Starbucks Earnings Preview—New CEO, New Sentiment?

Starbucks Earnings Preview—New CEO, New Sentiment?

By:Mike Butler

The stock shot off of annual lows after the announcement that Chipotle’s Brian Niccol would take over as chief executive

- Starbucks is set to report quarterly earnings after the market closes tomorrow.

- The coffee giant has had a slump recently, missing earnings-per-share (EPS) and revenue targets three quarters in a row

- It’s expected to announce an EPS of $0.89 on $9.14 billion in revenue

- The stock shot off of annual lows after the announcement that Brian Niccol would take over as CEO, moving away from Chipotle.

Starbucks earnings preview

Starbucks (SBUX) will report quarterly earnings on Wednesday, Oct. 30 after the stock market closes. This will be the first earnings report under the new CEO, Brian Niccol, who joined the Starbucks team on Sept. 9 of this year. SBUX stock opened the year at $95.45 and is currently sitting around $98 per share.

Without looking at a chart of the stock price you might think it has had a narrow trading range, but the stock recently surged off the annual low of $71.55 after announcing that Brian Niccol would be the new CEO and chairman of Starbucks after leaving Chipotle (CMG). The stock market took this as a massive bullish sentiment, as the stock rallied from $77 to $96, almost 25% in one trading day.

Rachel Ruggeri, Starbucks CFO, offered insight during the last earnings call: “Our efficiency efforts, which are tracking ahead of expectations, partially offset investments associated with the cautious consumer environment.”

She went on to say that “collectively, our disciplined approach enables us to preserve both balance sheet strength and flexibility, positioning us to successfully navigate through the current macroeconomic environment."

The press release seemed more defensive than a show of praise, which makes sense given the recent struggles Starbucks execs have endured. Maybe a new CEO can be a fresh start for the coffee giant—the stock market certainly reacted in a similar way when the news broke.

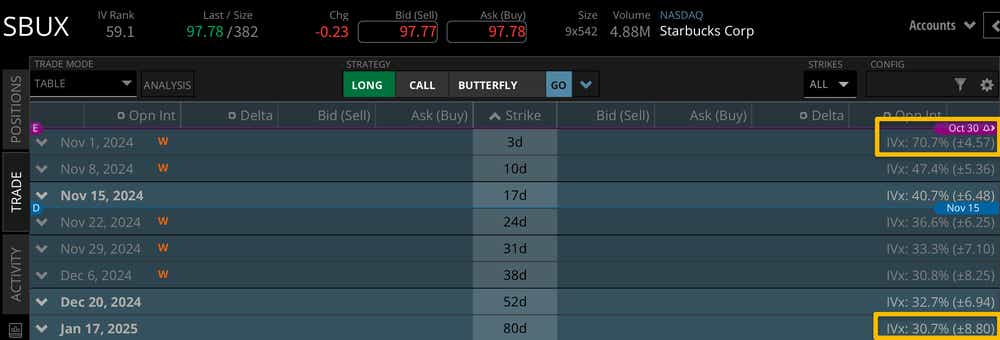

For this week, SBUX stock has a +/- $4.57 expected move based on current implied volatility. Implied volatility is derived from options prices and tells us a lot about expected movement in the stock for different timeframes. This week's expected move is under 5% of the current notional value of the stock price, which puts the earnings report on the lower end of expected moves. Most companies fall between 5%-10% of the stock price when reporting earnings.

Looking further to the January ’25 options cycle, which accounts for more than the rest of this year, we can see a +/- $8.80 expected stock price move. This tells us that even though this earnings report may not bring a ton of stock price movement, the expected move is more than 50% of the expected move through the end of the year. In a generally low implied volatility stock, this earnings report does bear some weight.

Bullish on SBUX stock for earnings

If you're bullish on SBUX stock for earnings, you want to see an EPS and revenue beat, and a lot of positive words from the new CEO Brian Niccol. If he can bring the profitability growth that he realized at Chipotle, we could see SBUX stock creep closer to all time highs.

Bearish on SBUX stock for earnings

If you're bearish on SBUX stock for earnings, you're looking for continued struggles related to earnings. The massive rally from the lows on the new CEO hype could be overstated, and another miss on earnings could reveal that. With a small dataset with the new CEO, the low IV may be a reflection of the "wait and see" approach the market may be taking for this earnings quarter, which could mean a deflation in the hype the company has benefited from over the past few months.

Tune in to Options Trading Concepts Live this week at 11 a.m. Central for a deep dive into all earnings reports!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.