Stocks Up, Dollar Down on Weak U.S. PMI Data

Stocks Up, Dollar Down on Weak U.S. PMI Data

By:Ilya Spivak

But some trends still point lower for Wall Street, the euro and the pound

April PMI data tops expectations in Europe but disappoints in the U.S.

Stocks cheer and the U.S. dollar falls as Fed interest rate cut hopefuls find a lifeline.

Trends still point lower for Wall Street and the euro and British pound.

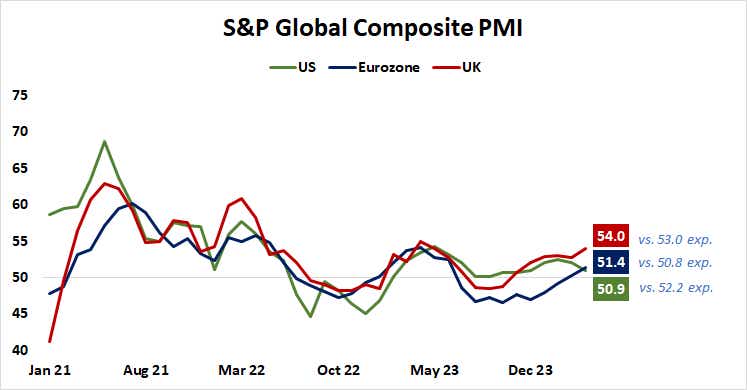

April marked an unexpected turn of the global business cycle, according to the latest round of purchasing managers index (PMI) data from S&P Global. The numbers revealed momentum was building behind economic recovery in Europe while performance in the U.S. has taken a sudden turn for the worse.

In the Eurozone, a booming service sector pushed the pace of economic activity growth to the fastest in 11 months even as contraction on the manufacturing side accelerated. It was the same story in the U.K. That PMI survey also recorded an 11-month high for overall growth as service-sector strength offset manufacturing weakness.

April PMI data: Europe heats up as the U.S. stumbles

The U.S. data set was decidedly gloomier. The service sector cooled for a third consecutive month while manufacturing snapped a three-month expansion streak, recording its first contraction of the year. That boiled down to the weakest growth in nonfarm economic activity since December.

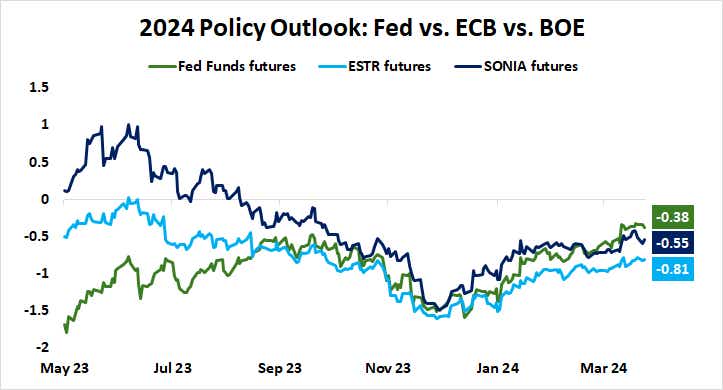

The markets’ eagle-eye focus on Federal Reserve monetary policy expectations made the U.S. survey the most impactful of the bunch. Stocks jumped higher and the U.S. dollar slumped immediately as the data crossed the wires. Tellingly, that lined up with an instant five-basis-point (bps) shift in the priced-in 2024 rate cut outlook, from 32bps to 38bps.

As the dust settled, however, the European Central Bank (ECB) and the Bank of England (BOE) still looked as though they would “out-dove” the Fed this year, delivering more stimulus than will be on offer across the Atlantic. The currency bloc is priced in for 81bps in cuts this year while the U.K. is expected to see 55bps in easing.

Stock market still in trouble, U.S. dollar aiming higher

This hints the greenback will retain a yield advantage against the euro and the British pound, making its pullback appear corrective within a broader uptrend. As for stocks, they might struggle to build a lasting uptrend while the markets are priced on the hawkish side of the Fed’s own stated view, last set on March 20 at 75bps in cuts for the year.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.