Jobs Data Beats Forecasts, Making S&P 500 Futures Slide and Bonds Retreat

Jobs Data Beats Forecasts, Making S&P 500 Futures Slide and Bonds Retreat

Also, 10-year T-note, gold, crude oil and Japanese yen futures

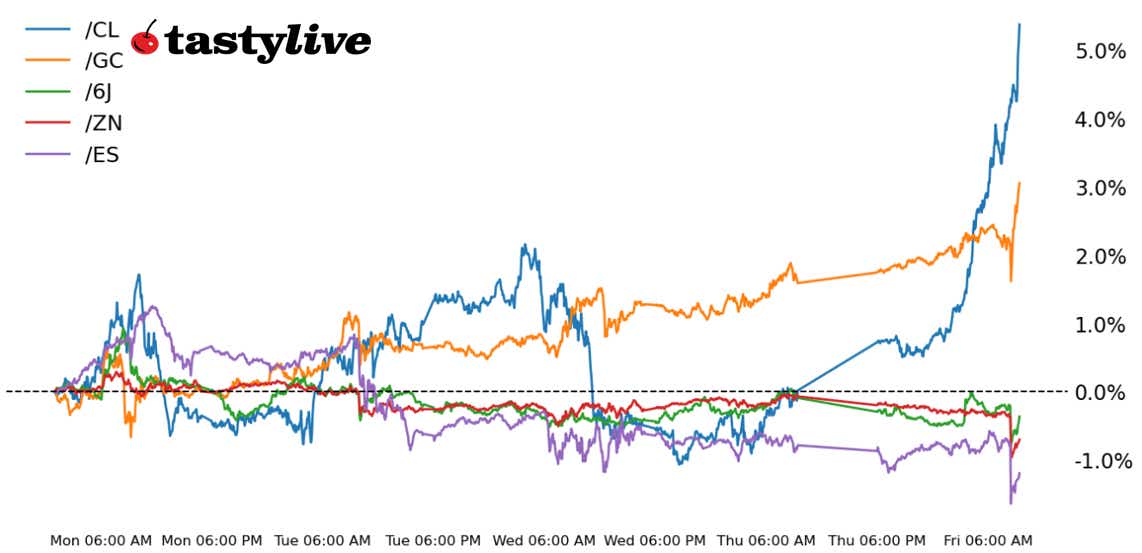

- S&P 500 E-mini futures (/ES): -1.19%

- 10-year T-note futures (/ZN): -0.46%

- Gold futures (/GC): +1.32%

- Crude oil futures (/CL): +4.37%

- Japanese yen futures (/6J): +0.05%

The December U.S. nonfarm payrolls showed 256,000 jobs added last month, well above the 160,000 consensus forecast. While traders had downplayed recent monthly jobs figures because of hurricanes and strikes, the December print represents the first set of relatively untainted data since September.

Treating the headline jobs growth as a more reliable indicator, traders are likewise looking to the internals and seeing signs of a still-resilient labor market. The U3 unemployment fell to 4.1% from 4.2% as expected, while the household employment survey showed 478,000 more jobs. Wages didn't surprise, coming in at the expected gain of 0.3% month over month, although they dipped to 3.9% year over year vs. the 4% gain expected on the headline.

The Sahm Rule indicator, which suggests a recession has started once the unemployment rate rises by more than 0.5% relative to the minimum of the three-month averages from the previous 12 months, dipped to 0.4% from 0.43%; the recession condition triggered over the summer has been absent for the past three consecutive jobs reports.

Overall, traders have taken the data as a sign that ongoing strength in the U.S. economy, particularly the labor market, will make it difficult for the Federal Reserve to push forward with its rate cut cycle in the short term. Per Fed funds futures, only one 25-basis-point (bps) rate cut is discounted for all of 2025, and it is set to arrive in October.

