S&P 500 Continues Churn as Energy Rally Pulls Up Treasury Yields

S&P 500 Continues Churn as Energy Rally Pulls Up Treasury Yields

Also, 30-year T-bond, copper, natural gas and euro futures

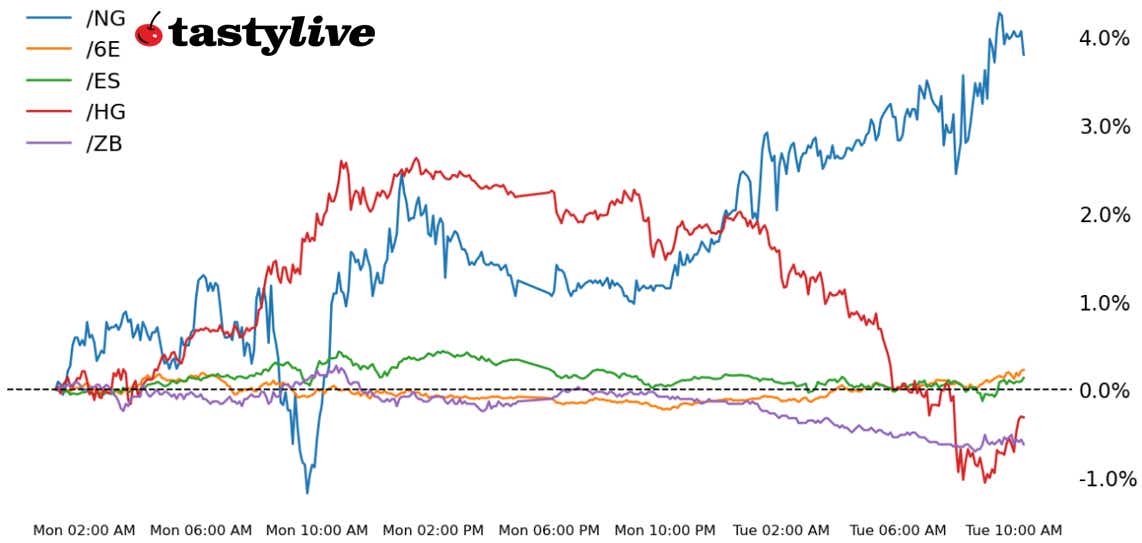

- S&P 500 E-mini futures (/ES): -0.13%

- 30-year T-bond futures (/ZB): -0.54%

- Copper futures (/HG): -2.58%

- Natural gas futures (/NG): +2.7%

- Euro futures (/6E): +0.31%

The imposition of new tariffs is taking some of the shine off U.S. equity markets today, although testimony from Federal Reserve Chair Jerome Powell on Capitol Hill is helping to soothe concerns otherwise. Treasury yields are pushing higher amid another rally in energy prices; market mea sures of inflation expectations have reached their highest level since early-2023. Elsewhere, Magnificent Seven stocks continue to lag the broader market, with Microsoft (MSFT) and Tesla (TSLA)weighing down gains.

Symbol: Equities | Daily Change |

/ESH5 | -0.13% |

/NQH5 | -0.06% |

/RTYH5 | -0.59% |

/YMH5 | -0.15% |

U.S. equity markets followed overnight losses in Asia, with S&P 500 futures (/ESH5) dropping about 0.13% in early trading. The indecision in the market reflects confusion over the macro backdrop concerning tariffs and corporate earnings. Vertex Pharmaceuticals (VRTX) fell 2% after missing its earnings forecast. Astera Labs (ALAB) dropped 3% in early trading despite beating on earnings. Shopify (SHOP) fell 0.5% after disappointing investors by providing mixed guidance. Coca-Cola (KO) rose over 3% after topping estimates. DoorDash (DASH) and Lyft (LYFT) are set to report earnings after the bell today.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5625 p Short 5775 p Short 6450 c Long 6500 c | 65% | +387.50 | -2112.50 |

