A New Financial Mechanism Promises Efficiency But Might Trigger a Crisis

A New Financial Mechanism Promises Efficiency But Might Trigger a Crisis

It’s called a “Significant Risk Transfer” and does exactly what the name suggests

- The election of Donald Trump has rekindled optimism in the financial sector, with the Financial Select Sector SPDR Fund (XLF) up 10% since Election Day and 34% year-to-date. Investors anticipate a deregulation-driven boost to banking and other industries.

- Significant risk transfers (SRTs) are emerging in the U.S. and Europe as a transformative tool in banking. They enable institutions to offload credit risk to investors and unlock capital.

- While SRTs showcase the promise of financial innovation, they also raise concern about systemic risk, particularly as non-bank investors take on new and complex exposure—a situation paralleling the collateralized loan obligation (CLO) debacle that contributed to the 2008-2009 Financial Crisis.

The election of Donald Trump has reignited optimism in the financial markets, with the financial sector itself emerging as a key beneficiary. The Financial Select Sector SPDR Fund (XLF), a prominent exchange-traded fund (ETF) tracking the industry, has climbed nearly 10% since Election Day and an impressive 34% year-to-date. Investors are betting on a second term that could mirror Trump’s first, with deregulation at the forefront of his agenda. For the financial sector, this signals the potential for streamlined operations, expanded lending and increased capital efficiency.

Amid this optimism, the emerging market for significant risk transfers (SRTs) offers a glimpse of both the promise and the complexities of this approach. By enabling banks to shift credit risk to investors, SRTs exemplify how deregulation can spur innovation and efficiency. However, they also highlight the need for careful oversight, as the long-term risks of such financial tools could pose challenges if left unchecked.

Understanding significant risk transfers (SRTs)

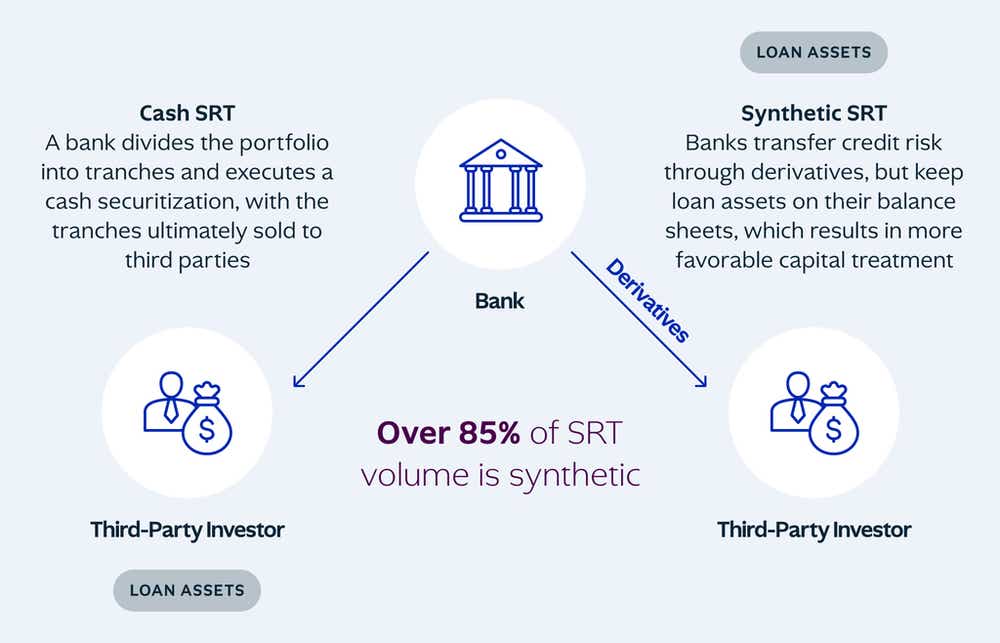

Significant risk transfers, or SRTs enable banks to transfer portions of their credit risk to third-party investors. By employing either cash-based or synthetic securitizations, banks can mitigate risks tied to specific loan portfolios while freeing up regulatory capital to fuel new lending. Long favored by European banks, SRTs are now gaining traction in the United States, where institutions face stricter capital requirements and heightened economic uncertainty.

