S&P 500 Presses Lower as Gold Stems Bleeding

S&P 500 Presses Lower as Gold Stems Bleeding

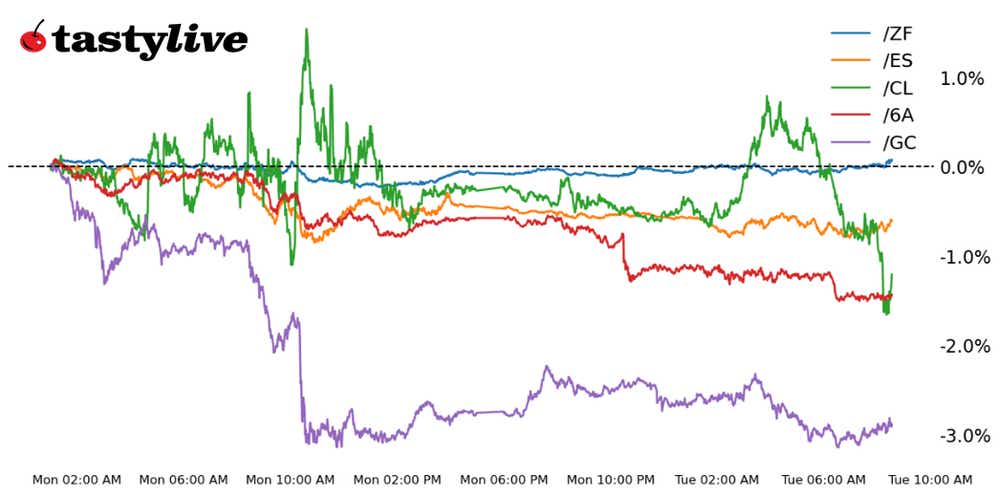

Also, five-year T-note, gold, crude oil and Australian dollar futures

- S&P 500 E-mini futures (/ES): -0.31%

- Five-year T-note futures (/ZF): +0.24%

- Gold futures (/GC): +0.20%

- Crude oil futures (/CL): -0.04%

- Australian dollar futures (/6A): -0.90%

We’re inching closer to the release of the November U.S. jobs report on Friday, the most important event on the calendar this week. Before then, however, a slew of minor yet intriguing data releases are set to come down the pipeline: the November U.S. JOLTS (Job Openings and Labor Turnover Survey) report and November U.S. ISM Services PMI (purchasing managers' index) today; the November U.S. ADP (Automatic Data Processing Inc.) employment change report tomorrow; and weekly U.S. jobless claims on Thursday. In front of these data releases, the U.S. dollar is firming up as stocks continue to cool off following their torrid November.

Symbol: Equities | Daily Change |

/ESZ3 | -0.31% |

/NQZ3 | -0.40% |

/RTYZ3 | -0.23% |

/YMZ3 | -0.25% |

U.S. equity markets are uniformly lower ahead of the cash equity session in New York, though losses are modest. The Nasdaq 100 (/NQZ3) is once again the loser to the downside, while the Russell 2000 (/RTYZ3) continues to outperform on a relative basis. (It is the best-performing major index through the early days of December). Seasonally, December has not been a good month for stocks in recent years as volatility tends to rise.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4560 p Short 4570 p Short 4660 c Long 4670 c | 18% | +387.50 | -112.50 |

Long Strangle | Long 4560 p Long 4670 c | 49% | x | -5137.50 |

Short Put Vertical | Long 4560 p Short 4570 p | 62% | +162.50 | -337.50 |

Symbol: Bonds | Daily Change |

/ZTZ3 | -0.13% |

/ZFZ3 | +0.24% |

/ZNZ3 | +0.41% |

/ZBZ3 | +0.96% |

/UBZ3 | +0.86% |

After yesterday’s reset in the bond market—predicated on Federal Reserve rate cut odds normalizing—Treasuries are moving mostly higher today, particularly at the long-end of the curve. As has often been the case in recent months, 30s (/ZBZ3) and ultras (/UBZ3) are leading the way. Odds of a 25-basis-point (bps) rate cut in March are now 62.3%, according to Fed Funds futures. The 2s10s spread is wider at -41.5-bps.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106 p Short 106.25 p Short 108.25 c Long 108.5 c | 34% | +148.44 | -101.56 |

Long Strangle | Long 106 p Long 108.5 c | 42% | x | -828.13 |

Short Put Vertical | Long 106 p Short 106.25 p | 80% | +78.13 | -171.88 |

Symbol: Metals | Daily Change |

/GCG4 | +0.20% |

/SIH4 | -0.23% |

/HGH4 | -0.99% |

A pullback in Treasury yield and inflation-adjusted yields pushed gold prices (/GCG4) higher this morning ahead of the opening bell. Yesterday, gold briefly hit a record high but quickly retreated to end the day lower. The narrative that drove prices higher over the past few weeks is in question ahead of key U.S. labor market data due this week, which should provide the metal with its next directional cue.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2005 p Short 2010 p Short 2080 c Long 2085 c | 25% | +370 | -130 |

Long Strangle | Long 2005 p Long 2085 c | 45% | x | -5200 |

Short Put Vertical | Long 2005 p Short 2010 p | 67% | +200 | -300 |

Symbol: Energy | Daily Change |

/CLF4 | -0.04% |

/HOZ3 | +0.45% |

/NGF4 | +2.04% |

/RBZ3 | -0.01% |

Crude oil (/CLF4) declined this morning, with prices now pushing into levels not seen since July. Some energy traders were hoping for a rally after the Saudi energy minister announced that OPEC+ production cuts could extend into the first quarter of 2024, but it wasn’t enough to sustain a rally, as traders were hoping for an extension through the first half of the year. Later today, the American Petroleum Institute (API) is expected to report an inventory reduction of 2.2 million barrels for the week ending Dec. 1. We may see a bigger draw, however, if private reports on imports and exports turn out to be accurate.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 70.5 p Short 71 p Short 76 c Long 76.5 c | 23% | +370 | -130 |

Long Strangle | Long 70.5 p Long 76.5 c | 45% | x | -4320 |

Short Put Vertical | Long 70.5 p Short 71 p | 60% | +180 | -320 |

Symbol: FX | Daily Change |

/6AZ3 | -0.90% |

/6BZ3 | +0.07% |

/6CZ3 | -0.32% |

/6EZ3 | +0.02% |

/6JZ3 | +0.27% |

The Australian dollar (/6AZ3) is producing its fourth down day over the past five sessions in the wake of a relatively dovish Reserve Bank of Australia meeting overnight. The central bank kept its main rate on hold, but eschewed promising additional policy tightening henceforth, a clear shift in tone relative to recent months. Coupled with lingering concerns over the Chinese economy (Chinese stocks hit a 52-week low in trading today), /6AZ3 is the clear loser today.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.64 p Short 0.645 p Short 0.675 c Long 0.68 c | 60% | +170 | -330 |

Long Strangle | Long 0.64 p Long 0.68 c | 25% | x | -300 |

Short Put Vertical | Long 0.64 p Short 0.645 p | 81% | +100 | -400 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.