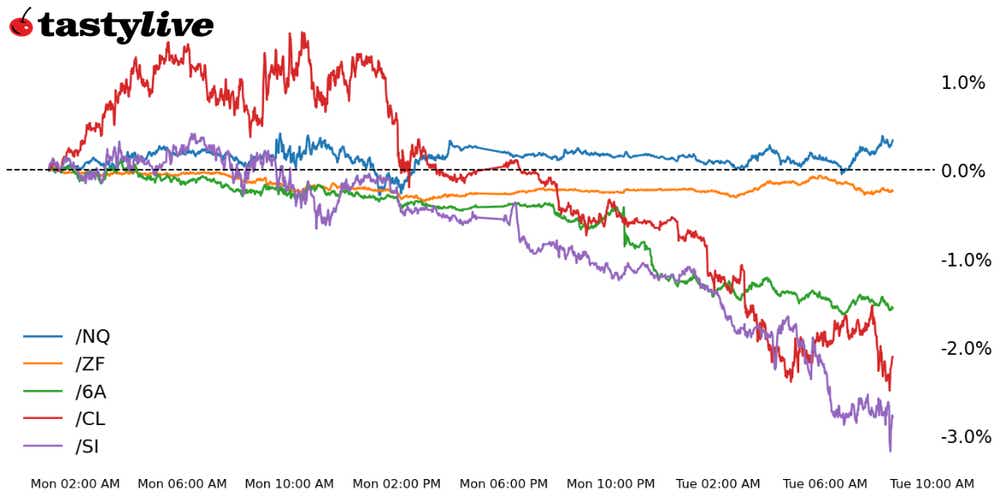

- Nasdaq 100 E-mini futures (/NQ): +0.01%

- Five-year T-note futures (/ZF): +0.10%

- Silver futures (/SI): -2.43%

- Crude oil futures (/CL): -1.63%

Australian dollar futures (/6A): -1.18%

The earnings and macro calendar are thin this morning, but a procession of Federal Reserve policymakers are set to hit the lecture circuit over the coming hours. Comments from Minneapolis Fed President Neil Kashkari and Chicago Fed President Austin Goolsbee have suggested that Federal Open Market Committee (FOMC ) officials aren’t ready to declare victory over inflation just yet but aren’t keen on raising rates again, either.

Symbol: Equities | Daily Change |

/ESZ3 | -0.19% |

/NQZ3 | +0.01% |

/RTYZ3 | -0.36% |

/YMZ3 | -0.22% |

U.S. equity index futures were pointing modestly lower ahead of the opening bell this morning , led lower by yesterday’s leader to the downside, the Russell 2000 (/RTYZ3). However, a drop in U.S. yields across the curve may help prop up stock prices as they did last week; the interest rate-sensitive Nasdaq 100 (/NQZ3) is treading water in positive territory, up by 0.01%. Read more here about how bond yields impact stock prices.

Strategy: (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 15000 p Short 15100 p Short 15700 c Long 15800 c | 25% | +1450 | -550 |

Long Strangle | Long 15000 p Long 15800 c | 45% | x | -9795 |

Short Put Vertical | Long 15000 p Short 15100 p | 65% | +600 | -1400 |

Symbol: Bonds | Daily Change |

/ZTZ3 | 0.00% |

/ZFZ3 | +0.10% |

/ZNZ3 | +0.23% |

/ZBZ3 | +0.69% |

/UBZ3 | +0.92% |

Comments from FOMC officials thus far have not propelled U.S. higher, and it’s the long-end of the bond curve that’s once again proving to be most moving early in the trading day today. Short-term T-bill issuances will hit the market later today, although in the wake of the Treasury’s Quarterly Refunding Announcement (QRA) last week, bonds have maintained an impressive rally that hints at meaningful technical bottoms having been formed.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 104.5 p Short 104.75 p Short 106.75 c Long 107 c | 38% | +140.63 | -109.38 |

Long Strangle | Long 104.5 p Long 107 c | 40% | x | -656.25 |

Short Put Vertical | Long 104.5 p Short 104.75 p | 80% | +70.31 | -179.69 |

Symbol: Metals | Daily Change |

/GCZ3 | -0.95% |

/SIZ3 | -2.43% |

/HGZ3 | -1.29% |

Silver prices (/SIZ3) are down about 2.5%, its biggest daily percentage decline since early October, as traders pull back from their dovish view on future rate cuts after Federal Reserve members cast doubt on the view that inflation has been tamed. Elsewhere, a firmer dollar is weighing on other precious metals.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 22 p Short 22.25 p Short 23.75 c Long 24 c | 32% | +795 | -455 |

Long Strangle | Long 22 p Long 24 c | 41% | x | -4265 |

Short Put Vertical | Long 22 p Short 22.25 p | 66% | +415 | -835 |

Symbol: Energy | Daily Change |

/CLZ3 | -1.63% |

/HOZ3 | -2.09% |

/NGZ3 | -3.77% |

/RBZ3 | -1.62% |

Crude oil (/CLZ3) dropped below $80 per barrel for the first time since August because traders expect Chinese fuel exports to slow through the rest of the year amid limited export quotas that will pressure refiners to reduce throughput. Inventory data from the American Petroleum Institute (API) is due today and will offer the next directional cue for the commodity.

Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 76 p Short 76.5 p Short 82.5 c Long 83 c | 26% | +350 | -150 |

Long Strangle | Long 76 p Long 83 c | 44% | x | -4140 |

Short Put Vertical | Long 76 p Short 76.5 p | 61% | +190 | -310 |

Symbol: FX | Daily Change |

/6AZ3 | -1.18% |

/6BZ3 | -0.42% |

/6CZ3 | -0.47% |

/6EZ3 | -0.46% |

/6JZ3 | -0.42% |

Despite a move by the Reserve Bank of Australia (RBA) to hike interest rates at its meeting today, Australian dollar futures (/6AZ3) are selling off amid a broader risk off move. The move comes after a selloff in Asian equity markets as traders reassess rate hike bets for the Federal Reserve and mull weakening economic data. The Australian currency is also suffering from growing confidence among RBA members that inflation will return to target, as suggested in the policy statement released alongside the rate decision.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.62 p Short 0.625 p Short 0.6575 c Long 0.66 c | 62% | +120 | -380 |

Long Strangle | Long 0.62 p Long 0.66 c | 25% | x | -290 |

Short Put Vertical | Long 0.62 p Short 0.625 p | 85% | +70 | -430 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.