S&P 500 Stalls into September Options Expiry; Gold Reaches New All-Time High

S&P 500 Stalls into September Options Expiry; Gold Reaches New All-Time High

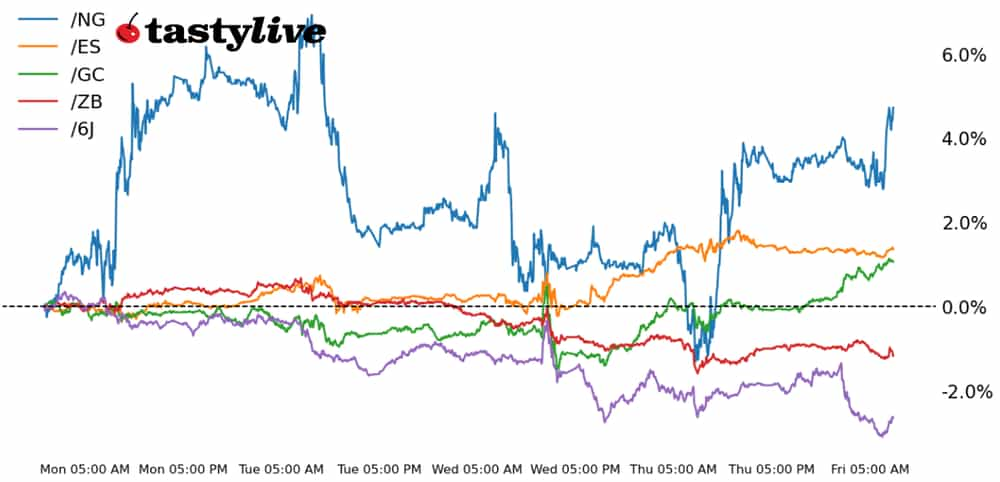

Also, 30-year T-bond, gold, natural gas and Japanese yen futures

S&P 500 E-mini futures (/ES): -0.08%

30-year T-bond futures (/ZB): +0.12%

Gold futures (/GC): +0.96%

Natural gas futures (/NG): +1.32%

Japanese yen futures (/6J): -0.66%

The upbeat mood following yesterday’s Federal Reserve’s interest rate cut faded today as traders took a pause to assess market conditions. Many are already claiming victory over a soft landing, and recent economic indicators such as jobless claims data show that could very well be the case. If so, it could help to lift equity markets higher in the coming weeks and months. The big risk for traders now is the upcoming presidential election. Elsewhere, the dollar strengthened on yen weakness, oil prices gave back some gains and copper prices pulled back after briefly touching a fresh two-month high.

Symbol: Equities | Daily Change |

/ESZ4 | -0.08% |

/NQZ4 | -0.11% |

/RTYZ4 | -0.21% |

/YMZ4 | +0.06% |

Traders are tapping the brakes after yesterday’s rosy performance in equity markets. S&P 500 contracts (/ESZ4) were down 0.29% ahead of the New York open. FedEx (FDX) fell 13% in pre-market trading after the global shipping company lowered its revenue guidance for the year, as customers opt for slower deliveries to save money. Nike (NKE) rose 8% ahead of the bell after a leadership shakeup. John Donahoe will step down and be replaced by Elliott Hill, a long-time company executive. Trump Media & Technology Group (DJT) fell 5.5% this morning, with traders worried about the lockup period ending, which would enable former President Donald Trump to sell his shares. DJT is set to record its worst week of trading since June, tracking for a nearly 20% loss.

Strategy: (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5690 p Short 5700 p Short 5810 c Long 5820 c | 15% | +375 | -125 |

Short Strangle | Short 5700 p Short 5810 c | 47% | +7287.50 | x |

Short Put Vertical | Long 5690 p Short 5700 p | 60% | +150 | -350 |

Symbol: Bonds | Daily Change |

/ZTZ4 | -0.01% |

/ZFZ4 | +0.01% |

/ZNZ4 | +0.07% |

/ZBZ4 | +0.12% |

/UBZ4 | +0.16% |

Bond yields rose across the curve today, extending the action from earlier in the week. Traders recalibrated their bets for rate cuts after seeing the Fed’s updated summary of economic projections (SEP) amid a strengthening economic backdrop. 30-year T-bond futures (/ZBZ4) was nearly unchanged at the New York open as prices swung between small losses and gains. Bond traders will digest PMI figures on Monday ahead of auctions for two-, five- and seven-year notes.

Strategy (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 123 p Short 124 p Short 126 c Long 127 c | 30% | 687.50 | -312.50 |

Short Strangle | Short 124 p Short 126 c | 55% | +2296.88 | x |

Short Put Vertical | Long 123 p Short 124 p | 67% | +328.13 | -671.88 |

Symbol: Metals | Daily Change |

/GCZ4 | +0.96% |

/SIZ4 | +0.83% |

/HGZ4 | +0.4% |

Gold traders are looking past a stronger dollar and higher yields this morning, instead focusing on the Fed’s path forward after they cut rates by a larger-than-expected 50 basis points (bps) this week. The path for gold clearly points higher, given that it is working against its typical headwinds with little effort. Next week brings some economic data but the rate cut path shouldn’t be influenced too much, given the amount of time until the next decision. Profit-taking is likely the only thing that will slow down the metal for now.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2600 p Short 2605 p Short 2665 c Long 2670 c | 20% | +390 | -110 |

Short Strangle | Short 2605 p Short 2665 c | 55% | +7320 | x |

Short Put Vertical | Long 2600 p Short 2605 p | 62% | +210 | -190 |

Symbol: Energy | Daily Change |

/CLZ4 | -0.38% |

/HOZ4 | -0.4% |

/NGZ4 | +1.32% |

/RBZ4 | -0.98% |

Natural gas futures (/NGV4) fell slightly this morning after recording a gain yesterday. Prices remain on track to record a small gain for the week of about 1%, assuming today’s price action holds steady. Yesterday, the Energy Information Administration (EIA) reported a 58 billion cubic feet injection for the week ending Sept. 13. That was near the top range of estimates. Today, Baker Hughes will release rig count data for oil and gas.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.15 p Short 2.2 p Short 2.5 c Long 2.55 c | 30% | +350 | -150 |

Short Strangle | Short 2.2 p Short 2.5 p | 60% | +2690 | x |

Short Put Vertical | Long 2.15 p

| 81% | +80 | -420 |

Symbol: FX | Daily Change |

/6AZ4 | -0.01% |

/6BZ4 | +0.3% |

/6CZ4 | +0.03% |

/6EZ4 | +0.08% |

/6JZ4 | -0.66% |

The Japanese yen is on track to record one of its biggest weekly losses of the year after the Bank of Japan (BOJ) held interest rates steady. That decision disappointed some bulls who expected the BOJ to hike rates. The hawkish tone that some expected from Gov. Kazuo Ueda further disappointed yen bulls.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0069 p Short 0.00695 p Short 0.0071 c Long 0.00715 c | 26% | +450 | -175 |

Short Strangle | Short 0.00695 p Short 0.0071 c | 56% | +2337.50 | x |

Short Put Vertical | Long 0.0069 p

| 65% | +250 | -375 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.