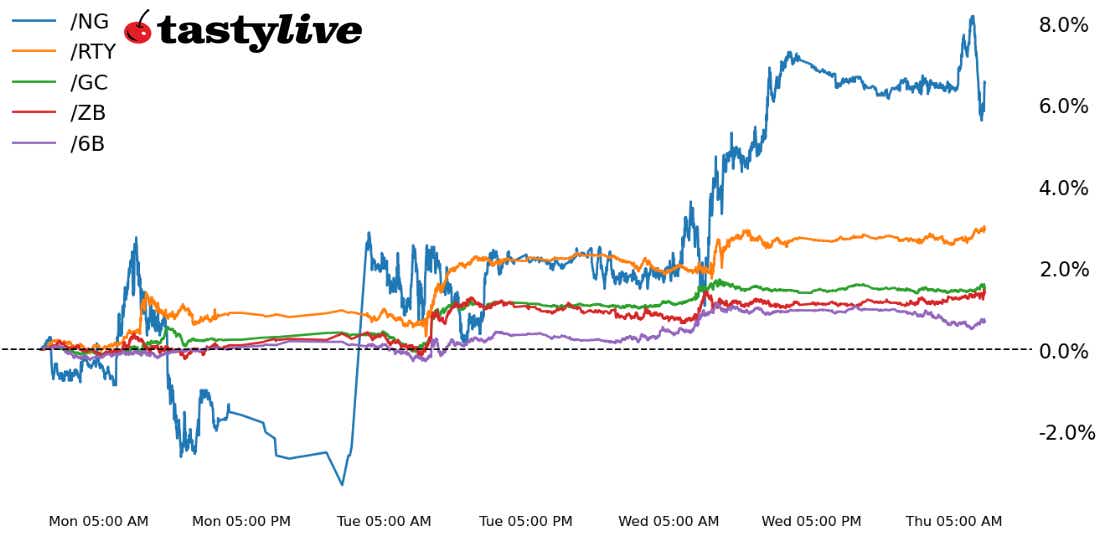

Russell 2000, 30-year T-Bonds, Gold, Natural Gas and British Pound Futures

Russell 2000, 30-year T-Bonds, Gold, Natural Gas and British Pound Futures

This Morning’s Five Futures in Focus

- Russell 2000 E-mini Futures (/RTY): +0.26%

- 30-Year T-Bond Futures (/ZB): +0.28%

- Gold Futures (/GC): +0.07%

- Natural Gas Futures (/NG): -0.89%

- British Pound Futures (/6B): -0.22%

The unwind of Federal Reserve rate hike expectations has continued for a third consecutive day, giving a further lift to U.S. equity index futures and U.S. bond futures. Each of the four major U..S stock indexes are working on their fifth consecutive day of gains, while U.S. bonds across the curve are carving out their fourth day of gains in a row. U.S. economic data released on Thursday morning offered little by way of new information that would change contemporary understanding of the state of the U.S. labor market or consumption patterns. Absent a surprise result from the August U.S. nonfarm payrolls report (NFP) on Friday, holiday-induced liquidity conditions are beginning to set in ahead of Labor Day.

Symbol: Equities | Daily Change |

/ESU3 | +0.30% |

/NQU3 | +0.13% |

/RTYU3 | +0.26% |

/YMU3 | +0.52% |

More gains are accumulating for U.S. equity index futures, with modest upside clocked ahead of the U.S. cash equity open. While the technical improvements in the S&P 500 (/ESU3) and the Nasdaq 100 (/NQU3) are noteworthy, perhaps no rebound is more critical to the belief that U.S. equity markets have bottomed than the continued rally in the Russell 2000 (/RTYU3). As has been the case for the past six months, where /RTYU3 heads, so heads everything else. At the end of the day, however, equities are following bonds, so a continued decline in U.S. Treasury yields is the keystone in the bridge for more upside in stocks, at least in the near-term.

