S&P 500 Aims at Record Close as Bond Yields Rise

S&P 500 Aims at Record Close as Bond Yields Rise

Also 30-year T-note, gold, crude oil and Japanese yen futures

- S&P 500 E-mini futures (/ES): +0.06

- 30-year T-note futures (/ZB): -0.42%

- Gold futures (/GC): -0.15%

- Crude oil futures (/CL): -0.57%

- Japanese yen futures (/6J): +0.69%

U.S. stock markets are trading little changed on the second to last trading day of the year. A pullback in Treasuries is pushing yields slightly higher despite some encouraging labor market data showing that initial jobless claims rose for the last week.

Symbol: Equities | Daily Change |

/ESH4 | +0.06% |

/NQH4 | -0.02% |

/RTYH4 | +0.37% |

/YMH4 | +0.09% |

The S&P 500 (/ESH4) traded slightly higher at the opening bell even as bond yields rose. The index is just short of its record high after this year delivered another Santa rally—the last five trading days of the year. The calendar remains light for the rest of the week, but event risks will return with the New Year, including tomorrow’s non-farm payrolls report.

Strategy: (34DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4,790 p Short 4,800 p Short 4,875 c Long 4,880 c | 63% | +275 | -225 |

Long Strangle | Long 4,790 p Long 4,880 c | 49% | x | -4,312 |

Short Put Vertical | Long 4,790 p Short 4,800 p | 62% | +170 | -325 |

Symbol: Bonds | Daily Change |

/ZTH4 | -0.06% |

/ZFH4 | -0.14% |

/ZNH4 | -0.25% |

/ZBH4 | -0.42% |

/UBH4 | -0.51% |

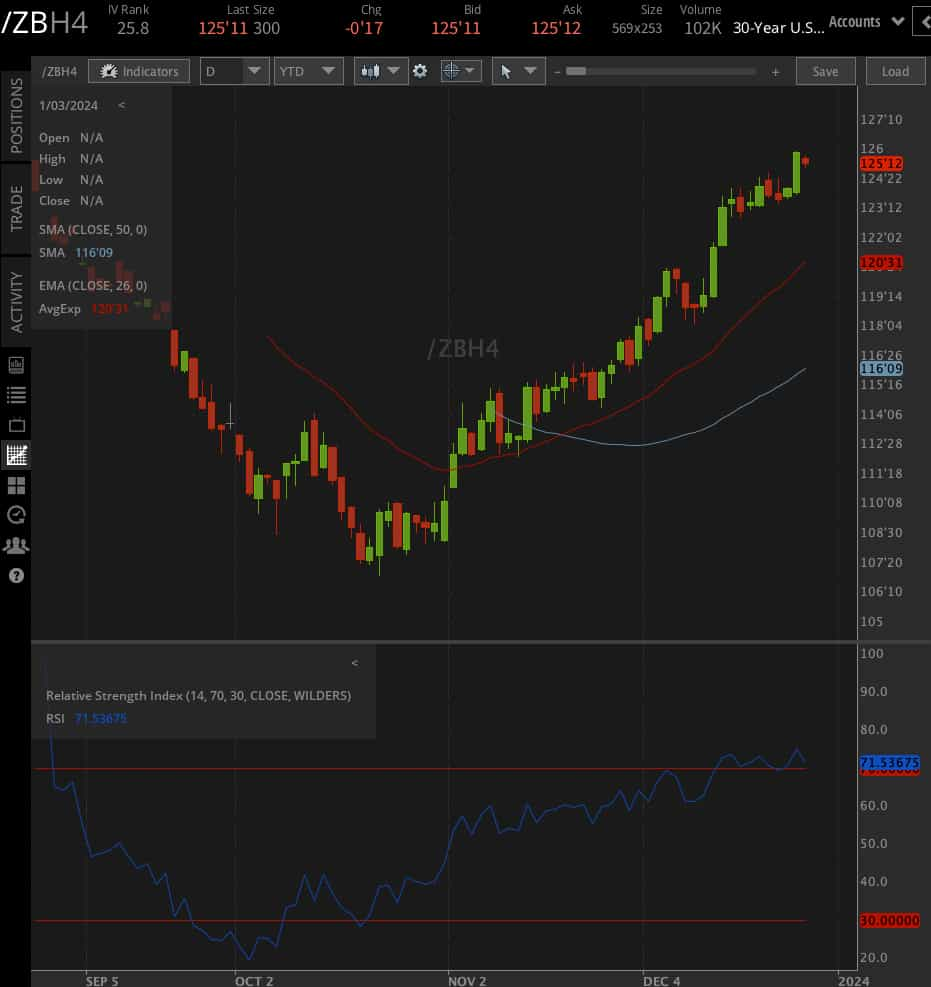

As for 30-year Treasury note futures (/ZBH4), prices fell nearly half a percentage point this morning. That follows yesterday’s biggest daily percentage increase since Dec. 14. Bond traders believe the Federal Reserve will start cutting as soon as March and they have been moving quickly to price that into the market. But that may leave Treasuries susceptible to some periods of volatility if economic data conflicts with the narrative. Next week should be revealing with several key data points scheduled to cross the wires.

Strategy (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 122 p Short 123 p Short 127 c Long 128 c | 29% | +687.50 | -312.50 |

Long Strangle | Long 122 p Long 128 c | 42% | x | -2,843 |

Short Put Vertical | Long 122 p Short 123 p | 69% | +328.13 | -671.88 |

Symbol: Metals | Daily Change |

/GCG4 | -0.41% |

/SIH4 | -0.98% |

/HGH4 | -1.00% |

