Are Stocks in Trouble if the Fed Delays Rate Cuts Too Long?

Are Stocks in Trouble if the Fed Delays Rate Cuts Too Long?

By:Ilya Spivak

Stock markets cheered as inflation data showed better progress than expected, but will it convince the Federal Reserve to cut interest rates?

May’s U.S. inflation data shows more downward progress than expected

A cautious Fed remains reluctant to cut rates. Will it overstay its welcome?

China and the Eurozone seem too weak to offset any lapse in U.S. growth

Financial markets were left with mixed cues after May’s U.S. consumer price index (CPI) data showed welcome progress on bringing inflation lower while the Federal Reserve seemed to adjust to a less dovish posture. The data pointed to a faster deceleration in price growth than economists anticipated, But the central seemed no more confident.

In monthly terms, overall prices did not rise for the first time since July 2022. Core CPI–the measure excluding volatile food and energy prices that is emphasized by policy officials–rose just 0.2% from the prior month, marking the smallest increase since June 2023. Annualized three- and six-month trackers for both gauges helpfully ticked lower.

Nevertheless, the Fed’s policy-setting Federal Open Market Committee (FOMC) upgraded its forecasts for inflation in 2024 and 2025, even as it left its view of growth unchanged and pushed up a bit the baseline for the unemployment rate. That saw the expected scope for rate cuts in this year and next reduced by 20 basis points (bps).

What’s more, the Fed pulled its forecast for the longer-term “neutral” interest rate–the level at which monetary policy is neither restrictive nor stimulative–sharply upward to 2.8%. This implies that the floor on borrowing costs at the end of any incoming rate cut cycle is now meaningfully higher.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

This raises an important question: Is the Fed now running the risk of overtightening, whereby it waits too long to begin cutting interest rates and hurts the economy? If so, and the U.S. economy suffers a harder landing than the central bank envisions, will the other major drivers of global performance–the Eurozone and China–step up as potent offsets?

China’s economy is still in trouble

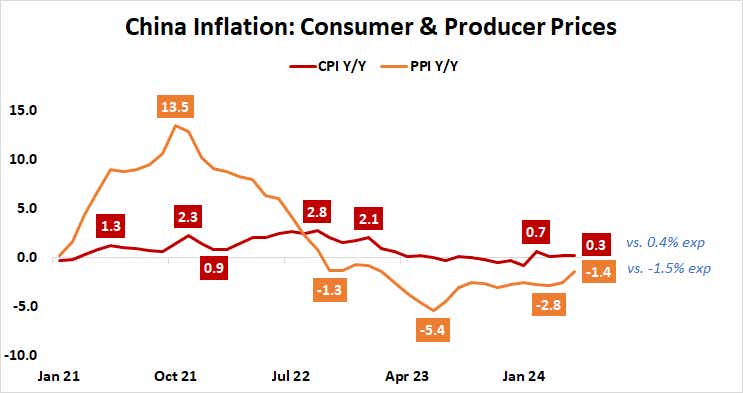

The May edition of China’s headline inflation data proved to be disappointing, as expected. The CPI rose 0.3% year over year, undershooting forecasts calling for a slightly warmer rise of 0.4%. Meanwhile, producer price index (PPI) fell at the slowest rate since February 2023, down 1.4% year-on-year.

While the uplift in PPI speaks to somewhat better prospects at the wholesale level–enterprises appear better able to pass through rising input costs into selling prices, producing the first monthly PPI rise since September 2023–the CPI print looks ominous. It speaks to anemic domestic demand.

Overall, this is a troubling mix. May’s official purchasing managers index (PMI) showed the manufacturing sector shrank for the first time in three months. It has recorded only three monthly expansions since PPI began to recover from its cycle low in mid-2023. The improvement in pricing power makes for cold comfort under such conditions.

The same PMI data also shows that overall economic activity has deteriorated for two consecutive months after a pop in March, echoing a parallel slowdown in the service sector. This puts the pain from weak conditions at home front and center.

Europe to the rescue?

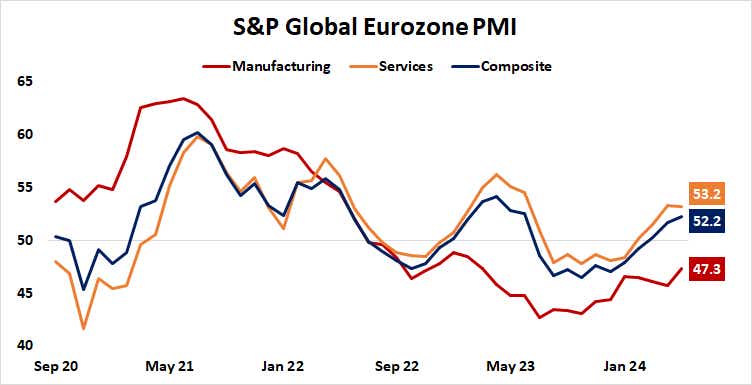

While China struggles, the economic state of play in the Eurozone appears to be improving. S&P Global PMI data showed that the currency bloc grew at the fastest pace in almost a year last month. The manufacturing sector remains in the doldrums, but a chipper rebound in services has powered the way back from a shallow recession in late 2023.

The key question now is whether positive momentum is sustainable. Analytics from Citigroup warn that incoming Eurozone economic data outcomes began to cool relative to forecasts in early March. Whether the buoyancy on display in the first quarter of this year amounts to more than normalization after a downturn remains to be seen.

Perhaps most tellingly, Eurozone stock markets (ETF: EZU) have fallen by nearly 4% since the European Central Bank (ECB) cut interest rates for the first time in five years on June 6. If investors were more confident in the path for growth, the prospect of cheaper credit might have sent shares soaring. As it stands, they appear circumspect.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.