Super Micro Computer’s (SMCI) Pain is Dell’s (DELL) Gain

Super Micro Computer’s (SMCI) Pain is Dell’s (DELL) Gain

In the AI gold rush, Dell appears to be digging in the right spot

- Super Micro Computer faces mounting challenges, including reputational setbacks and a reduced supply of Nvidia’s chips.

- Dell is positioned to capitalize on SMCI’s difficulties, with strong AI server sales, reliable partnerships and new products tailored for Nvidia’s latest Blackwell chips.

- As demand for AI infrastructure continues to grow, Dell’s strong reputation and strategic alignment with Nvidia position it for growth.

Super Micro Computer (SMCI) has entered a dizzying descent. When we last examined the company, its shares traded around $415 ($41.50 in post-split terms). At the time, we warned that legal and operational issues could push prices down drastically, potentially as low as $20 per share in post-split terms. Today, that grim forecast has become reality, with shares of “Supermicro” trading about $18/share.

One of the most devastating blows came when Ernst & Young, SMCI’s auditor, abruptly resigned on Oct. 30 over concern about the company’s accounting practices. An auditor’s exit in turbulent times rarely inspires confidence, and for Supermicro, it has been a dark cloud hovering over its financial disclosures. In response, the company has tried to soothe anxieties, but the optics of an auditor shakeup amid a DOJ investigation are unmistakably grim.

Reputation, in the end, is priceless. In our previous analysis, we noted reputational damage could weigh heavily on Supermicro’s valuation. Now, Nvidia (NVDA), one of the most important players in AI hardware, has reportedly rerouted some of its chip supply away from Supermicro to rival manufacturers like Gigabyte and ASRock—a seismic shift that signals just how deep SMCI’s troubles run. Industry analysts have indicated Dell Technologies (DELL) and Hewlet Packard Enteprise (HPE) are well-positioned to gain market share because of the fallout associated with Supermicro.

As Nvidia’s finds new sources for chips, Dell’s reputation for stability and HP’s trusted enterprise relationships make them natural landing spots for customers looking for reliable AI server partners. Losing Nvidia’s confidence amounts to an open question about Supermicro's future, and a tacit warning for its other customers: Stability and integrity are paramount. Nvidia’s pivot undermines the foundation of SMCI’s once-dominant position, casting a shadow over its lofty ambitions and shrouding its long-term prospects in a blanket of uncertainty.

Dell’s growing appeal in a shifting market

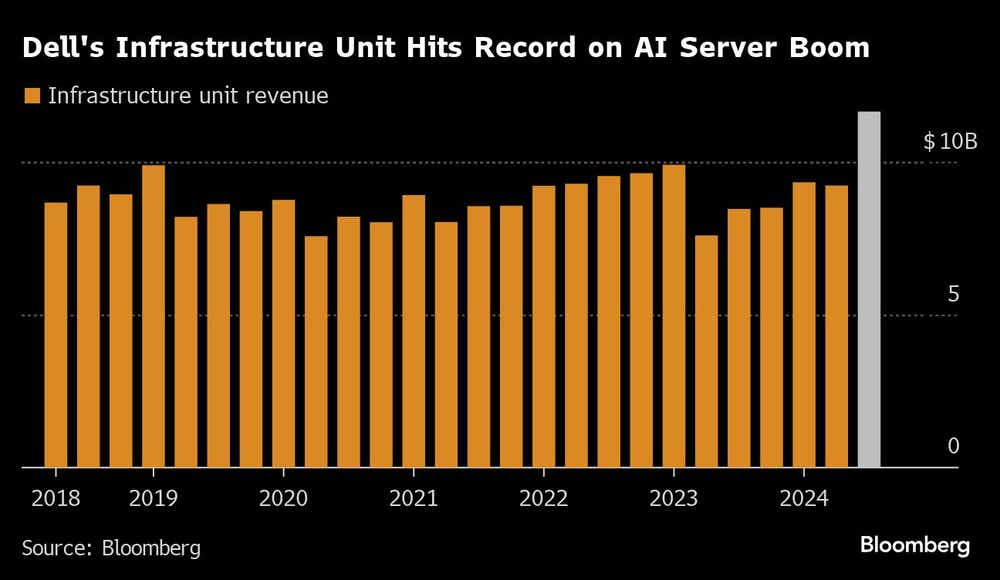

As SMCI grapples with reputational and operational challenges, Dell is primed to capitalize on opportunities. Recent quarterly results underscore Dell’s formidable position in the AI-driven server market. Last quarter, Dell reported $3.1 billion in AI server sales—an uptick from $1.7 billion from the quarter before that and a remarkable 80% increase. This surge highlights Dell’s capacity to meet the exploding demand for AI infrastructure, driven largely by major cloud providers and enterprises funneling billions into next-generation AI technology.

Dell’s Infrastructure Solutions Group (ISG), which encompasses AI-oriented servers built around Nvidia’s high-performance chips, has become the company’s fastest-growing unit. ISG sales rose by an impressive 38% to $11.65 billion, outpacing expectations and underscoring Dell’s role in fulfilling large-scale AI deals. Along those lines, Dell has been identified by Nvidia’s CEO, Jensen Huang, as a critical partner for delivering AI-capable systems—a notable endorsement given Nvidia’s role at the heart of the AI ecosystem.

