Snowflake Earnings Report This Week: What to Know

Snowflake Earnings Report This Week: What to Know

By:Mike Butler

Investors will want to hear more about the Snowflake AI deal with Nvidia and the outlook for the rest of the year.

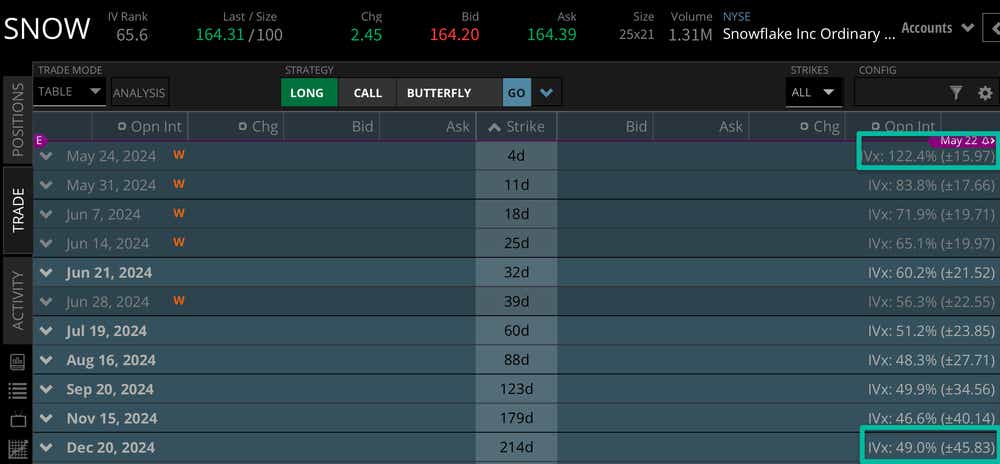

The expected stock price move for the week is +-$15.97—just under 10% of the notional value

- Snowflake is set to report earnings on May 22 after the stock market closes.

The company is projected to announce earnings-per-share (EPS) of $0.17 on $785.89 billion in revenue.

Last quarter, SNOW stock dropped over 20% despite beating EPS estimates by almost 100%.

Snowflake earnings preview

Snowflake (SNOW) opened the trading year at $195 per share, and the company has realized a substantial amount of volatility so far in 2024. After climbing as high as $237.72 in February., the stock dropped like a rock after the last earnings call, falling to a near-term low $144.32. The stock currently sits around $165 per share:

Frank Slootman, who was then Snowflake CEO, offered some remarks in the last earnings call:

"We are successfully campaigning the largest enterprises globally, as more companies and institutions make Snowflake’s Data Cloud the platform of their AI and data strategy."

A few weeks after the last #earnings call, Snowflake’s new CEO, Sridhar Ramaswamy, announced an AI partnership with Nvidia (NVDA):

"Our partnership with Nvidia is delivering a secure, scalable and easy-to-use platform for trusted enterprise data,” Ramaswamy said. “And we take the complexity out of AI, empowering users of all types, regardless of their technical expertise, to quickly and easily realize the benefits of AI."

Bringing the NVDA full stack accelerated program to enterprise customers is the main idea here, and the stock price is now higher than it was when the news was released.

Looking at the implied volatility of the options market in Snowflake can help us see just how much pressure the market is putting on the company during this earnings call. The expected stock price move for the week is +-$15.97, which is just under 10% of the notional value of the stock price. This is on the higher end of the range compared to other tech stocks that have reported this quarter.

Looking farther into the year, we can see a stock price expected move of +-$45.83 through the Dec. options cycle. In other words, this week's expected stock price move accounts for a third of the expected move through almost the remainder of the year.

Bullish on Snowflake for earnings

It's always scary to see a stock plummet after reporting strong numbers on an earnings call. Last quarter, it blew EPS estimates out of the water after reporting earnings of $0.35 per share on an estimated $0.18 per share. The stock still dropped over 20% the next day. With that said, Snowflake executives have released positive AI statements and new deals with tech giants like Nvidia, so maybe the market will see this in a positive light if the company can elaborate on plans for the rest of the year. SNOW stock bulls will likely want to see another EPS and revenue beat, with positive sentiment on the NVDA deal and more.

Bearish on Snowflake for earnings

Snowflake bears may believe an EPS or revenue miss is coming, and heightened implied volatility this week isn't necessarily a good thing. The rest of the tech sector and general stock market is rallying quite aggressively, but SNOW stock isn't following suit. If the company fails to deliver on a strong sentiment this year, and/or misses on EPS estimates, we may see the stock drop.

Tune in to Options Trading Concepts Live on Wednesday at 11 a.m. CDT for a more in-depth look at options strategies in both SNOW and NVDA stock, as they both report Wednesday afternoon.

dfdfdfd

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.