Nasdaq 100, Russell 2000 Surge After Soft Inflation Report

Nasdaq 100, Russell 2000 Surge After Soft Inflation Report

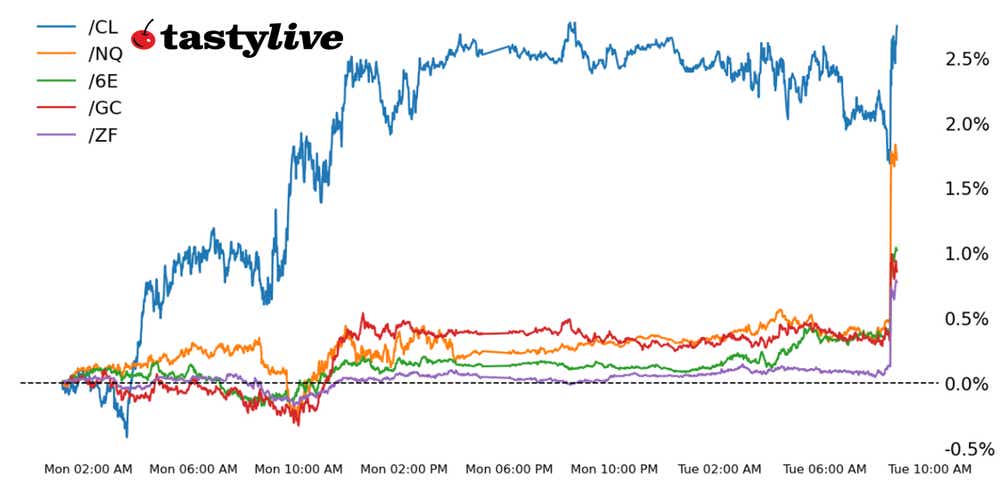

Also, five-year T-note, gold, crude oil, and euro futures

- Nasdaq 100 e-mini futures (/NQ): +1.68%

- Five-year T-note futures (/ZF): +0.74%

- gold futures (/GC): +0.52%

- Crude oil futures (/CL): +0.75%

- Euro futures (/6E): +0.83%

Jubilance spread across global financial markets this morning following release of the October U.S. inflation report.

The U.S. consumer price index (CPI) was unchanged at 0.0% month over month and +3.2% year over year on the headline rate. The core rate was +0.2% month over month and +4% year over year. Both the headline and core readings were a touch softer than anticipated (+0.1% month over month and +3.3% year over year expected for the headline rate. The core rate projection was +0.3% month over month and +4.1% year over year).

Alongside the initial reaction that sent stock futures immediately higher and bond yields sharply lower, there was a further deterioration in Federal Reserve rate hike expectations. Rate markets are discounting a 99.7% chance of no change in policy in December (up from 85.5% yesterday), while the odds of no change in January rose to 95.6% from 74.9%.

Symbol: Equities | Daily Change |

/ESZ3 | +1.32% |

/NQZ3 | +1.68% |

/RTYZ3 | +3.37% |

/YMZ3 | +1.03% |

Stock index futures

Equity index futures shot higher as traders digested a rosy U.S. inflation report that slashed already-small market bets for another Federal Reserve rate hike. Rate traders now expect the first cut in June of 2024. Nasdaq 100 futures (/NQZ3) are poised for a third weekly gain if prices hold through the week. While several other data points remain for the week, including wholesale prices and retail sales, it would be hard to negate the impact that the CPI data had on rate hike bets. All signs are pointing to a continued risk-on mood on Wall Street.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4480 p Short 4490 p Short 4590 c Long 4600 c | 20% | +362.50 | -137.50 |

