S&P 500 Jumps 2% as Earnings Season Kicks Off

S&P 500 Jumps 2% as Earnings Season Kicks Off

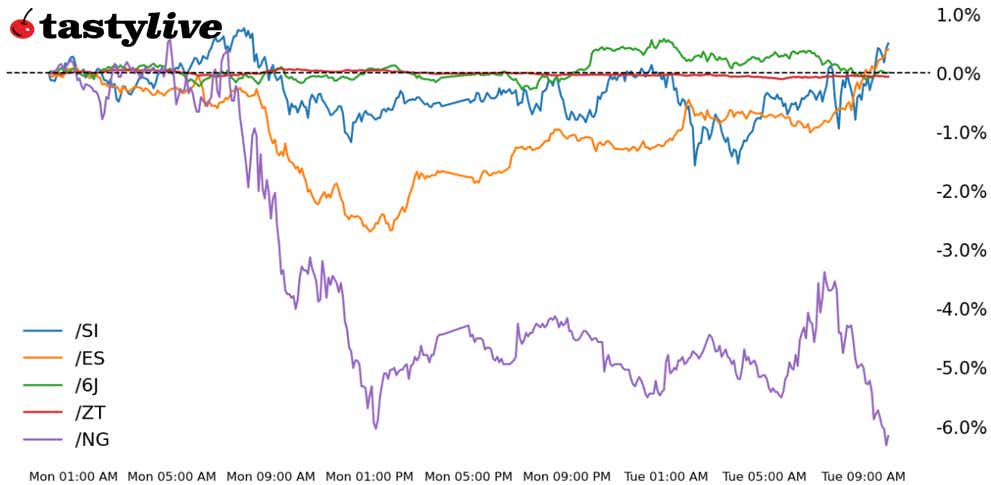

Also, two-year T-note, silver, natural gas and Japanese yen futures

- S&P 500 E-mini futures (/ES): +2.18%

- 2-year T-note futures (/ZT): -0.08%

- Silver futures (/SI): +1.2%

- Natural gas futures (/NG): -2.42%

- Japanese yen futures (/6J): -0.19%

It’s a turnaround Tuesday in markets, with a reversal of fortune for most major asset classes. Whereas yesterday weakened stocks, bonds and the U.S. dollar in favor of gold and Bitcoin, today’s action is seeing the opposite transpire. News flow has been light, although there have been reports of a U.S.-Indian trade deal that could see companies like Amazon (AMZN) and Walmart (WMT) gain tariff-free access to the world’s largest population. Earnings flow dominates the calendar starting today, with Tesla (TSLA) reporting after hours.

Symbol: Equities | Daily Change |

/ESM5 | +2.18% |

/NQM5 | +2.52% |

/RTYM5 | +1.86% |

/YMM5 | +2.16% |

Stocks’ weakness that occurred yesterday has not found any additional follow-up today. The S&P 500 is up over 2% as traders are seeing the weakness that transpired in thin trading volumes at the start of the week as an opportunity to return to the market at more favorable prices. The Trump-Powell standoff appears to be a bridge to nowhere, with some market observers noting that Powell is gone by May 2026, one way or the other. After touching 35.75 on Monday, the spot VIX is back down to 30.49.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4700 p Short 4800 p Short 5800 c Long 5900 c | 65% | +1050 | -3950 |

Short Strangle | Short 4800 p Short 5800 c | 70% | +3750 | x |

Short Put Vertical | Long 4700 p Short 4800 p | 83% | +625 | -4375 |

Symbol: Bonds | Daily Change |

/ZTM5 | -0.08% |

/ZFM5 | -0.09% |

/ZNM5 | -0.03% |

/ZBM5 | +0.3% |

/UBM5 | +0.4% |

Bonds are stabilizing at the long-end of the curve, an important development in the context of surging concern over the United States’ reliability as a global counterparty—for both trade deals and in financial markets. The reduction in term premium gives risk assets breathing room otherwise. For now, there’s no evidence to support the assertion that foreigners are jettisoning Treasuries; recent auctions have shown strong demand from abroad. To this end, there is a two-year note (/ZTM5) auction later today.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 102.5 p Short 103 p Short 104.5 p Long 105 p | 61% | +187.50 | -812.50 |

Short Strangle | Short 103 p Short 104.5 p | 65% | +312.50 | x |

Short Put Vertical | Long 102.5 p Short 103 p | 93% | +62.50 | -937.50 |

Symbol: Metals | Daily Change |

/GCM5 | +0.23% |

/SIK5 | +1.2% |

/HGK5 | +2% |

Gold prices (/GCM5) have had an astounding run, but after a sharp intraday reversal, one can’t help but one wonder if it’s “too far, too fast.” Indeed, gold prices are now more than 25% above their 200-SMA, a unique occurrence in history that has typically been a sign of weakness to come: one-week, two-week and one-month returns are negative thereafter. This may give some breathing room to silver (/SIK5) to step into the spotlight, which has been relatively out of favor (see: gold/silver ratio above 100) during the Trump tariff turmoil.

Strategy (64DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 27.5 p Short 28 p Short 37.5 c Long 38 c | 66% | +550 | -1950 |

Short Strangle | Short 28 p Short 37.5 c | 73% | +4440 | x |

Short Put Vertical | Long 27.5 p Short 28 p | 85% | +220 | -2280 |

Symbol: Energy | Daily Change |

/CLM5 | +1.91% |

/HOK5 | +1.7% |

/NGM5 | -2.42% |

/RBK5 | +1.75% |

Natural gas prices (/NGM5) are a textbook example of the real economic consequences of tariffs remaining in place. The United States is the world’s largest producers of liquefied natural gas, and abrupt trade barriers leave the domestic market awash in supply in the short-term. A double top carved out in 1Q’25 sees potential losses below 2.8 in the short-term.

Strategy (64DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.25 p Short 2.3 p Short 3.95 c Long 4 c | 69% | +160 | -340 |

Short Strangle | Short 2.3 p Short 3.95 c | 78% | +2020 | x |

Short Put Vertical | Long 2.25 p Short 2.3 p | 84% | +50 | -450 |

Symbol: FX | Daily Change |

/6AM5 | -0.31% |

/6BM5 | +0.01% |

/6CM5 | +0.1% |

/6EM5 | -0.35% |

/6JM5 | -0.19% |

One of the clearer signs of relaxation across asset classes is the U.S. dollar is no longer bleeding out across the board. The two biggest beneficiaries of the greenback deleveraging have been the euro (/6EM5) and the Japanese yen (/6JM5), which are among the loss leaders in today’s session. A light macroeconomic calendar keeps FX markets trapped in the gravitational well of tariff headlines.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0067 p Short 0.0068 p Short 0.0075 c Long 0.0076 c | 69% | +250 | -1000 |

Short Strangle | Short 0.0068 p Short 0.0075 c | 75% | +700 | x |

Short Put Vertical | Long 0.0067 p Short 0.0068 p | 87% | +112.50 | -1137.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.