S&P 500 Soars to New All-Time High After Trump’s Red Wave

S&P 500 Soars to New All-Time High After Trump’s Red Wave

Also, 10-year T-note, gold, crude oil and Japanese yen futures

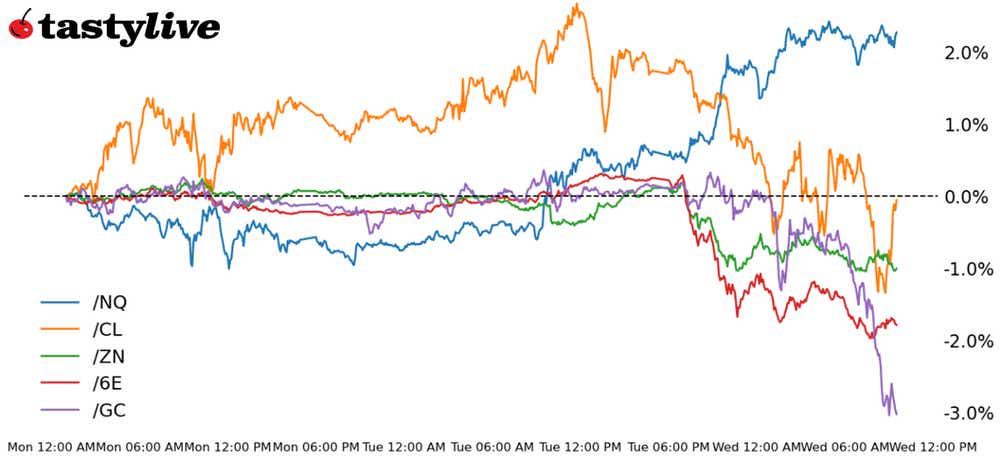

- S&P 500 E-mini futures (/ES): +1.62%

- 10-year T-note futures (/ZN): -0.99%

- Gold futures (/GC): -3.03%

- Crude oil futures (/CL): -0.82%

- Euro futures (/6E): -2.01%

Donald Trump will be the next President of the United States, and by the looks of it, Republicans may have the hallowed trifecta for the first time since 2017-2018. The way markets had been trending throughout October—and as they performed in the immediate wake of Trump’s 2016 victor—has reemerged today: higher stocks, higher yields and a stronger U.S. dollar.

The reflation trade is in full-swing, as is pricing around the potential path of Federal Reserve interest rate cuts. Don’t forget, there’s a Federal Open Market Committee (FOMC) meeting tomorrow. Plus, Trump’s desire for widespread tariffs could raise structural inflation. The most important development for traders: Volatility has been crushed. The spot VIX was last seen near 16.60, more than a 4-point drop from its close on yesterday.

Symbol: Equities | Daily Change |

/ESZ4 | +1.62% |

/NQZ4 | +1.59% |

/RTYZ4 | +3.83% |

/YMZ4 | +2.77% |

S&P 500 futures rose over 2% this morning, marking the biggest daily percentage increase since August 2024. Traders see an economy fueled by deficit spending and less regulation as being a big tailwind for stocks. Trump Media & Technology Group (DJT) was up nearly 30% in pre-market trading. Tesla (TSLA) rose over 12% and Nvidia (NVDA) rose nearly 2%. Qualcomm (QCOM) and Arm holdings (ARM) are scheduled to report earnings after the closing bell.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5840 p Short 5850 p Short 5980 c Long 5990 c | 16% | +375 | -125 |

Short Strangle | Short 5850 p Short 5980 c

| 48% | +7925 | x |

Short Put Vertical | Long 5840 p Short 5850 p | 61% | +145 | -355 |

Symbol: Bonds | Daily Change |

/ZTZ4 | -0.17% |

/ZFZ4 | -0.51% |

/ZNZ4 | -0.99% |

/ZBZ4 | -2.2% |

/UBZ4 | -3.22% |

Treasury yields surged across the curve after the results of the election became clear. A Republican controlled government is expected to fuel deficit spending, which is driving inflation expectations higher and that is bringing bonds down accordingly. The 10-year T-note contract fell nearly 1% this morning.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 108.5 p Short 109 p Short 110.5 c Long 111 c | 27% | +359.38 | -140.63 |

Short Strangle | Short 109 p Short 110.5 c | 54% | +1625 | x |

Short Put Vertical | Long 108.5 p Short 109 p | 68% | +187.50 | -312.50 |

Symbol: Metals | Daily Change |

/GCZ4 | -3.03% |

/SIZ4 | -5.06% |

/HGZ4 | -4.96% |

Gold prices sank as a stronger dollar and higher yields weighed heavily on the non-interest-bearing asset. The December contract (/GCZ4) was down 3% this morning, marking its biggest percentage decline of the year. Traders will shift their focus to this week’s Federal Reserve rate announcement. An interest rate cut may help to stop some gold selling but the short-term outlook for the metal remains dented following the election results.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2645 p Short 2650 p Short 2735 c Long 2740 c | 21% | +390 | -110 |

Short Strangle | Short 2650 p Short 2735 c | 55% | +8810 | x |

Short Put Vertical | Long 2645 p Short 2650 p | 64% | +200 | -300 |

Symbol: Energy | Daily Change |

/CLZ4 | -0.82% |

/HOZ4 | -0.82% |

/NGZ4 | +2.28% |

/RBZ4 | -1.12% |

Crude oil prices (/CLZ4) fell in response to the U.S. election, dropping about 2.5% this morning. A stronger dollar was one of the factors weighing on oil prices, as traders see higher interest rates to combat inflation going forward, given the expected government spending by a Republican controlled Congress. Tariffs are also seen as a negative for growth in demand for oil, as protectionism will likely reduce global trade.

Strategy (40DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 69 p Short 69.5 p Short 74.5 c Long 75 c | 22% | +380 | -120 |

Short Strangle | Short 69.5 p Short 74.5 c | 57% | +5540 | x |

Short Put Vertical | Long 69 p Short 69.5 p | 57% | +230 | -270 |

Symbol: FX | Daily Change |

/6AZ4 | -1.31% |

/6BZ4 | -1.37% |

/6CZ4 | -0.8% |

/6EZ4 | -2.05% |

/6JZ4 | -1.88% |

Euro futures (/6EZ4) were down 2% today, the biggest drop since June 2016. The story is much of the same across the market, with a Trump presidency expected to bolster corporate earnings in the U.S. but at the costs of higher government spending and increased trade protectionism. The move is both directly and indirectly bad for Europe, as it would hurt economic growth there via tariffs on Europe itself and China, one of Europe’s largest trading partners.

Strategy (58DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.065 p Short 1.07 p Short 1.085 c Long 1.09 c | 26% | +450 | -175 |

Short Strangle | Short 1.07 p Short 1.085 c | 54% | +2137.50 | x |

Short Put Vertical | Long 1.065 p Short 1.07 p | 72% | +200 | -425 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.