Symbol: Equities | Daily Change |

/ESH5 | -1.19% |

/NQH5 | -1.5% |

/RTYH5 | -1.89% |

/YMH5 | -0.88% |

Equity traders didn’t like the jobs numbers this morning because they make it harder for the Fed to keep cutting rates. S&P 500 futures (/ESH5) fell over 1% following the data release but trimmed some of those losses heading into the opening bell. Delta Air Lines (DAL) rose over 6% in pre-market trading after posting strong guidance during its fourth quarter earnings. Walgreens Boots Alliance (WBA) surged 15% ahead of the bell after the drugstore chain reported strong first-quarter revenue.

Strategy: (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5810 p Short 5820 p Short 5970 c Long 5975 c | 60% | +275 | -217.50 |

Short Strangle | Short 5820 p Short 5970 c | 48% | +9700 | x |

Short Put Vertical | Long 5810 p Short 5820 p | 59% | +162.50 | -342.50 |

Symbol: Bonds | Daily Change |

/ZTH5 | -0.14% |

/ZFH5 | -0.31% |

/ZNH5 | -0.46% |

/ZBH5 | -0.56% |

/UBH5 | -0.54% |

Yields rose across the curve as a resilient labor market weighed down bets on further cutting from the Federal Reserve. The 10-year T-bond futures contract (/ZNH5) fell 0.50% just ahead of the New York open. Some analysts are already calling for the Fed to be finished after one more cut this year. That may be the case as financial conditions in the economy tighten down on the Fed’s need to loosen policy further. Across the curve we’re seeing a bear flattener.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106.5 p Short 107 p Short 108.5 c Long 109 c | 30% | +312.50 | -187.50 |

Short Strangle | Short 107 p Short 108.5 c | 51% | +1140.63 | x |

Short Put Vertical | Long 106.5 p

| 71% | +156.25 | -343.75 |

Symbol: Metals | Daily Change |

/GCG5 | +1.32% |

/SIH5 | +1.98% |

/HGH5 | +0.75% |

Gold crossed above the 2,700 mark for the first time since Dec. 13. A haven move from the selloff in equities is likely helping to fuel speculation for the metal ahead of the weekend. Meanwhile, traders remain concerned about fiscal policy ahead of President-elect Donald Trump’s new administration. The higher yields post-jobs report did little to stop gold’s advance, which means traders are likely more focused on the upcoming tariffs and their potential to ignite some inflation.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2690 p Short 2695 p Short 2775 c Long 2780 c | 23% | +380 | -120 |

Short Strangle | Short 2695 p Short 2775 c | 58% | +8170 | x |

Short Put Vertical | Long 2690 p Short 2695 p | 67% | +190 | -310 |

Symbol: Energy | Daily Change |

/CLG5 | +4.37% |

/HOG5 | +5.02% |

/NGG5 | +5.7% |

/RBG5 | +3.01% |

A winter storm across the United States from Texas to West Virginia is bolstering the need for energy demand. Crude oil futures (/CLG5) rose over 5% this morning, the best daily performance since early October. The prompt spread in crude rose 26 cents to its highest level since September, reflecting tightness in the physical market as short-term demand spikes. The move puts oil prices above the year-end targets from analysts, including the International Energy Agency.

Strategy (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 74 p Short 74.5 p

Long 79 c | 23% | +370 | -130 |

Short Strangle | Short 74.5 p Short 78.5 c | 55% | +4030 | x |

Short Put Vertical | Long 74 p Short 74.5 p | 59% | +210 | -290 |

Symbol: FX | Daily Change |

/6AH5 | -0.56% |

/6BH5 | -0.62% |

/6CH5 | -0.06% |

/6EH5 | -0.42% |

/6JH5 | +0.05% |

Japanese yen futures (/6JH5) managed to trim overnight losses following some downbeat economic data out of Japan. The yen hit the lowest level since July overnight before traders started to bid on the currency. The move is likely because of profit taking after the jobs report removed some risk from the currency markets. It’s hardly a reversal signal for the downbeat currency but the pressure to sell seems to be easing.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00625 p Short 0.0063 p Short 0.00645 c Long 0.0065 c | 29% | +425 | -200 |

Short Strangle | Short 0.0063 p Short 0.00645 c | 53% | +1725 | x |

Short Put Vertical | Long 0.00625 p Short 0.0063 p | 69% | +225 | -400 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.