At their essence, SRTs shift the credit risk associated with defined asset pools—such as corporate loans or mortgages—to investors willing to take on that risk for a fee. These arrangements, often secured by guarantees or credit-linked notes, are attractive to banks aiming to optimize their balance sheets and to investors seeking high-yield, diversified opportunities. Regulators, too, have increasingly acknowledged the value of SRTs in bolstering financial system stability by spreading risk beyond the banking sector.

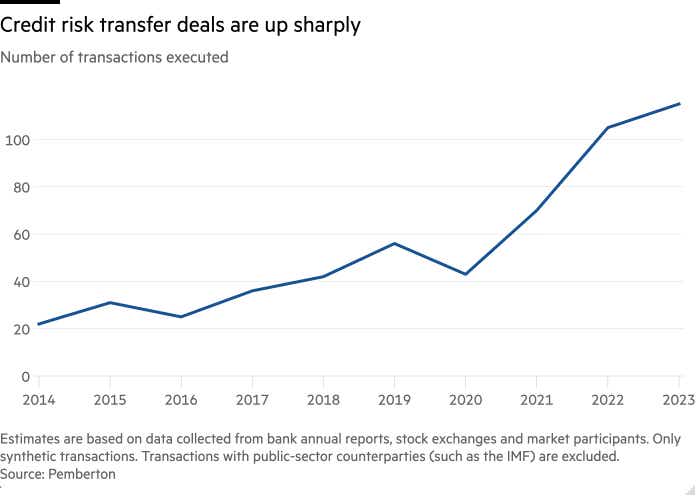

The SRT market has expanded significantly in recent years, particularly in Europe, where banks have relied on these transactions as a strategic tool to manage their balance sheets and maintain lending capacity. In 2022, the global loan pools underlying SRTs climbed to roughly $200 billion, with synthetic structures leading the charge.

In the U.S., the SRT market is also gaining momentum. Recent clarifications from the Federal Reserve regarding the regulatory treatment of certain SRT structures have encouraged more banks to adopt these tools. This shift has fueled activity as U.S. institutions look to manage their credit exposures and optimize their capital deployment.

Rising influence of SRTs in the U.S. financial sector

The Significant Risk Transfer (SRT) market has grown rapidly in recent years, with major banks and institutional investors leveraging these transactions to manage credit risk and optimize capital deployment. For example, in July of this year, AXA IM Alts—the alternative investment arm of the French insurer AXA—raised $2.5 billion to invest in SRT deals.

This funding, sourced from 46 global investors, including Danish pension funds and the Arizona State Retirement System, demonstrates the increasing demand for SRTs among institutional players. AXA’s Partner, Capital Solutions 9 Fund, focuses on performing loan portfolios, offering stable cash flows to investors while helping banks reduce regulatory capital requirements. Deborah Shire, deputy head of AXA IM Alts, called the market “too big to be ignored,” predicting it could double to $500 billion in size as more banks adopt SRT strategies to optimize balance sheets.

JPMorgan Chase (JPM) has also turned to SRTs, recently negotiating a deal tied to a $3 billion portfolio of net asset value loans. It transfers $250 million in credit risk to third-party investors, freeing up capital while allowing the bank to retain some exposure to potential gains. Similar moves by other major U.S. banks, such as Goldman Sachs (GS), highlight the sector's growing reliance on SRTs to manage risk, particularly as regulatory requirements evolve. With U.S. SRT issuance is projected to climb as high as $30 billion in 2024, up from $24 billion the previous year, the market is becoming a critical tool for financial institutions navigating tighter capital rules.

