S&P 500, Nasdaq 100 Reach New Highs as Low Volumes Persist

S&P 500, Nasdaq 100 Reach New Highs as Low Volumes Persist

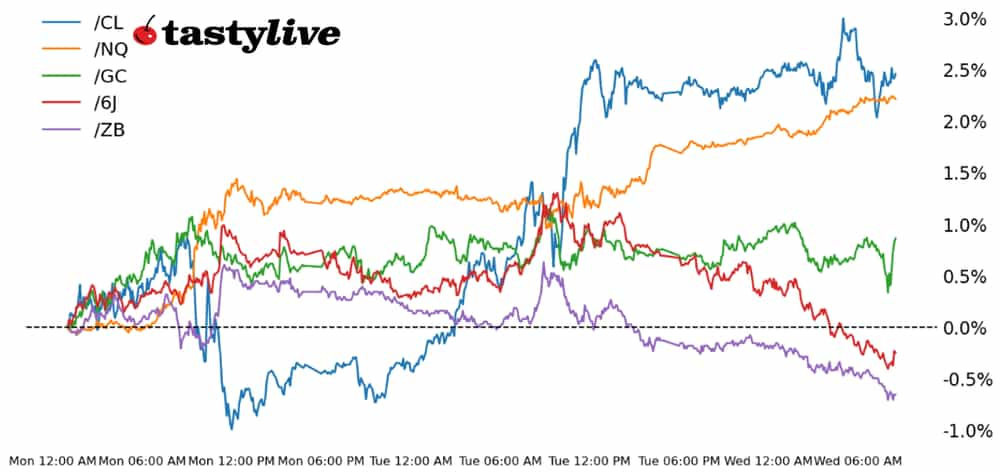

Also, 30-year T-bond, gold, crude oil and Japanese yen futures

- Nasdaq 100 E-mini futures (/ES): +0.28%

- 30-year T-Bond futures (/ZB): -0.66%

- Gold futures (/GC): -0.23%

- Crude oil futures (/CL): +0.17%

- Japanese yen futures (/6J): -0.93%

The start of the week has been defined by numerous significant events: the collapse of the French government; an attempted coup (“martial law”) in South Korea; and just this morning, the CEO of UnitedHealthcare was murdered in Manhattan.

And yet, none of these developments seem to be making traders blink, let alone trade: the past two days were the lowest volume days for stocks thus far in 2024. Price action on Wednesday is producing more strength in equity markets led by mega cap tech, while the U.S. Dollar is mostly higher versus its peers.

Symbol: Equities | Daily Change |

/ESZ4 | +0.28% |

/NQZ4 | +0.66% |

/RTYZ4 | +0.21% |

/YMZ4 | +0.39% |

The Nasdaq 100 (/NQZ4) remains the leader this week, with gains on Wednesday pushing the tech-heavy index to new all-time highs. Volatility remains exceptionally low (IVR: 3.8), momentum remains positive (the slopes of moving averages are rising), and volume remains at the lowest levels of the year. Melt-up conditions are in play for now, but a wave of macro risk over the coming days (Powell speech, NFP) could help shake traders out of their slumber.

Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 20250 p Short 20500 p Short 22750 c Long 23000 c | 62% | +1125 | -3875 |

Short Strangle | Short 20500 p Short 22750 c | 68% | +4260 | x |

Short Put Vertical | Long 20250 p Short 20500 p | 84% | +540 | -4460 |

Symbol: Bonds | Daily Change |

/ZTH5 | -0.02% |

/ZFH5 | -0.17% |

/ZNH5 | -0.27% |

/ZBH5 | -0.66% |

/UBH5 | -0.91% |

Treasuries have been at the whims of headline risk this week, given the light auction schedule and lack of meaningful U.S. economic data up to this point this week—which will change starting later today when Fed Chair Powell speaks at 1:45pm ET/12:45pm CT. If the South Korean coup attempt helped provoke a move higher in bonds on Tuesday, then the quick resolution to the matter may be leading to an unwind today.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 112 p Short 114 p Short 123 c Long 125 c | 66% | +500 | -1500 |

Short Strangle | Short 114 p Short 123 c | 71% | +1000 | x |

Short Put Vertical | Long 112 p Short 114 p | 85% | +265.63 | -1734.38 |

Symbol: Metals | Daily Change |

/GCG5 | -0.23% |

/SIH5 | +0.25% |

/HGH5 | -0.48% |

Both base and precious metals are chopping around on Wednesday, refusing to make meaningful directional progress after landing at significant technical support in recent days. For both gold (/GCG5) and silver prices (/SIH5), a marked decline in volatility in recent weeks has been a bearish omen for price action, and the continued state of contracting volatility portends difficulty in staging a meaningful low; conversely, expanding volatility would be welcomed for metals bulls.

Strategy (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2500 p Short 2525 p Short 2825 c Long 2850 c | 66% | +650 | -1850 |

Short Strangle | Short 2525 p Short 2825 c | 73% | +2880 | x |

Short Put Vertical | Long 2500 p Short 2525 p | 85% | +330 | -2170 |

Symbol: Energy | Daily Change |

/CLF5 | +0.17% |

/HOF5 | -0.32% |

/NGF5 | -1.18% |

/RBF5 | +0.29% |

After several days of significant swings, energy markets are relatively quiet on Wednesday. Natural gas prices (/NGF5) have produced their first trading day without a move in excess of +/-2% for the first time since Nov. 19. Crude oil prices (/CLF5) have been trapped in a tight range between 66.5 and 72.5 for nearly six weeks, and today’s moves haven't been meaningful enough to warrant a shift towards a directional bias.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 62 p Short 64 p Short 78 c Long 80 c | 65% | +420 | -1580 |

Short Strangle | Short 64 p Short 78 c | 70% | +1330 | x |

Short Put Vertical | Long 62 p Short 64 p | 79% | +270 | -1730 |

Symbol: FX | Daily Change |

/6AZ4 | -1.1% |

/6BZ4 | +0.06% |

/6CZ4 | +0.06% |

/6EZ4 | -0.15% |

/6JZ4 | -0.93% |

Lackluster GDP data from Australia and the continued sluggishness of the Chinese economy have proved too great a burden for the Australian dollar (/6AZ4) on Wednesday. The quick reversal of martial law in South Korea likewise has provoked an unwind of positions in the regional safe haven, the Japanese yen (/6JZ4). Eyes are on France today as a no-confidence vote is being held that could result in the collapse of the government, thrusting the Eurozone’s second-largest economy back into political turmoil; the lack of reaction in the euro (/6EZ4) suggests the news is already discounted.

Strategy (65DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0062 p Short 0.00635 p Short 0.00695 c Long 0.0071 c | 64% | +450 | -1425 |

Short Strangle | Short 0.00635 p Short 0.00695 c | 69% | +937.50 | x |

Short Put Vertical | Long 0.0062 p Short 0.00635 p | 89% | +150 | -1725 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.