S&P 500, Nasdaq 100 Extend Gains as FOMC Preaches Patience

S&P 500, Nasdaq 100 Extend Gains as FOMC Preaches Patience

... but, FOMC statement indicated that the time for the cut cycle to begin is approaching.

The Federal Reserve did not change its main rate, as anticipated, but the FOMC statement indicated that the time for the cut cycle to begin is approaching.

Fed Chair Powell suggested that if data continue along their current path, the September FOMC meeting would be a ‘live meeting’ – a rate cut is then possible.

Additionally, Fed Chair Powell noted that the FOMC was unanimous in their decision today.

Market Update: S&P 500 up +1.12% month-to-date

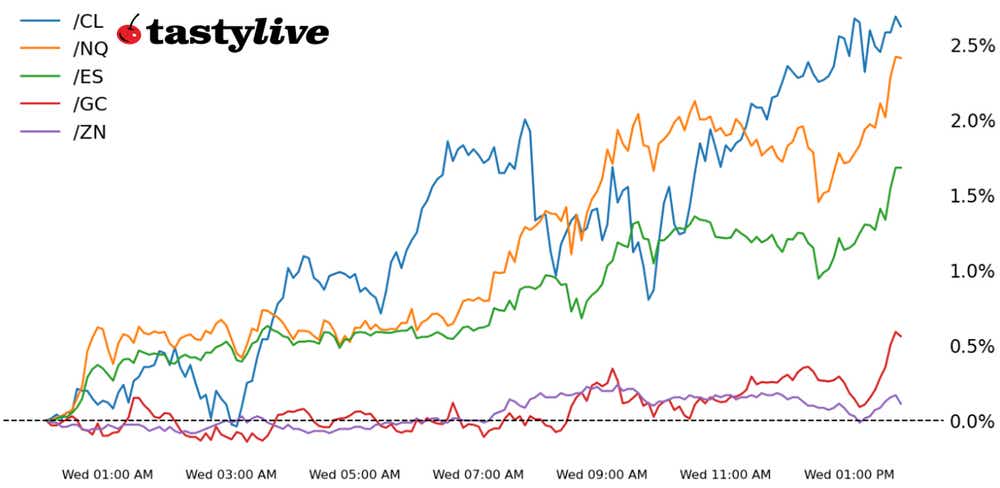

The Federal Reserve’s July rate decision has come and gone without disturbing markets pre-decision trajectory. U.S. equity markets are sitting near their highs of the day, with the Nasdaq 100 (/NQU4) up by over +3% and both the S&P 500 (/ESU4) and Russell 2000 (/RTYU4) nipping on its heels. Bonds are cooling off a bit, though that shouldn’t be surprised considering that there was a small chance of a 25-bps rate cut today, and about a 10% chance of a 50-bps rate cut in September.

Why no change? Fed Chair Powell, in his press conference, noted that policymakers believe that data are trending in the right direction but they haven’t arrived at the junction to declare that the time to cut is now. Fed Chair Powell did say, however, that if the data continue to trend in current direction, the FOMC might have enough confidence to start cutting rates in September this year. Conversely, if inflation proves sticky over the next two reports, then a September cut might not materialize.

Perhaps most importantly, Fed Chair Powell confirmed the shift in language in the policy statement: “the economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.” With the July U.S. nonfarm payrolls report due out on Friday, any significant miss could solidify expectations of a September cut.

Reading between the lines, it’s clear that the FOMC doesn’t want to fall into the trap that the European Central Bank currently finds itself in: the ECB has started its cut cycle, but is now stuck waiting for more information to see if that was the right decision.

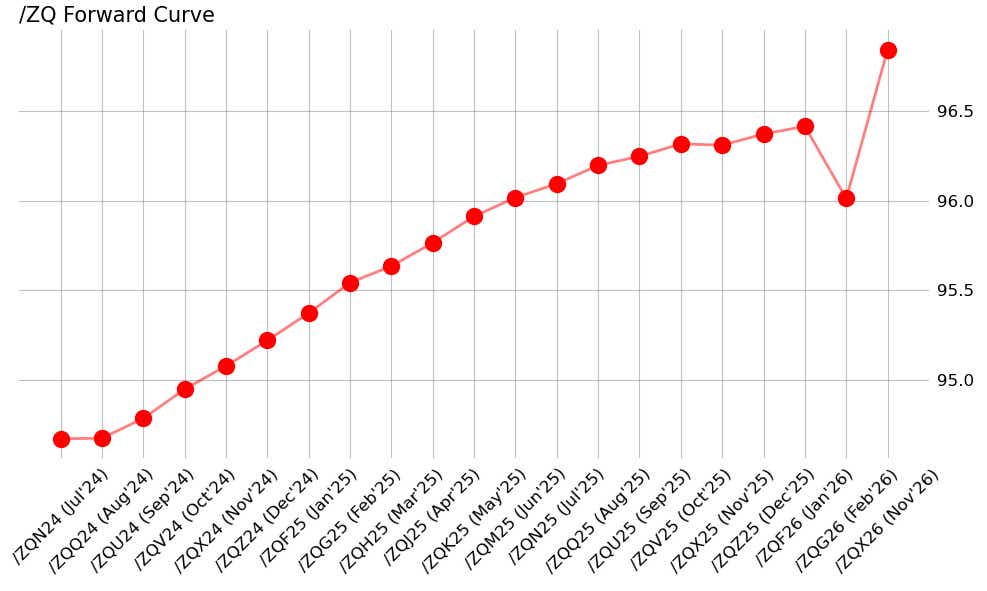

/ZQ Fed Funds Futures Forward Curve (July 2024 to December 2026)

Rates markets have started to adjust to the rate cut cycle starting in September 2024 with a 25-bps rate cut: the /ZQU4 contract is now pricing a Fed funds rate of 5.220%, up from 5.205% yesterday. A further adjustment in rate expectations may prove to be a short-term stumbling block for bonds (which is why bond bulls’ mantra should be ‘time in the market, not timing the market’), even as Fed rate cut cycles are typically bullish for the bond market.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.