Long Strangle | Long 4480 p Long 4600 c | 49% | x | -4887.50 |

Short Put Vertical | Long 4480 p Short 4490 p | 62% | +162.50 | -337.50 |

Symbol: Bonds | Daily Change |

/ZTZ3 | +0.32% |

/ZFZ3 | +0.74% |

/ZNZ3 | +1.03% |

/ZBZ3 | +1.52% |

/UBZ3 | +1.78% |

Bonds rally

Bond prices have rallied across the curve in the wake of the latest U.S. inflation report. The drop in the odds of a Fed rate hike happened at the short-end of the curve, while market-derived inflation expectations sank, undercutting yields at the long-end of the curve. Once again, the long end remains the biggest mover both in nominal and percentage terms, with 30s (/ZBZ3) and ultras (/UBZ3) leading the way.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 105 p Short 105.25 p Short 107.25 c Long 107.5 c | 43% | +125 | -125 |

Long Strangle | Long 105 p Long 107.5 c | 37% | x | -515.63 |

Short Put Vertical | Long 105 p Short 105.25 p | 80% | +70.31 | -179.69 |

Symbol: Metals | Daily Change |

/GCZ3 | +0.52% |

/SIZ3 | +1.71% |

/HGZ3 | +0.87% |

The gold price jumps

Gold prices (/GCZ3) liked this morning’s inflation report, with the metal jumping to trade around $1,960. Gold speculators have grown increasingly bullish over the past several weeks and continued to add long contracts while ditching short positions, according to Friday’s Commitments of Traders (COT) report.

If bonds yields continue to fall this week, it should bode well for more upside in precious metals. Traders are watching U.S. wholesale price data to help confirm that price pressures are easing. Retail sales, also due out tomorrow, are also in the scope for traders, with the data expected to show softening consumer demand. That would help to further moderate Fed rate hike bets, which would support gold prices.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1945 p Short 1950 p Short 2010 c Long 2015 c | 30% | +350 | -150 |

Long Strangle | Long 1945 p Long 2015 c | 42% | x | -3440 |

Short Put Vertical | Long 1945 p Short 1950 p | 69% | +180 | -320 |

Symbol: Energy | Daily Change |

/CLZ3 | +0.75% |

/HOZ3 | +0.48% |

/NGZ3 | -1.19% |

/RBZ3 | +0.90% |

Crude oil futures rise

Crude oil futures (/CLZ3) rose about 24 cents a barrel, or 0.43%, this morning after the Paris-based International Energy Agency (IEA) raised its demand forecast to 2.4 million barrels per day (bpd) from 2.3 million bpd. However, demand is seen easing to 930,000 barrels per day (kb/d) next year.

Meanwhile, a planned purchase of 1.2 million barrels of oil for the Strategic Petroleum Reserve (SPR) by the Department of Energy (DOE) at $75.57 a barrel is helping to support prices. The DOE has previously stated its intentions to buy three million barrels a month for December and January.

Strategy (30DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 75 p Short 75.5 p Short 81.5 c Long 82 c | 28% | +320 | -180 |

Long Strangle | Long 75 p Long 82 c | 44% | x | -3670 |

Short Put Vertical | Long 75 p Short 75.5 p | 64% | +160 | -340 |

Symbol: FX | Daily Change |

/6AZ3 | +0.96% |

/6BZ3 | +0.97% |

/6CZ3 | +0.28% |

/6EZ3 | +0.83% |

/6JZ3 | +0.40% |

Euro jumps as Treasury yields fall

Euro futures (/6EZ3) jumped on this morning’s inflation numbers, as Treasury yields fell, and the dollar softened. The softening in U.S. rates is cutting the yield premium that Treasuries hold against European counterparts, a major factor that largely dictates foreign exchange rates.

Several Fed speakers are on tap to round out this week and FX traders also have their eyes on European inflation figures for October, which are due for an update later this week.

Strategy (24DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.0675 p Short 1.07 p Short 1.095 c Long 1.1 c | 57% | +175 | -450 |

Long Strangle | Long 1.0675 p Long 1.1 c | 27% | x | -387.50 |

Short Put Vertical | Long 1.0675 p Short 1.07 p | 83% | +62.50 | -250 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.