These examples illustrate the rising prominence of SRTs as a strategic mechanism for banks to offload credit risk and redeploy capital, while offering investors compelling opportunities to access high-quality, diversified portfolios. As both European and U.S. markets continue to expand, SRTs are becoming an increasingly important niche in the global credit markets.

Managing emerging risks related to SRTs

While SRTs have proven themselves powerful tools for banks to optimize balance sheets and free up regulatory capital, growing concern about their potential risk is prompting scrutiny from market participants and regulators alike. A key issue lies in the transfer of credit risk to non-bank investors, such as private credit funds, which may lack the expertise to fully assess and manage the risks they are absorbing. This surge in new participants has compressed risk premiums, making it less lucrative for seasoned investors and raising questions about whether buyers are being adequately compensated for the risk they undertake.

Global regulators, including the Fed, the Bank of England and the European Central Bank, are closely monitoring SRT markets to ensure they do not destabilize the financial system. While global losses from these transactions have been modest to date, the International Monetary Fund (IMF) has warned that SRTs could obscure the true health of banks by retaining significant risk while reducing the capital coverage required.

The concern extends to transaction pricing. With the supply of SRTs increasing, favorable pricing for banks is deteriorating, limiting their cost efficiency as a tool for capital optimization. Already, some private credit managers are turning to alternative investments, such as collateralized loan obligation (CLO) equity, which offer higher returns despite complexity and risk. This shift carries echoes of the 2008-2009 financial crisis, when CLOs played a significant role in amplifying systemic vulnerabilities, raising fresh concern about whether today’s investors are prepared to navigate the complexities of these instruments.

Under a second term for Trump, regulation of SRTs could undergo substantial changes. During his first administration, financial deregulation was a priority, exemplified by the 2018 rollback of provisions in the Dodd-Frank Act, which loosened oversight for mid-sized banks. This deregulatory momentum could resurface, potentially easing compliance burdens for banks engaging in SRTs. Such changes might accelerate adoption, as institutions seize the opportunity to transfer credit risk more freely and redeploy capital into higher-yielding opportunities.

However, the potential for relaxed oversight raises concerns about systemic risk. SRTs often involve transferring risk to non-bank investors, such as private credit funds, which may not have the expertise or regulatory safeguards of traditional lenders. Reduced scrutiny could exacerbate vulnerabilities at the intersection of banks and these investors, amplifying risk in the event of economic turbulence. That’s why the administration’s approach to SRT policy demands close attention. It could profoundly reshape the banking industry with critical implications for its future.

While easing regulations might drive greater efficiency in the near term, it also risks leaving the financial system more vulnerable to long-term instability, raising questions about the trade-offs between growth and resilience. As SRTs continue to evolve, the balance benefits and risks remain a key concern. Creating the right regulatory framework will be essential to ensuring these transactions enhance financial stability without introducing unintended vulnerability.

The evolving role of SRTs in a changing financial world

The rapid rise of SRTs reflects a shifting financial industry where banks increasingly seek new ways to manage credit risk and optimize capital. These instruments have already proven their ability to enhance efficiency and spur growth, particularly in Europe and now, increasingly, in the United States. However, the stakes are high, as the delicate balance between innovation and oversight becomes apparent.

SRTs offer a compelling case for how deregulation can fuel financial sector momentum, as seen in the optimism surrounding a potential second Trump administration. Yet, the growing complexities of these transactions, coupled with concern about non-bank investors' capacity to manage risk, underline the importance of vigilance. Without proper safeguards, the mechanisms designed to strengthen banks' balance sheets could introduce vulnerability that ripples across the broader financial system.

As the SRT market continues to evolve, its trajectory will depend on thoughtful regulation that encourages growth without compromising stability. With the financial sector poised to benefit from this niche market, policymakers and market participants alike must strike a careful balance to ensure SRTs fulfill their potential as a powerful yet sustainable tool for modern banking.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.