Gold prices (/GCG4) are pulling back from a point of resistance set earlier this month around 2,090. A stronger dollar and higher bond yields are working against precious metals. While this week’s jobless claims data showed a rise in the number of claims, the measure remains subdued vs. the number of rate hikes the Fed has made. As with other assets, next week should provide more direction for gold.

Strategy (61DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2,060 p Short 2,065 p Short 2,100 c Long 2,105 c | 13% | +410 | -80 |

Long Strangle | Long 2,060 p Long 2,105 c | 48%% | x | -7,390 |

Short Put Vertical | Long 2,060 p Short 2,065 p | 67% | +200 | -300 |

Symbol: Energy | Daily Change |

/CLG4 | -0.91% |

/HOG4 | -0.65% |

/NGG4 | +3.41% |

/RBG4 | -1.08% |

The U.S.-led maritime coalition in the Red Sea is bearing some results in deterring attacks from Houthi rebels, and that is bringing some shippers back into the vital channel. That is causing crude oil prices (/CLG4) to fall. We also saw an inventory build for the United States, according to data from the American Petroleum Institute (API). Today, the Energy Information Administration (EIA) will report its own numbers.

Strategy (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 71.5 p Short 72 p Short 76.5 c Long 77 c | 21% | +380 | -120 |

Long Strangle | Long 71.5 p Long 77 c | 45%% | x | -4,610 |

Short Put Vertical | Long 71.5 p Short 72 p | 58% | +200 | -300 |

Symbol: FX | Daily Change |

/6AH4 | +0.05% |

/6BH4 | -0.20% |

/6CH4 | +0.17% |

/6EH4 | -0.01% |

/6JH4 | +0.66% |

The yen (/6JH4) is breaking higher to add onto yesterday’s gains as traders remain focused on the currency going into 2024. Last week, institutional traders flipped net long on the currency, and tomorrow the Commodity Futures Trading Commission (CFTC) will provide a fresh commitments of traders report (COT) that will likely show further building of bullish positions. Yesterday, retail sales for November were stronger-than-expected, which should help the Bank of Japan’s quest to end negative rates next year.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00705 p Short 0.0071 p Short 0.0073 c Long 0.00735 c | 36% | +400 | -225 |

Long Strangle | Long 0.00705 p Long 0.00735 c | 38% | x | -1,237 |

Short Put Vertical | Long 0.00705 p Short 0.0071 p | 70% | +212.50 | -412.50 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.