Short Strangle | Short 5775 p Short 6450 c | 69% | +1937.50 | x |

Short Put Vertical | Long 5625 p Short 5775 p | 87% | +200 | -2300 |

Symbol: Bonds | Daily Change |

/ZTH5 | -0.04% |

/ZFH5 | -0.16% |

/ZNH5 | -0.26% |

/ZBH5 | -0.54% |

/UBH5 | -0.55% |

Bond traders are focused on Federal Reserve Chair Jerome Powell’s speech today as yields rise across the curve. Confusion over the exact impact of tariffs and retaliatory measures remains the focus for markets, as traders try to decipher how those measures will affect global trade and demand. The 30-year T-bond futures contract (/ZBH5) fell 0.54% in early trading. Powell recently said that the Fed is in no hurry to cut rates further, given that it's in a less restrictive stance after the recent cuts. There is a 3three-year note auction later today.

Strategy (73DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 110 p Short 120 c Long 123 c | 64% | +703.13 | -2296.88 |

Short Strangle | Short 110 p Short 120 c | 68% | +1218.75 | x |

Short Put Vertical | Long 107 p Short 110 p | 83% | +390.63 | -2609.38 |

Symbol: Metals | Daily Change |

/GCJ5 | -0.31% |

/SIH5 | -0.59% |

/HGH5 | -2.58% |

Copper futures (/HGH5) are giving back some of the gains from the last week as traders take profits following some weakness in Chinese equity markets. Copper prices soared after President Trump announced plans to impose tariffs on industrial metals, which pushed copper prices to the highest level since October. The premium for U.S. copper surged against prices in London over the last week amid the news, fueled by the relatively strong move in Comex copper prices. That caused short covering in the market, but today’s move likely brings some relief to that dynamic.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4.25 p Short 4.3 p Short 4.9 c Long 4.95 c | 64% | +462.50 | -787.50 |

Short Strangle | Short 4.3 p Short 4.9 c | 74% | +2250 | x |

Short Put Vertical | Long 4.25 p Short 4.3 p | 84% | +225 | -1025 |

Symbol: Energy | Daily Change |

/CLH5 | +0.93% |

/HOH5 | +1.77% |

/NGH5 | +2.7% |

/RBH5 | +1.74% |

Natural gas futures (/NGH5) rose over 3% as the United States prepares for a major winter storm that is expected to move across the Eastern U.S., which could impact some production and raise demand. Meanwhile, European and Asian gas prices continue to outpace U.S. prices, which is keeping an arbitrage window open for U.S. products. According to Bloomberg, natural gas production in the U.S. is down to about 105 billion cubic feet per day, while demand rose about 1 billion cubic feet per day. The January swing high just short of 3.8 offers the next technical target for bulls as prices hover around 3.55 as of this morning.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.9 p Short 3.05 p Short 4.15 c Long 4.3 c | 67% | +470 | -1030 |

Short Strangle | Short 3.05 p Short 4.15 c | 75% | +1520 | x |

Short Put Vertical | Long 2.9 p Short 3.05 p | 81% | +270 | -1230 |

Symbol: FX | Daily Change |

/6AH5 | +0.1% |

/6BH5 | +0.39% |

/6CH5 | -0.05% |

/6EH5 | +0.31% |

/6JH5 | -0.36% |

Treasury yields and oil prices may be moving up, but the U.S. dollar is not seeing the usual benefits. The imposition of aluminum and steel tariffs on March 12 has sparked a wave of promised reprisals from a variety of trading partners, including the European Union. Currency market volatility remains relatively elevated, offering IVRs between 44 and 82 among the majors.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.995 p Short 1.01 p Short 1.06 c Long 1.075 c | 62% | +575 | -1300 |

Short Strangle | Short 1.01 p Short 1.06 c | 68% | +1075 | x |

Short Put Vertical | Long 0.995 p Short 1.01 p | 90% | +212.50 | -1662.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.