S&P 500 Slammed Lower as Trump Fires First Shots in Global Trade War

S&P 500 Slammed Lower as Trump Fires First Shots in Global Trade War

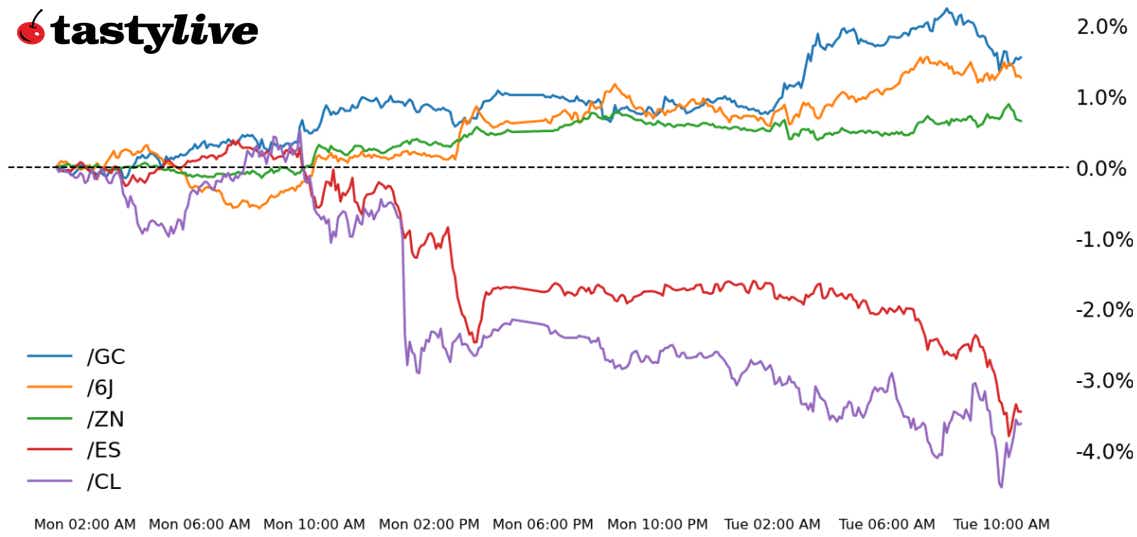

Also 10-year T-note, gold, crude oil, and Japanese yen futures

- S&P 500 E-mini futures (/ES): -1.5%

- 10-year T-note futures (/ZN): +0.27%

- Gold futures (/GC): +0.53%

- Crude oil futures (/CL): -1.48%

- Japanese yen futures (/6J): +1.31%

A lot of people are saying that trade wars are good and easy to win. Markets didn’t get the memo today. Stocks were slammed across the board as the first shots of a new global trade war were fired last night, when the U.S. implemented 25% tariffs against Canada and Mexico while slapping another 10% tariff on China—all of which brought immediate reprisals. Concern about growth remains ascendant, with bond yields down across the curve as oil prices drop. The Japanese yen and gold are among the top performers. By now, you get the picture: It’s a classic risk-off day.

Symbol: Equities | Daily Change |

/ESH5 | -1.5% |

/NQH5 | -1.17% |

/RTYH5 | -1.55% |

/YMH5 | -2.11% |

S&P 500 futures are now lower than where they were on election day back in early November. The trade war between the U.S. and its major trading partners ramped up overnight after Trump announced 25% duties on goods from Canada and Mexico would take effect at midnight. S&P 500 futures (/ESH5) dropped nearly 2% in early trading, with losses extending to all S&P 500 sectors, excluding consumer staples. Auto makers were hard hit despite a statement from a lobbying group claiming they would be exempt if they comply with the 2020 United States-Mexico-Canada Agreement (USMCA). General Motors (GM) fell 4% in early trading.

Strategy: (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5700 p Short 5725 p Short 5925 c Long 5950 c | 18% | +975 | -250 |

Short Strangle | Short 5725 p Short 5925 c | 48% | +12462.50 | x |

Short Put Vertical | Long 5700 p Short 5725 p | 59% | +350 | -875 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.17% |

/ZFM5 | +0.27% |

/ZNM5 | +0.27% |

/ZBM5 | +0.13% |

/UBM5 | -0.17% |

The risk-off move in equity markets pushed traders into safe-haven assets, which caused a bid across the Treasury curve. The 10-year T-note futures (/ZNM5) rose 0.27% in early trading, which pushed the underlying yield to the lowest level traded since Oct. 21. Several events could influence the bond market this week, with Trump scheduled to address Congress later today, and we’ll also get the Federal Reserve’s Beige Book tomorrow before traders shift their focus to Friday’s jobs report.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 110.5 p Short 111 p Short 112.5 c Long 113 c | 32% | +359.38 | -140.63 |

Short Strangle | Short 111 p Short 112.5 c | 63% | +1687.50 | x |

Short Put Vertical | Long 110.5 p Short 111 p | 73% | +187.50 | -312.50 |

Symbol: Metals | Daily Change |

/GCJ5 | +0.53% |

/SIK5 | -0.5% |

/HGK5 | -1.27% |

A drop in the dollar and Treasury yields opened some upside for precious metals, with gold prices (/GCJ5) rising over 0.5% this morning. Gold prices extended a pullback from last week on Monday before prices moderated. The safe-haven asset remains in a technically constructive position as prices hover just below recent all-time highs. The bet could pay off if tariffs are short-lived, but if the economy starts to show more signs of distress, it could bring a liquidation type of trade back to the table, which would likely complicate gold’s path higher.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2900 p Short 2905 p Short 2995 c Long 3000 c | 20% | +400 | -100 |

Short Strangle | Short 2905 p Short 2995 c | 56% | +10320 | x |

Short Put Vertical | Long 2900 p Short 2905 p | 62% | +220 | -290 |

Symbol: Energy | Daily Change |

/CLJ5 | -1.48% |

/HOJ5 | +0.33% |

/NGJ5 | +8.35% |

/RBJ5 | -0.96% |

Crude oil prices joined the sell-off, with prices dropping over 1% through the morning trading session. OPEC+ is expected to move forward with an increase in output in April, which will put more supply onto an already fragile market. Meanwhile, tariffs are expected to hit economic growth. The withdrawal of U.S. support for Ukraine is expected to force a negotiation to end the war with Russia, which is impacting oil prices to the downside, as a peace deal would remove geopolitical tensions from the market.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 65 p Short 65.5 p Short 68.5 c Long 69 c | 21% | +390 | -110 |

Short Strangle | Short 65.5 p Short 68.5 c | 56% | +4150 | x |

Short Put Vertical | Long 65 p Short 65.5 p | 59% | +180 | -320 |

Symbol: FX | Daily Change |

/6AH5 | -0.26% |

/6BH5 | +0.21% |

/6CH5 | 0% |

/6EH5 | +0.51% |

/6JH5 | +1.31% |

Traders are getting more bullish on the yen, with contracts (/6JH5) up over 1% this morning. The Bank of Japan is expected to take a more decisive path on rate hikes this year as inflation pressures in the economy increase, primarily through wage hikes. The commitments of traders report (COT) showed long bets on the yen among non-commercial traders, otherwise known as speculators, soared to nearly 100,000 for the week ended Feb. 25, increasing from 61,000.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0067 p Short 0.00675 p Short 0.0069 c Long 0.00695 c | 40% | +412.50 | -212.50 |

Short Strangle | Short 0.00675 p Short 0.0069 c | 66% | +1550 | x |

Short Put Vertical | Long 0.0067 p Short 0.00675 p | 69% | +225 | -400 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.