S&P 500 Slumps as $4.5 Trillion of Options Expire on March Quad Witching

S&P 500 Slumps as $4.5 Trillion of Options Expire on March Quad Witching

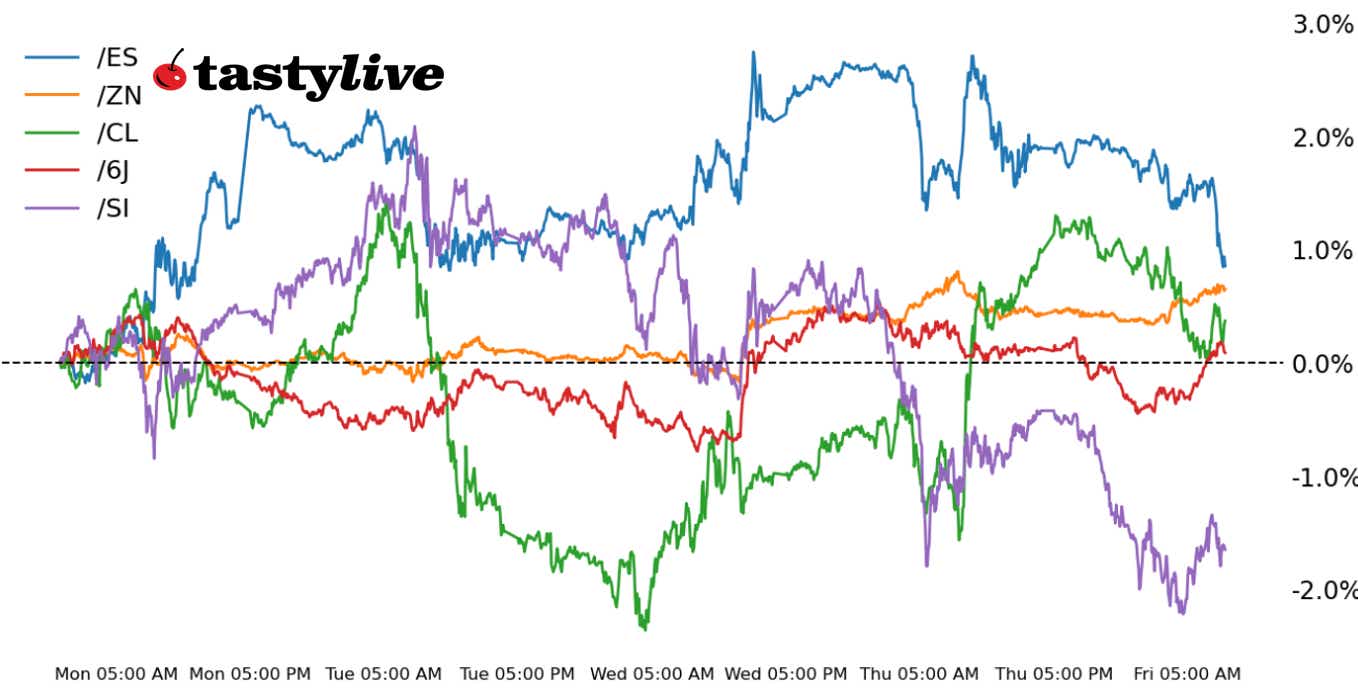

Also, 10-year T-note, silver, crude oil and Japanese yen futures

- S&P 500 E-mini futures (/ES): -0.87%

- 10-year T-note futures (/ZN): +0.2%

- Silver futures (/GC): -1.21%

- Crude oil futures (/CL): -0.59%

- Japanese yen futures (/6J): -0.04%

About $4.5 trillion of options are set to expire today as quad witching Friday has arrived. A quick scan of order flow shows top of book depth in the equity index futures is fairly light, which may be setting us up for a day of meaningful two-sided action. The sell-off in stocks is helping bonds find new favor after yesterday’s ugly reversal, while traders have likewise jettisoned some of their metals positioning (although given the year-to-date performances, it would appear to be profit-taking tied to today’s options expiries).

