Selling Options Yields Consistent Success

Selling Options Yields Consistent Success

By:Kai Zeng

Managing positions 21 days before expiration helps stabilize performance, benefiting delta strategies

The tastylive research team tested a 45-day options strategy on the SPDR S&P 500 ETF Trust (SPY) and discovered a success rate of about 77% for SPY. This is significantly higher than the theoretical rate of 68%.

But do these success rates vary greatly when applied to other stocks?

To find out, we examined multiple stocks from various sectors, including AT&T (T), Pfizer (PFE), Apple (AAPL), Microsoft C (MSFT), Tesla (TSLA), Alibaba (BABA), First Solar (FSLR), Exxon Mobil (XOM), JPMorgan (JPM) and United Parcel Service (UPS). We compared the success rates of two option strategies, both with and without managing the positions at 21 days before they expired.

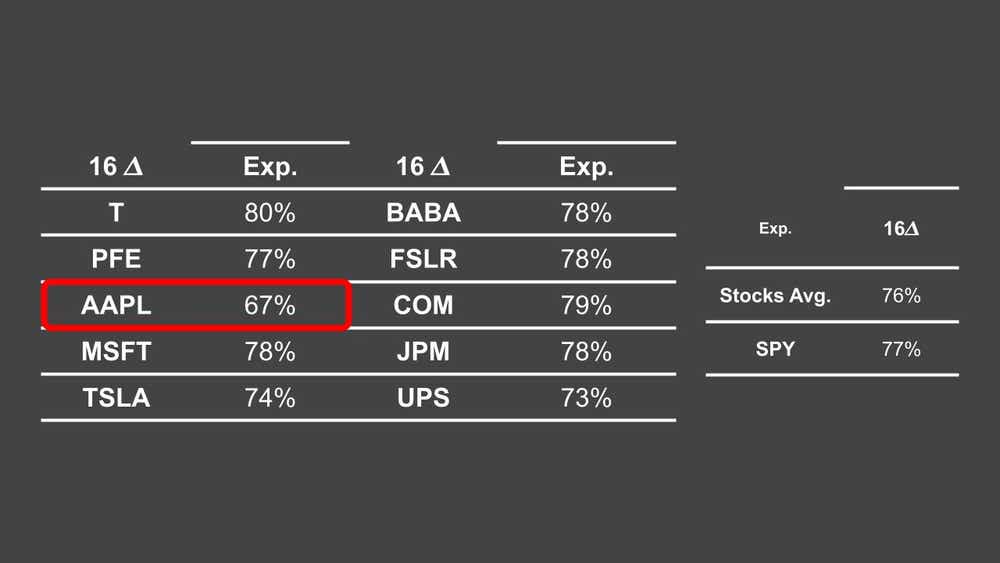

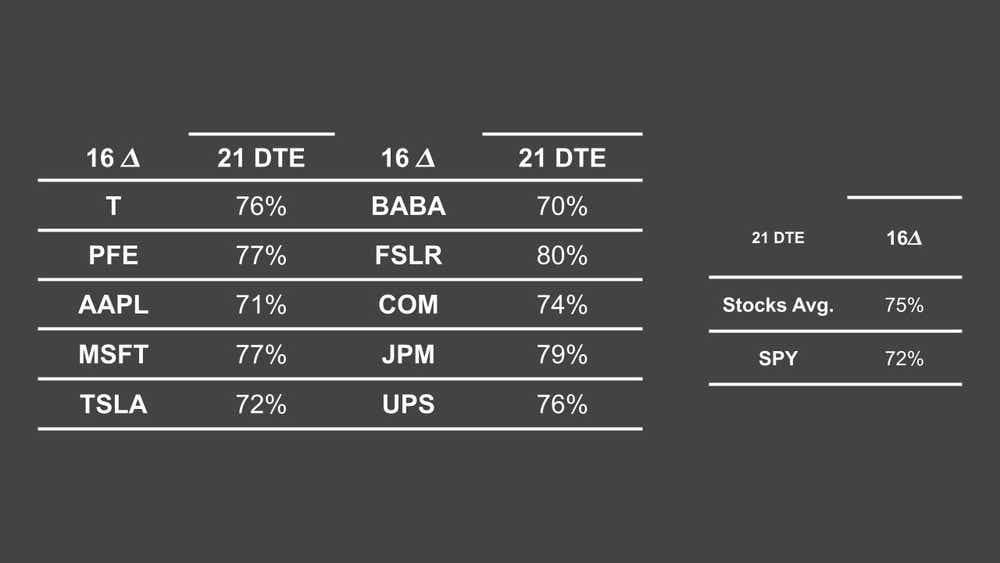

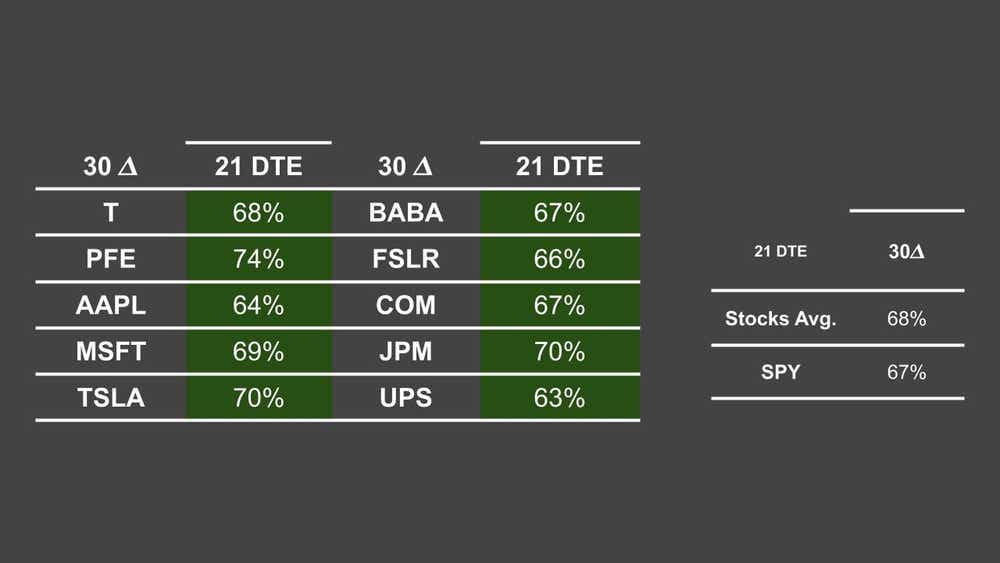

According to the tastytrade platform, these strategies, labeled 16 delta and 30 delta, should theoretically have success rates around 68% and 55%, respectively.

For the 16 Delta strategy, almost all the stocks tested showed much higher success rates than the theoretical prediction. Apple was the only stock with a lower success rate. Overall, the average success rate for these stocks was similar to that of SPY.

For the 30 delta strategy, the success rates were more consistent compared to the 16 delta strategy and were higher than the expected 55%. On average, the success rate was the same as that of SPY.

Exiting positions 21 days before expiration smoothed the results across all these stocks. The Apple success rate significantly improved and aligned with the other stocks.

Our findings indicate the improvement is more noticeable in larger delta positions. The success rates for these positions were equal to or higher than when holding them until expiration across all 10 stocks.

To sum it up, selling options on individual stocks can yield relatively consistent success rates, regardless of sector variations. On average, these success rates are comparable to those achieved with SPY. Managing positions 21 days before expiration helps reduce volatility in success rates, offering more consistent performance. This is especially beneficial for larger delta strategies, making it a worthy consideration for traders looking to optimize their options trading approach.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.