Dell’s valuation adds to its appeal. Trading at a price-to-earnings (P/E) ratio of 25—below the sector median of 32—Dell stands out as both a growth leader and a value-driven investment. This relatively modest P/E indicates that despite Dell’s impressive performance in 2024, the stock still has room to appreciate, particularly as demand for AI servers continues to surge. With a robust AI pipeline and a $3.8 billion backlog in AI server orders, Dell is strategically positioned to seize market share, particularly as Supermicro grapples with eroding customer confidence and reputational challenges.

Beyond all this, Dell has a track record of stable and consistent performance, further supported by its strategic share repurchases and dividends, which totaled $1 billion in the recent quarter. While SMCI’s challenges are mounting, Dell’s combination of impressive AI sales, competitive valuation and dependable operational foundation offers a compelling choice for investors seeking exposure to the booming AI market without the baggage of unresolved accounting issues.

Blackwell chip rollout, a potential game-changer for Dell

The release of Nvidia’s highly anticipated Blackwell chips has brought a new wave of interest in AI supercomputing. Recently, SoftBank became the first recipient of Nvidia’s DGX B200 systems, powered by Blackwell GPUs, marking a milestone in AI infrastructure. SoftBank’s new supercomputer in Japan will harness Blackwell’s capabilities, advancing AI research across sectors from telecommunications to healthcare.

While it will take time to scale up production, companies receiving Blackwell chips will face an immediate need to deploy them. Major players like Alphabet (GOOGL), Amazon (AMZN) and Microsoft (MSFT) are among those slated to receive initial Blackwell deliveries in 2025. Dell, meanwhile, is positioned to gain from this rollout. Earlier this year, the company announced a new line of AI servers designed to support Blackwell technology. These servers, featuring advanced liquid cooling, are expected to hit the market by late 2024, placing Dell in prime position to meet surging demand for cutting-edge AI infrastructure.

For Supermicro, the delayed availability of Blackwell chips could strain its already precarious position. With Nvidia now redirecting orders to alternative suppliers, Supermicro’s challenges could deepen, leaving it vulnerable to a loss of market share at a crucial time. As Nvidia pivots to stabilize its supply chain by shifting Supermicro’s orders to other companies, Supermicro faces the risk of being increasingly marginalized in the AI server market.

These risks are underscored by recent shifts in analyst coverage of SMCI shares. At the end of October, Needham suspended its coverage of Super Micro Computer, citing concern over the resignation of Ernst & Young as auditor. Needham said in a statement that “not only does Ernst & Young’s resignation raise considerable questions about the validity of Supermicro’s current and past financial statements, but it also raises significant questions about Supermicro’s corporate governance and management’s commitment to integrity and ethical values.” Adding to the mounting pressure, JPMorgan downgraded SMCI from “neutral” to “underweight” and cut its price target from $50 per share to $23, signaling a significant loss of confidence in the company’s prospects.

A compelling value proposition for AI-focused investors

As SMCI struggles with accounting and reputational issues, Dell Technologies emerges as a formidable player that’s well-positioned to capitalize on unexpected opportunities. Despite Supermicro’s initial promise, a string of damaging developments—including the resignation of its auditor and Nvidia’s decision to redirect chip supply—has cast doubt over SMCI’s future in the AI server market. Dell, on the other hand, has demonstrated impressive growth in AI server sales, supported by strong partnerships and a stable operational foundation.

Even without immediate access to Nvidia’s Blackwell chips, Dell is poised to boost its market share through its close relationship with Nvidia, and its long history of delivering consistent, high-quality products and services. The company’s Infrastructure Solutions Group, which posted an 80% jump in server sales last quarter, underscores Dell’s ability to meet the surging demand for AI infrastructure among top cloud providers and enterprises.

Dell trades at a relatively modest P/E ratio of 25 compared to the sector median of 32, giving it a value edge. Currently trading around $134/share, Dell offers an implied potential upside of roughly 10%, considering that the average analyst price target for the stock is closer to $148. Of 29 analysts covering Dell, 18 have a “buy” rating, with 7seven rating it as “overweight” and only four as “hold”—notably, no analysts rate the shares as “sell” or “underweight.” This strong analyst support reflects confidence in Dell’s ability to leverage a favorable position, especially as customers increasingly turn to stable, trusted providers amid the latest upheaval in the supply chain.

In a dynamic and fast-moving market, Dell’s stability and strategic positioning could ensble it to capture gains, especially if Supermicro’s troubles persist. With an expanding AI server backlog and an impressive sales pipeline, Dell’s mix of growth, value and reliability positions it as a top pick for investors seeking exposure to the AI sector without the uncertainties facing other players in the sector.

Dell’s next earnings report—its Q3 fiscal year 2025 report—will be released Nov. 26 at 3:30 p.m. CST. While the upcoming report is expected to be robust, the financial benefits stemming from SMCI’s recent setbacks may take another quarter or two to materialize in Dell’s results.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.