Symbol: Equities | Daily Change |

/ESM5 | -0.87% |

/NQM5 | -1.22% |

/RTYM5 | -1.18% |

/YMM5 | -0.92% |

S&P 500 futures (/ESM5) fell nearly 1% this morning, but prices are on track to record the first gain in over four weeks. FedEx (FDX) fell 10% in pre-market trading after the global shipping company cut its profit outlook. Nike (NKE) fell 8% ahead of the bell after the company warned that tariffs could hit the business. Tesla (TSLA) was slightly weaker this morning after receiving a downgrade from Morgan Stanley’s Adam Jonas.

Strategy: (40DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5575 p Short 5600 p Short 5750 c Long 5775 c | 19% | +975 | -275 |

Short Strangle | Short 5600 p Short 5750 c | 50% | +9550 | x |

Short Put Vertical | Long 5575 p | 60% | +407.50 | -850 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.06% |

/ZFM5 | +0.17% |

/ZNM5 | +0.2% |

/ZBM5 | +0.21% |

/UBM5 | +0.08% |

The risk-off tone to end the week is pushing yields lower, as growth concerns move back into focus after the weak corporate results from Wall Street. 10-year T-note futures (/ZNM5) rose 0.14% in early trading. The underlying yield is now trading at 4.214%, which is near a floor in place since October. Traders will shift their focus to inflation data next week via the personal consumption expenditures (PCE) index.

Strategy (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 110 p Short 110.5 p Short 112 c Long 112.5 c | 37% | +312.50 | -187.50 |

Short Strangle | Short 110.5 p | 59% | +1046.88 | x |

Short Put Vertical | Long 110 p Short 110.5 p | 75% | +156.25 | -343.75 |

Symbol: Metals | Daily Change |

/GCJ5 | -0.52% |

/SIK5 | -1.21% |

/HGK5 | -0.99% |

Silver futures (/SIK5) fell 0.86% in early trading. The metal is on track to snap a two-week win streak, with prices down 2% from the start of the week. The May contract is now trading at its 21-day exponential moving average (EMA), which aligns with a swing high from earlier this month. The divergence from gold prices has pushed the gold/silver ratio above 91, near the highest level since September 2022. That said, it might be a good time to get long the metal for traders who believe that the dollar decline will resume next week.

Strategy (34DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 32.5 p Short 32.75 p Short 34.25 c Long 34.5 c | 23% | +915 | -335 |

Short Strangle | Short 32.75 p Short 34.25 c | 52% | +7580 | x |

Short Put Vertical | Long 32.5 p Short 32.75 p | 60% | +505 | -745 |

Symbol: Energy | Daily Change |

/CLK5 | -0.59% |

/HOJ5 | -0.55% |

/NGJ5 | +1.11% |

/RBJ5 | -0.8% |

Crude oil futures (/CLK5) fell today but prices are on track to record a second weekly gain. The losses this morning come despite newly announced U.S. sanctions on Iran that target the country’s oil exports. President Trump has vowed to destroy Iran’s oil export business, and the new round of sanctions is the fourth levied by the new administration. Meanwhile, OPEC is moving to enforce production quotas that could see the group produce less oil going forward despite a pledge to release more spare capacity starting next month. Still, with the growth risks facing the global economy, the risk to oil remains skewed to the downside.

Strategy (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 65.5 p Short 69.5 c Long 70 c | 20% | +380 | -120 |

Short Strangle | Short 66 p Short 69.5 c | 53% | +4210 | x |

Short Put Vertical | Long 65.5 p Short 66 p | 58% | +200 | -300 |

Symbol: FX | Daily Change |

/6AM5 | -0.42% |

/6BM5 | -0.26% |

/6CM5 | -0.26% |

/6EM5 | -0.14% |

/6JM5 | -0.04% |

Japanese yen futures (/6JM5) trimmed overnight losses to trade nearly flat going into the U.S. trading session. Prices held above the 21-day EMA after bulls defended prices earlier this week at the early February swing high. Technically, the uptrend for the yen remains in place, and the policy divergence between the Fed and the Bank of Japan (BOJ) is expected to remain supportive for yen buying.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00665 p Short 0.0067 p Short 0.00685 c Long 0.0069 | 32% | +412.50 | -212.50 |

Short Strangle | Short 0.0067 p Short 0.00685 c | 57% | +1675 | x |

Short Put Vertical | Long 0.00665 p | 71% | +225 | -400 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.