Strategy: (14DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1860 p Short 1870 p Short 1950 c Long 1960 c | 46% | +205 | -295 |

Long Strangle | Long 1860 p Long 1960 c | 38% | x | -680 |

Short Put Vertical | Long 1860 p Short 1870 p | 74% | +92.50 | -407.50 |

Symbol: Bonds | Daily Change |

/ZTU3 | +0.04% |

/ZFU3 | +0.07% |

/ZNU3 | +0.16% |

/ZBU3 | +0.28% |

/UBU3 | +0.27% |

Fed rate hike odds are continuing to decline for November, with rates markets (as evidenced by the spread between /SR3U3 and /SR3Z3) suggesting no further hikes are coming in this cycle. U.S. Treasury yields are falling across the curve, and the rebound in the two-year T-Note (/ZTU3) has dragged the two-year yield below 4.900%. All eyes will be on the August U.S. (NFP) report tomorrow morning as a waypoint to confirm whether the recent optimism is warranted.

Strategy (22DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 118.5 p Short 119 p Short 124 c Long 124.5 c | 52% | +218.75 | -281.25 |

Long Strangle | Long 118.5 p Long 124.5 c | 32% | x | -875 |

Short Put Vertical | Long 118.5 p Short 119 p | 79% | +109.38 | -390.63 |

Symbol: Metals | Daily Change |

/GCV3 | +0.07% |

/SIU3 | -0.30% |

/HGU3 | -0.46% |

After modest gains on Wednesday, gold prices (/GCV3) are nearly unchanged this morning as traders continue to assess the Federal Reserve’s next move. Tomorrow’s NFP report will likely be a deciding factor for bullion given the tight correlation between /GCV3 and /ZBU3 in recent weeks (rolling one-month correlation of +0.77). Silver prices (/SIU3) aren’t holding up as well, however, falling as the gold/silver ratio rises from multi-month lows.

Strategy (27DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1910 p Short 1915 p Short 2000 c Long 2005 c | 54% | +200 | -300 |

Long Strangle | Long 1910 p Long 2005 c | 32% | x | -1280 |

Short Put Vertical | Long 1910 p Short 1915 p | 78% | +100 | -400 |

Symbol: Energy | Daily Change |

/CLV3 | +1.05% |

/NGU3 | -0.89% |

Crude oil (/CLV3) is gaining, up about $0.80 per barrel, or 0.98%, after China reported purchasing managers’ index (PMI) figures overnight. The gauge remains in contraction at 49.7 but edged toward the 50 mark, whereby economic activity would move into expansion territory. A similar dataset from Caixin is due out tonight, which should offer further insight into the world’s second largest economy. Energy traders have also been encouraged to buy oil as inventory levels in the U.S. fall at a faster-than-expected pace. Baker Hughes rig count numbers may guide price action this afternoon. Next week, OPEC is expected to confirm that its current production cuts will be extended into October.

Strategy (26DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.4 p Short 2.45 p Short 3.2 c Long 3.25 c | 55% | +200 | -300 |

Long Strangle | Long 2.4 p Long 3.25 c | 31% | x | -1080 |

Short Put Vertical | Long 2.4 p Short 2.45 p | 73% | +130 | -370 |

Symbol: FX | Daily Change |

/6AU3 | +0.12% |

/6BU3 | -0.22% |

/6CU3 | +0.03% |

/6EU3 | -0.42% |

/6JU3 | +0.30% |

The euro (/6EU3) fell overnight after Euro-area inflation growth appeared to moderate in August, culling bets that the European Central Bank (ECB) may continue to hike rate hikes in the near future. Consumer prices for August on a core basis—a measure that excludes volatile food and energy prices—crossed the wires at 5.3% on a year-over-year basis, down from 5.5% in July. Meanwhile the Australian dollar (/6AU3) is moving higher as it benefits from a broader risk-on move in equity markets amid signs that Chinese stimulus efforts are accelerating.

Strategy (8DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.255 p Short 1.2575 p Short 1.2775 c Long 1.28 c | 53% | +68.75 | -87.50 |

Long Strangle | Long 1.255 p Long 1.28 c | 31% | x | -193.75 |

Short Put Vertical | Long 1.255 p Short 1.2575 p | 82% | +25 | -131.25 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.