S&P 500, 10-Year T-note, Gold, Crude Oil and Euro Futures

S&P 500, 10-Year T-note, Gold, Crude Oil and Euro Futures

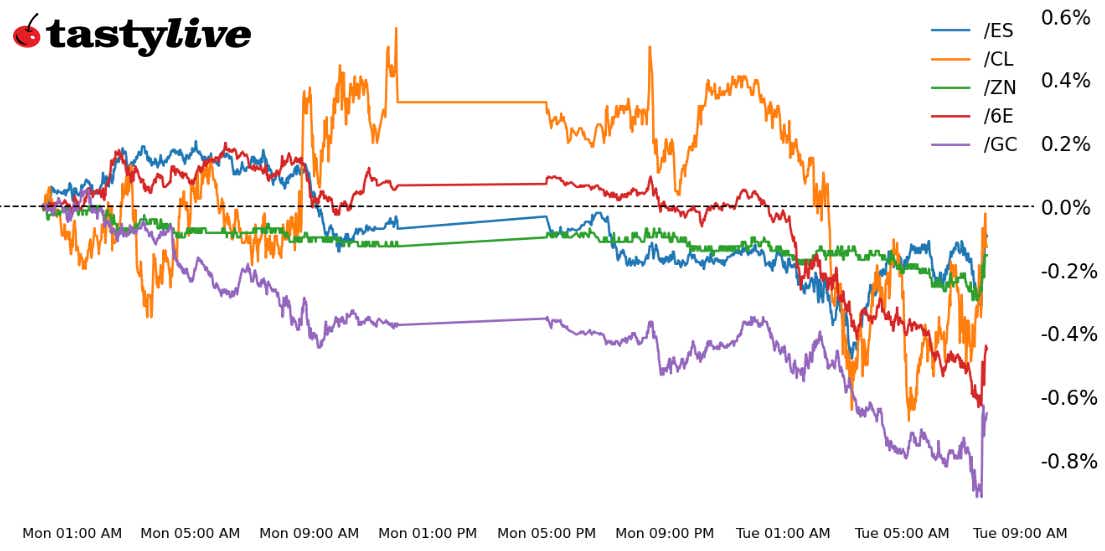

This Morning’s Five Futures in Focus:

- S&P 500 e-mini futures (/ES): -0.14%

- 10-year T-note futures (/ZN): -0.30%

- Gold futures (/GC): -0.47%

- Crude oil futures (/CL): +0.05%

- Euro futures (/6E): -0.40%

After spending most of the overnight session underwater, futures started to rebound across the board on approach to the U.S. cash equity session on Tuesday. Perhaps the most surprising development, in the wake of the August U.S. jobs report, has been the renewed march higher by U.S. Treasury yields, which in turn have proved to be a cumbersome weight on most other asset classes: precious metals, energy, and FX have all traded lower.

Symbol: Equities | Daily Change |

/ESU3 | -0.14% |

/NQU3 | -0.30% |

/RTYU3 | -0.63% |

/YMU3 | +0.01% |

U.S. equity markets are slightly weaker from where they opened, led to the downside by the Russell 2000 (/RTYU3) amid the sell-off in bonds. That’s not to say that there isn’t a technical rationale; indeed, each of the major U.S. equity index futures traded into meaningful resistance at the end of last week, and those hurdles have yet to be cleared. Lighter macro and earnings calendars leave much to be desired in terms of actionable binary events this week, leaving U.S equities left to the whims of cross-asset trends.

Strategy: (9DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4470 p Short 4480 p Short 4540 c Long 4550 c | 30% | +325 | -175 |

Long Strangle | Long 4470 p Long 4550 c | 44% | x | -1712.50 |

Short Put Vertical | Long 4470 p Short 4480 p | 65% | +150 | -350 |

Symbol: Bonds | Daily Change |

/ZTZ3 | -0.05% |

/ZFZ3 | -0.22% |

/ZNZ3 | -0.30% |

/ZBZ3 | -0.49% |

/UBZ3 | -0.86% |

A late-day sell-off on Friday has continued into the new trading week, with U.S. Treasury yields up across the board. While the move seems unrelated to developments in the August U.S. jobs report, there has been a noticeable tick higher in market measures of inflation expectations on the back of a surge in energy prices in recent days. It may be the case that markets are beginning to get worried about a more meaningful bounce in inflation over the coming months.

Strategy (24DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 109 p Short 109.25 p Short 111 c Long 111.25 c | 38% | +156.25 | -93.75 |

Long Strangle | Long 109 p Long 111.25 c | 39% | x | -703.13 |

Short Put Vertical | Long 109 p Short 109.25 | 75% | +78.13 | -171.88 |

Symbol: Metals | Daily Change |

/GCV3 | -0.47% |

/SIU3 | -1.74% |

/HGU3 | -0.54% |

Gold prices (/GCV3) are trading $10.70 per ounce lower this morning as the dollar strengthens. An increasing likelihood of a European recession is crushing the euro currency (/6EU3), providing a major tailwind for the greenback. In percentage terms, silver prices (/SIV3) are making a bigger move at about 1.3% to the downside. That is accelerating the gold/silver ratio higher after the gauge hit a multi-month low last week.

Strategy (21DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1915 p Short 1920 p Short 1965 c Long 1970 c | 38% | +300 | -200 |

Long Strangle | Long 1915 p Long 1970 c | 38% | x | -1690 |

Short Put Vertical | Long 1915 p Short 1920 c | 71% | +160 | -340 |

Symbol: Energy | Daily Change |

/CLV3 | +2.19% |

/NGU3 | -6.26% |

Crude oil (/CLV3) jumped higher on Tuesday morning after Saudi Arabia opted to extend its voluntary production cut until the end of the year, according to Saudi Press Agency (SPA). The one million barrel per day cut will be reviewed monthly. The news reversed earlier losses in oil after Chinese data released over the weekend showed slowing growth in the country’s services sector.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 86 p Short 86.5 p Short 87.5 c Long 88 c | 9% | +460 | -40 |

Long Strangle | Long 87 p Long 88 c | 48% | x | -5,810 |

Short Put Vertical | Long 86.5 p Short 87 p | 50% | +250 | -250 |

Symbol: FX | Daily Change |

/6AZ3 | -1.15% |

/6BZ3 | -0.18% |

/6CZ3 | -0.27% |

/6EZ3 | -0.40% |

/6JZ3 | -0.79% |

The gap between the Federal Reserve and other major central banks, at least in the short term, appears to be growing. While another rate hike by the Fed is still off the table–neither the September nor November meetings are favoring a move, according to Fed funds futures (/ZQ) and Secured Overnight Financing Rates (/SR3)–rate cut expectations by the European Central Bank and Reserve Bank of Australia have started to perk up. Technical evidence of the U.S. dollar (via the DXY Index) topping out has been negated, as a result.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.05 p Short 1.055 p Short 1.1 c Long 1.105 c | 67% | +175 | -450 |

Long Strangle | Long 1.05 p Long 1.105 c | 22% | x | -350 |

Short Put Vertical | Long 1.05 p Short 1.055 p | 90% | +75 | -550 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.