S&P 500 and Nasdaq 100 Rally After Trump Assassination Attempt

S&P 500 and Nasdaq 100 Rally After Trump Assassination Attempt

Also, 10-year T-note, silver, crude oil and Japanese yen futures

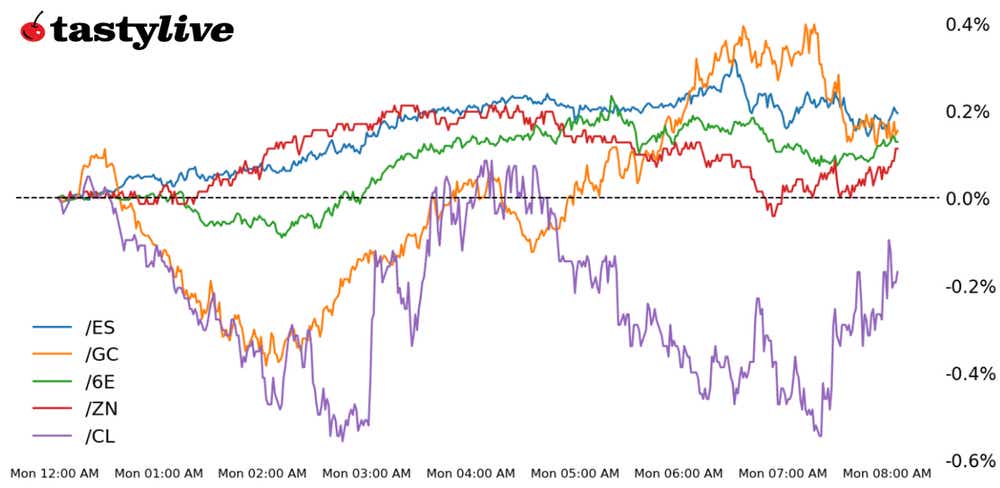

S&P 500 E-mini futures (/ES): +0.4%

10-year T-note futures (/ZN): -0.18%

Gold futures (/GC): -0.15%

Crude oil futures (/CL): +0.07%

Euro futures (/6E): +0.03%

The assassination attempt on presidential candidate Donald Trump over the weekend increased the odds for a Trump presidency, according to betting markets. Those odds have traders buying equities and selling bonds as markets see looser fiscal policy from a Republican administration that would also likely ease corporate regulation.

Bitcoin futures (/BTCN4) rose nearly 10% in response to the political developments, and defense industry stocks also climbed. Trump Media & Technology Group (DJT) soared over 30% this morning. Goldman Sachs (GS) rose 1% in morning trading after the bank reported second-quarter earnings beat. Macy’s (M) fell 15% after discussions with Arkhouse fell through, ending months of talks over a buyout.

San Francisco Federal Reserve President Mary Daly will speak today before markets shift their focus to U.S. retail sales due tomorrow morning.

Symbol: Equities | Daily Change |

/ESU4 | +0.4% |

/NQU4 | +0.39% |

/RTYU4 | +0.88% |

/YMU4 | +0.56% |

U.S. equity futures moved higher this morning, with S&P 500 contracts (/ESU4) rising 0.42% just ahead of the New York open. Traders see the improved bets for a Trump presidency translating to looser regulations and possibly lower corporate tax rates, both of which would act as a net positive for corporate earnings. Increased tariffs are also being priced into Chinese equities, which fell overnight.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5425 p Short 5450 p Short 5925 c Long 5950 c | 63% | +282.50 | -967.50 |

Short Strangle | Short 5450 p Short 5925 c | 69% | +2000 | x |

Short Put Vertical | Long 5425 p Short 5450 p | 85% | +150 | -1000 |

Symbol: Bonds | Daily Change |

/ZTU4 | 0% |

/ZFU4 | -0.05% |

/ZNU4 | -0.18% |

/ZBU4 | -0.7% |

/UBU4 | -1.03% |

The 10-year T-Note futures contract (/ZNU4) fell this morning but it failed to keep pace with the longer-dated 30-year contract, reflecting a bear steepening in the yield curve. The move is likely being driven by increased odds for Trump to take the presidency, which would likely usher in looser fiscal policies. The Treasury will auction off 13- and 26-week bills today, and 20-year bonds and 10-year TIPS (Treasury inflation protected securities) later this week.

Strategy (67DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 108 p Short 108.5 p Short 113.5 c Long 114 c | 57% | +171.88 | -328.13 |

Short Strangle | Short 108.5 p Short 113.5 c | 65% | +656.25 | x |

Short Put Vertical | Long 108 p Short 108.5 p | 91% | +62.50 | -437.50 |

Symbol: Metals | Daily Change |

/GCQ4 | -0.15% |

/SIU4 | -0.89% |

/HGU4 | -1.23% |

Gold futures (/GCQ4) trimmed losses at the New York open to trade nearly unchanged this morning as precious metals traders assess the movements in the bond and currency markets. Friday’s data from the Commodities Futures Trading Commission (CFTC) showed speculators increased their long positions for the week ending July 9 by nearly 20,000 contracts. That shows the biggest outright long position since April 2022.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2405 p Short 2410 p Short 2435 c Long 2440 c | 11% | +450 | -50 |

Short Strangle | Short 2410 p Short 2435 c | 54% | +8,110 | x |

Short Put Vertical | Long 2405 p Short 2410 p | 67% | +200 | -300 |

Symbol: Energy | Daily Change |

/CLQ4 | +0.07% |

/HOQ4 | -0.29% |

/NGQ4 | -4.72% |

/RBQ4 | -0.56% |

Crude oil prices (/CLQ4) pulled back today, adding to Friday’s losses as concerns about demand weigh on the commodity. Data from China on Friday showed that crude oil imports fell over 2% in the first six months of the year. While those demand concerns should weigh on prices, markets continue to see deficits forming this quarter as OPEC tamps down on output. Russia also said over the weekend that the country is considering export bans on gasoline later this summer if supply shortages worsen. Prompt spreads in WTI (West Texas intermediate) crude and Brent crude oil also remain elevated, suggesting a tight physical market.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 80 p Short 80.5 p Short 82.5 c Long 83 c | 20% | +390 | -110 |

Short Strangle | Short 80.5 p Short 82.5 c | 54% | +3,150 | x |

Short Put Vertical | Long 80 p Short 80.5 p | 55% | +230 | -270 |

Symbol: FX | Daily Change |

/6AU4 | -0.16% |

/6BU4 | -0.05% |

/6CU4 | -0.14% |

/6EU4 | +0.03% |

/6JU4 | -0.08% |

Euro futures gained today to continue last week’s trend higher. Friday’s CFTC data showed a rise in long speculators in the currency, which brought speculators into a net long position. Prices are near the June swing high at 1.09680. Clearing that high would put /6EU4 at the highest level traded since March. U.S. retail sales data may support rate cut bets for the Fed and possibly drag on the dollar more, which would clear the path higher for the euro.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.08 p Short 1.085 p Short 1.1 c Long 1.105 c | 33% | +375 | -250 |

Short Strangle | Short 1.085 p Short 1.1 c | 53% | +1,337.50 | x |

Short Put Vertical | Long 1.08 p Short 1.085 p | 81% | +162.50 | -462.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.