S&P 500 Rebound Continues as End-of-Quarter Performance Comes into Focus

S&P 500 Rebound Continues as End-of-Quarter Performance Comes into Focus

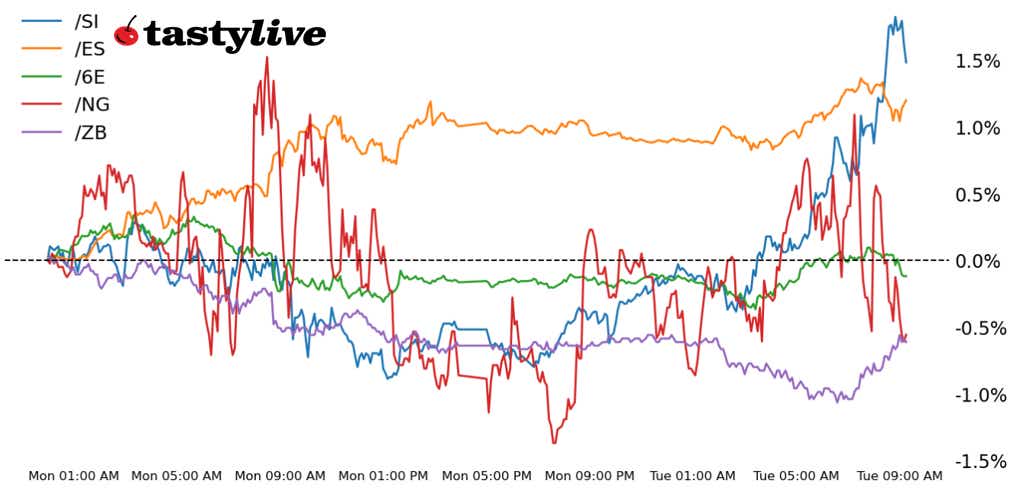

Also, 30-year T-bond, silver, natural gas and euro futures

- S&P 500 E-mini futures (/ES): +0.14%

- 30-year T-bond futures (/ZB): -0.05%

- Silver futures (/SI): +2.51%

- Natural gas futures (/NG): +0.15%

- Euro futures (/6E): +0.02%

U.S. equity markets are rallying today, continuing the rebound from late last week that’s revolved around a retreat by the Trump administration around the April 2 tariffs. After a weak run throughout the first quarter, traders seem eager to run up markets to window dress an otherwise bleak start to the year. Elsewhere, weakness in bonds has continued, although dip buyers have been seen throughout the morning. A few days of profit taking in metals has ended, with silver racing higher by more than 2%. Energy markets are relatively quiet, and FX markets continue to show a modest anti-greenback bias.

Symbol: Equities | Daily Change |

/ESM5 | +0.14% |

/NQM5 | +0.24% |

/RTYM5 | -0.32% |

/YMM5 | -0.03% |

U.S. equity markets were slightly higher this morning, with S&P 500 futures (/ESM5) up about 0.24%, as investors remain cautiously optimistic about tariffs. President Trump said Monday that countries may receive breaks on reciprocal tariffs. KB Home (KBH) fell 7% in pre-market trading after the home builder posted disappointing results for its first quarter. Trump Media & Technology Group (DJT) rose 8% ahead of the bell after the company announced a deal with Crypto.com for an exchange-traded fund (ETF).

Strategy: (66DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5725 p Short 5750 p Short 5925 c Long 5950 c | 18% | +962.50 | -275 |

Short Strangle | Short 5750 p Short 5925 c | 49% | +10587.50 | x |

Short Put Vertical | Long 5725 p Short 5750 p | 60% | +395 | -855 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.03% |

/ZFM5 | +0.05% |

/ZNM5 | +0.04% |

/ZBM5 | -0.05% |

/UBM5 | -0.21% |

30-year T-bond futures (/ZBM5) fell amid the continuation of a risk-on mood across Wall Street. Yields rose most on the long end of the curve, as investors sold bonds on news that the White House would take a more targeted approach to tariffs. Atlanta Federal Reserve President Raphael Bostic told Bloomberg he sees only one rate cut this year because of inflation. The Treasury will auction two-year notes today.

Strategy (59DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 114 p Short 115 p Short 118 c Long 119 c | 31% | +656.25 | -328.13 |

Short Strangle | Short 115 p Short 118 c | 56% | +2640.63 | x |

Short Put Vertical | Long 114 p Short 115 p | 67% | +375 | -625 |

Symbol: Metals | Daily Change |

/GCM5 | +0.78% |

/SIK5 | +2.51% |

/HGK5 | +1.89% |

Silver prices (/SIK5) are up 1.67% in early trading, putting the metal on track to break a three-day losing streak. Prices bounced from resistance turned support from the early February swing high and moved above the 34 handle. Physical silver flows into the U.S. have been strong, and speculators still have an elevated position on the metal. The gold/silver ratio dropped on the move but remains above 90. The elevated ratio suggests silver may have some catching up to do if the precious metals rally continues.

Strategy (30DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 33.25 p Short 33.5 p Short 34.75 c Long 35 c | 21% | +950 | -290 |

Short Strangle | Short 33.5 p Short 34.75 c | 53% | +7760 | x |

Short Put Vertical | Long 33.25 p Short 33.5 p | 59% | +525 | -725 |

Symbol: Energy | Daily Change |

/CLK5 | +0.59% |

/HOK5 | +1.29% |

/NGK5 | +0.15% |

/RBK5 | +0.67% |

Natural gas prices (/NGK5) rose about 1% in early trading but the commodity remains below 4 following last week’s drop in prices. Gas production in the U.S. is sitting just above 106 billion cubic feet per day, according to Bloomberg. However, demand, especially from power generation, has dropped about half a billion cubic feet per day over the last five days. Meanwhile, liquified natural gas (LNG) flows have dropped over the past day but remain higher on a five-day basis. LNG flows have been a key driver of strength over the past couple of months, so if those continue to drop, we could see more weakness come into the futures market.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3.85 p Short 3.9 p Short 4.2 c Long 4.25 c | 28% | +400 | -100 |

Short Strangle | Short 3.9 p Short 4.2 c | 71% | +4040 | x |

Short Put Vertical | Long 3.85 p Short 3.9 p | 57% | +240 | -260 |

Symbol: FX | Daily Change |

/6AM5 | +0.39% |

/6BM5 | +0.09% |

/6CM5 | +0.03% |

/6EM5 | +0.02% |

/6JM5 | +0.47% |

The U.S. dollar ceded some ground in early trading today, which allowed euro futures (/6EM5) to gain some ground following a multi-day sell-off. Euro prices are holding above 1.080, which was eclipsed earlier this month when they ripped higher during a five-day rally that saw prices rise from 1.045 to 1.090. Higher Treasury yields may stall the rally, but so far losses in U.S. bonds remain contained to the long end of the curve.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.075 p Short 1.08 p Short 1.095 c Long 1.1 c | 28% | +437.50 | -187.50 |

Short Strangle | Short 1.08 p Short 1.095 c | 55% | +1937.50 | x |

Short Put Vertical | Long 1.075 p Short 1.08 p | 69% | +212.50 | -412.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.