S&P 500 and Nasdaq 100 Futures Retain Bullish Momentum

S&P 500 and Nasdaq 100 Futures Retain Bullish Momentum

Both have hit fresh record highs over the past 24-hours, while the Dow Jones 30 did it just last week

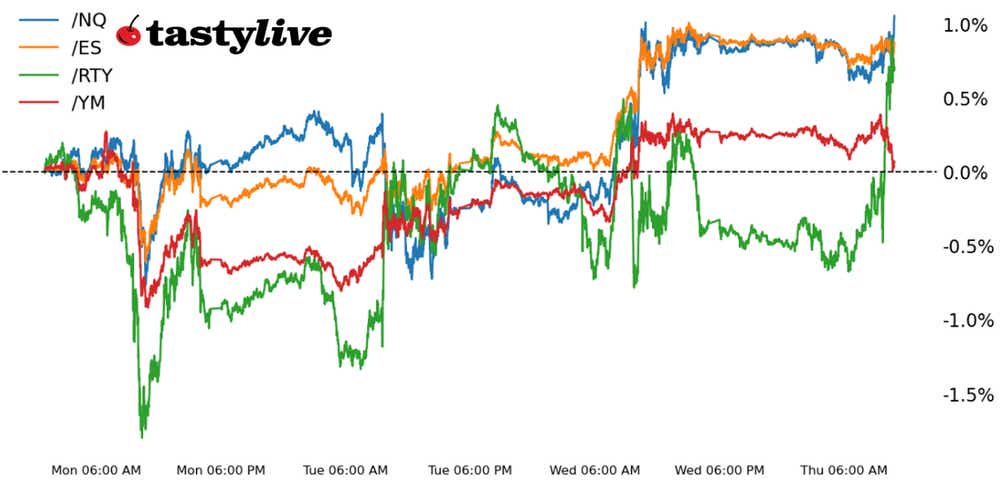

● U.S. stock markets remain in positive territory, working on their fifth straight week of gains.

● The S&P 500 (/ESH4) set an all-time high yesterday, while the Nasdaq 100 (/NQH4) reached a fresh all-time high today.

● The Russell 2000 (/RTYH4) is showing technical resiliency within a recent consolidation.

Market update: S&P 500 up 2.29% month-to-date

Earnings growth may be modest (1.6% year-over-year blended growth rate thus far for 4Q ’23) and the Federal Reserve may not be cutting rates as soon or as deep as previously anticipated (100 basis points of cuts beginning in May as opposed to 150 bps of cuts beginning in March), but U.S. equity markets don’t seem to care.

Both the S&P 500 (/ESH4) and Nasdaq 100 (/NQH4) have hit fresh record highs over the past 24-hours, while the Dow Jones 30 (/YMH4) did so just last week. Technical momentum remains by-and-large bullish, save for in the Russell 2000 (/RTYH4), where a multi-week consolidation has prevailed.

As we’ve been noting for several weeks now, it remains the case that “markets at fresh all-time closing highs demand respect.”

/ES S&P 500 Price Technical Analysis: Daily Chart (June 2023 to February 2024)

The S&P 500 (/ESH4) is trading sideways today, having established a fresh record high just yesterday. The inverse head and shoulder’s pattern eyed since mid-January, which called for “a gain into 4981,” has been completed. Accordingly, traders should be approaching /ESH4 on a pure momentum basis (e.g. no defined target).

Momentum remains firmly bullish. /ESH4 is above its daily 5-, 13- and 21- EMA (exponential moving average) envelope, which is in bullish sequential order. Slow stochastics are trending higher into overbought territory, while MACD (moving average convergence/divergence) is trending higher while above its signal line. As has been the case for the past two weeks, “with volatility declining, traders may prefer long ATM (at-the-money) call spreads as opposed to short OTM (out-of-the-money) put spreads as a way to express a bullish point of view.”

/NQ Nasdaq 100 Price Technical Analysis: Daily Chart (July 2023 to February 2024)

The Nasdaq 100 (/NQH4) broke out of an ascending triangle consolidation yesterday, setting a fresh all-time high in the process. Like /ESH4, /NQH4 is also above its daily 5-, 13- and 21-EMA envelope, which is in bullish sequential order. Slow stochastics are trending higher in overbought territory, while MACD is similarly trending higher while above its signal line. Accordingly, it remains the case that “with volatility declining, traders may prefer long ATM call spreads as opposed to short OTM put spreads as a way to express a bullish point of view in /NQH4.”

/RTY Russell 2000 Price Technical Analysis: Daily Chart (July 2023 to February 2024)

An alternative perspective on the Russell 2000 (/RTYH4) may be coming together as a symmetrical triangle appears to have been carved out since earlyDecember. If this is the primary thrust, then the recent break of the uptrend from the November 2023, December 2023 and January 2024 swing lows may be of little consequence.

While a symmetrical triangle following an uptrend is typically viewed as a part of a bullish continuation effort, traders should remain open minded about a directional break in either direction, given the fact that a symmetrical triangle may duly be a neutral pattern. Instead of looking at long/short call/put spreads, the relatively elevated volatility may cater to deploying range strategies (short strangles or iron condors) around the December low at 1865 and the December high at 2097 that define the initiation of the triangle.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.