Starbucks Earnings—Can the company finally beat estimates?

Starbucks Earnings—Can the company finally beat estimates?

By:Mike Butler

A lot of weight is being placed on next week’s earnings announcement

- Starbucks is scheduled to report quarterly earnings on Jan. 28 after the market closes.

- The company looks to recover from four bad earnings reports.

- Its stock is up almost 10% to start 2025.

- Analysts expect the company to report earnings per share of $0.67 on $9.32 billion in revenue.

Starbucks (SBUX) is slated to release quarterly earnings on Jan.28 after the stock market closes. The company is expected to report earnings per share (EPS) of $0.67 on $9.32 billion in revenue. Revenue estimates are higher than last quarter, while EPS estimates are significantly lower. All said, Starbucks has failed to exceed EPS and revenue estimates for the past four quarters. The coffee company is looking to rebound with a solid earnings report this week.

SBUX stock has rallied over $10 from the recent low in December 2024, and many investors are looking for change after the hiring of new CEO Brian Niccol. After such poor earnings results, it feels like only a matter of time before things change—it's just a matter of how.

In the last earnings call, execuitives did not lay out much of a plan but made defensive remarks: “As shared in our press release last week, our results do not reflect the strength of our brand,” said Rachel Ruggeri, chiief financial officer. “I have seen what Starbucks is capable of when we focus on what we do best. I have confidence in our ability to turn around our business and expect we will return to long-term growth.”

Niccol has expressed optimism, saying that “it is clear we need to fundamentally change our strategy to win back customers. ‘Back to Starbucks’ is that fundamental change. My experience tells me that when we get back to our core identity and consistently deliver a great experience, our customers will come back. We have a clear plan and are moving quickly to return Starbucks to growth.”

Regardless of what’s in the headlines, we can look to the options market for clarity around earnings announcements. Implied volatility helps us put context around expected stock price moves for the week that earnings are announced, and that is no different for Starbucks.

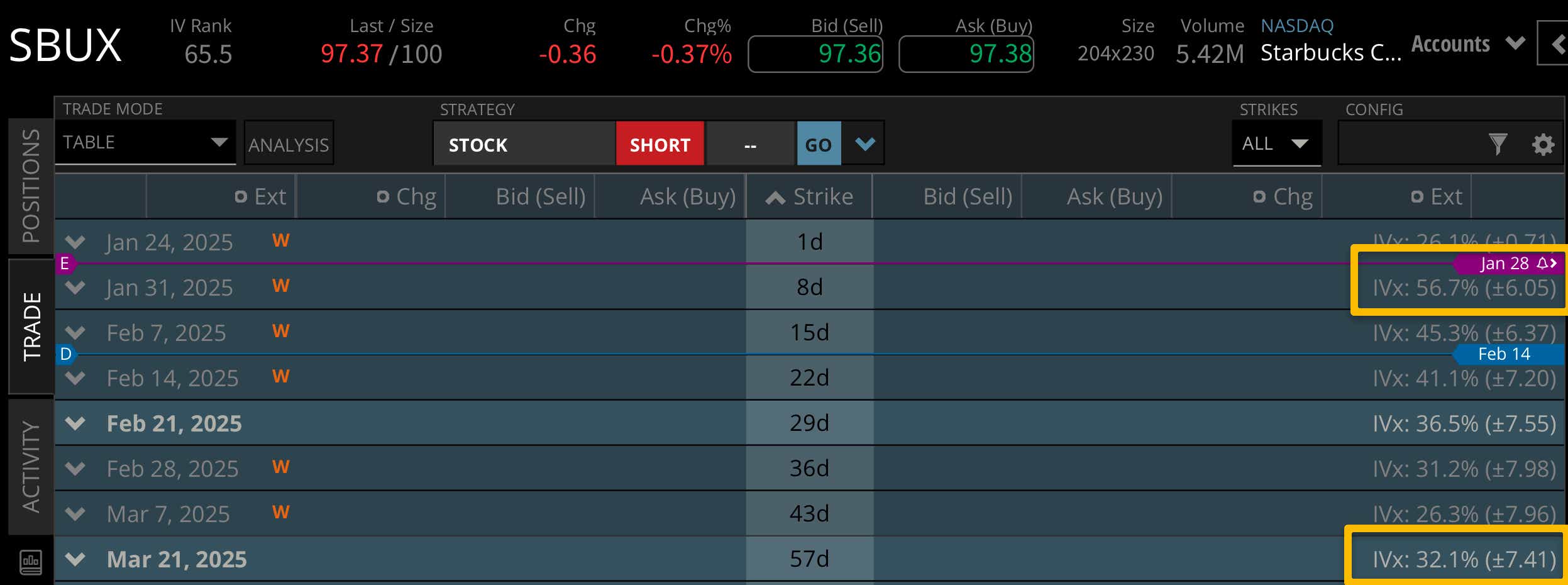

Starbucks has a decent expected stock price move relative to the notional value of the stock price for earnings next week. We're seeing a +/- $6.05 expected stock price move against the current price of around $97. This is just over 6% of the stock price, and we typically see earnings reports land between 5%-10% of the stock price for most companies.

This seems low for so much uncertainty around Starbucks, but looking to the March options expiration cycle we can see an expected move of just +/- $7.41.

That tells us next week's stock price expected move makes up for a massive chunk of the expected move through March. In other words, a lot of weight is being placed on next week’s earnings announcement.

Bullish on Starbucks stock for earnings

If you're bullish on Starbucks earnings, you're looking for an EPS and revenue beat. It feels natural that if they can finally break out of the slump of poor earnings, the stock market may look favorably upon such data. A clearer and more positive sentiment for the rest of 2025 wouldn't hurt, either.

Bearish on Starbucks stock for earnings

If you're bearish on Starbucks earnings, you're looking for an EPS and revenue miss. If one of the numbers exceeds estimates, that may result in a stalemate but earnings are very volatile and unpredictable. If we hear more of the same sentiment without clear direction and some bad numbers, we could see the stock price fall from the recent rally.

Tune in to Options Trading Concepts Live at 11 a.m. CST on Jan. 28 ahead of the Starbucks earnings call for some options trading strategies.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.