S&P 500, Russell 2000 Surge as Inflation Doesn’t Surprise Higher

S&P 500, Russell 2000 Surge as Inflation Doesn’t Surprise Higher

Also, 10-year T-note, silver, crude oil and Japanese yen futures

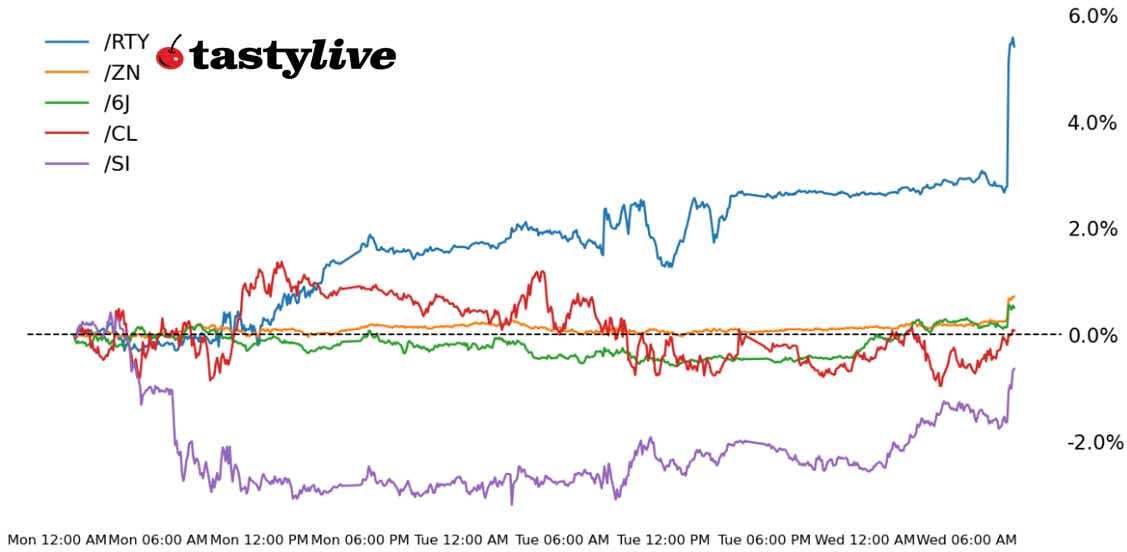

- Russell 2000 E-mini futures (/RTY): +2.87%

- 10-year T-note futures (/ZN): +0.71 %

- Silver futures (/SI): +2.52%

- Crude oil futures (/CL): +1.05%

- Japanese yen futures (/6J): +1%

Relief is the mood on Wall Street this morning following the release of the December U.S. inflation report. The consumer price index came in mostly in line with forecasts, with headline inflation meeting expectations at 0.4% month over month (m/m) and 2.9% year over year (y/y). However, the spark came from the core readings coming in marginally weaker at 0.2% m/m and 3.2% y/y; the m/m reading was expected at 0.3%.

The scope of the “beat” may seem small, but for a market that has been increasingly fearful of inflation, the lack of upside surprise constitutes a victory, at least in the short-term. Coming into today, the VIX1D was 22.48, the highest reading for the day ahead of an inflation report going back to 2022. The scale of the reaction to the “beat” likewise is worth monitoring, as the internals of the report suggest inflation is settling into a 0.2% m/m run-rate, which translates into y/y gains north of the Fed's 2% medium-term target.

The initial reaction boosted stock futures, and bond yields plunged. For equities, the Russell 2000 has emerged as the leader, though each of the four indexes are effectively back to where they were early last week. For bonds, this is a legitimate dose of good news, so price action today deserves close attention: Recent “good” news has not led to a sustainable rally; if today is different, then a regime change may be afoot. If so, the U.S. dollar may be in trouble.

Symbol: Equities | Daily Change |

/ESH5 | +1.52% |

/NQH5 | +1.76% |

/RTYH5 | +2.87% |

/YMH5 | +1.61% |

Stock futures rallied after this morning’s inflation report eased concern about the future of Federal Reserve interest rate cuts. Small-cap stocks benefited from the change in interest rate expectations, with Russell 2000 futures (/RTYH5) rising over 3% this morning. JPMorgan (JPM) reported record-breaking annual profit this morning, citing a big rebound in investment banking revenue. Wells Fargo (WFC) also rose in pre-market trading after reporting its own impressive results. It puts a positive spin on the start of earnings season, which should help to bolster sentiment going into next week when more companies report.

Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2225 p Short 2250 p Short 2325 c Long 2350 c | 23% | +925 | -325 |

Short Strangle | Short 2250 p Short 2325 c | 51% | +4720 | x |

Short Put Vertical | Long 2225 p Short 2250 p | 61% | +435 | -815 |

Symbol: Bonds | Daily Change |

/ZTH5 | +0.17% |

/ZFH5 | +0.45% |

/ZNH5 | +0.71% |

/ZBH5 | +1.27% |

/UBH5 | +1.46% |

Treasury yields rose across the curve following the inflation report. January put a bearish start on bond prices, extending the trend from the last few months of 2024. The 10-year T-note futures (/ZNG5) rose 0.57% ahead of the New York open, the largest daily percentage gain since November. The move in yields tells markets the Fed has more room to cut later this year. The Treasury will auction 17-week bills today.

Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 107.5 p Short 109 c Long 109.5 c | 32% | +312.50 | -187.50 |

Short Strangle | Short 107.5 p Short 109 c | 51% | +1062.50 | x |

Short Put Vertical | Long 107 p Short 107.5 p | 71% | +156.25 | -343.75 |

Symbol: Metals | Daily Change |

/GCG5 | +1.28% |

/SIH5 | +2.52% |

/HGH5 | +0.4% |

Silver futures (/SIH5) rose over 2% today as the dollar and Treasury yields fell. This is gold's biggest daily move so far this year and follows several days of losses when a stronger dollar worked against the metal. A softer dollar makes the metal cheaper for foreign purchasers to buy. President-elect Trump will be sworn in next week, and markets are focused on how and when his administration will implement tariffs, which could impact the inflation outlook—a key component for silver prices.

Strategy (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 30.25 p Short 30.5 p Short 31.75 c Long 32 c | 22% | +970 | -280 |

Short Strangle | Short 30.5 p Short 31.75 c | 55% | +8160 | x |

Short Put Vertical | Long 30.25 p Short 30.5 p | 59% | +580 | -670 |

Symbol: Energy | Daily Change |

/CLH5 | +1.05% |

/HOG5 | +0.2% |

/NGG5 | +0.33% |

/RBG5 | +2.41% |

Crude oil prices (/CLH5) are trading back near four-month highs after trimming overnight losses. The market remains focused on possible supply disruptions following the newest round of U.S. sanctions on Russia. They make it harder around the world to find buyers for Russian cargo, but this could be a temporary disruption because Moscow will likely adjust its strategy to sidestep sanctions, as they’ve done before. The Energy Information Administration (EIA) will release inventory data today.

Strategy (40DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 70 p Short 71.5 p Short 84.5 c Long 86 c | 62% | +430 | -1070 |

Short Strangle | Short 71.5 p Short 84.5 c | 70% | +1620 | x |

Short Put Vertical | Long 70 p Short 71.5 p | 76% | +300 | -1200 |

Symbol: FX | Daily Change |

/6AH5 | +0.93% |

/6BH5 | +0.85% |

/6CH5 | +0.42% |

/6EH5 | +0.45% |

/6JH5 | +1% |

Japanese yen futures (/6JH5) surged the most since November after this morning’s CPI report cleared a path for the U.S. central bank to cut rates later this year. Meanwhile, market bets on more tightening from the Bank of Japan (BOJ) increased overnight after BOJ Gov. Kazuo Ueda said wages are likely increasing, according to his own personal insight. There is now a more likely chance than not the BOJ will hike rates this month.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00605 p Short 0.0062 p Short 0.00665 c Long 0.0068 c | 64% | +412.50 | -1462.50 |

Short Strangle | Short 0.0062 p Short 0.00665 c | 68% | +712.50 | x |

Short Put Vertical | Long 0.00605 p Short 0.0062 p | 85% | +175 | -1700 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.