Saudi Minister Threatens Crude Oil Traders, But OPEC Influence Has Waned

Saudi Minister Threatens Crude Oil Traders, But OPEC Influence Has Waned

By:Ilya Spivak

Saudi Arabia's energy minister told speculators betting on crude oil weakness to "watch out", but the influence that the kingdom and its OPEC allies have on prices has been vastly diminished.

- Saudi energy minister threatened to “ouch” crude oil speculators betting on lower prices

- OPEC market power has demonstrably waned as it struggles to enforce production quotas

- Crude oil prices lead OPEC output trends, with global commodities demand the pace-setter

Speaking during a panel discussion at the Qatar Economic Forum in Doha last week, Saudi Arabia’s Minister of Energy Abdulaziz bin Salman offered some choice words for crude oil traders:

“Speculators, like in any market, they are there to stay. I keep advising that they will be ouching. They did ouch in April. I don’t have to show my cards, I’m not [a] poker player…but I would just tell them, watch out.”

Presumably, this less-than-subtle threat was meant to discourage bets on lower prices.

The “ouching in April” of which the minister is boasting refers to an unexpected decision by Organization of Petroleum Exporting Countries (OPEC) and its allies – the so-called “OPEC+” group – to cut its output quota by 1 million barrels per day over the month’s opening weekend. Prices shot higher by nearly 6 percent at Monday’s trading open on April 3 and limped higher by a further 4.3 percent over the next 8 trading days. They then turned briskly lower, erasing all of the rise just two weeks later (and before month’s end).

The episode is a telling illustration of the limits of OPEC’s influence. The cartel is still able to generate some headlines and trigger knee-jerk volatility, but its ability to shape lasting market outcomes has been vastly diminished. It isn’t difficult to see why.

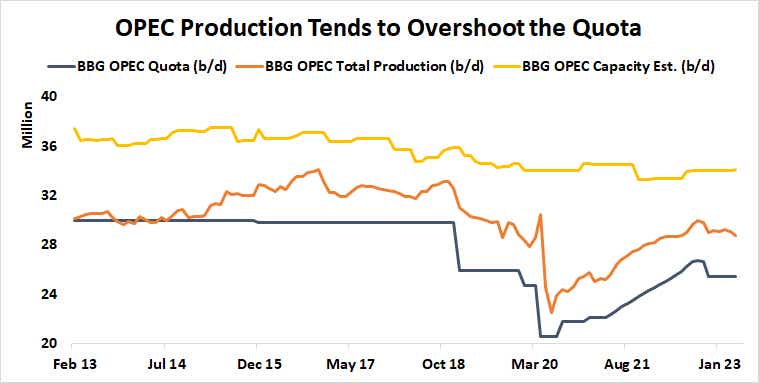

1. OPEC routinely overshoots its output quota.

The entire period of active quota management triggered in the wake of crude’s sharp decline in 2014 has been marked by overproduction, according to data compiled by Bloomberg. This makes it clear that the group is unable to maintain discipline within its ranks, draining away the market power that could have been asserted were it truly able to act as one.

Data Source: Bloomberg

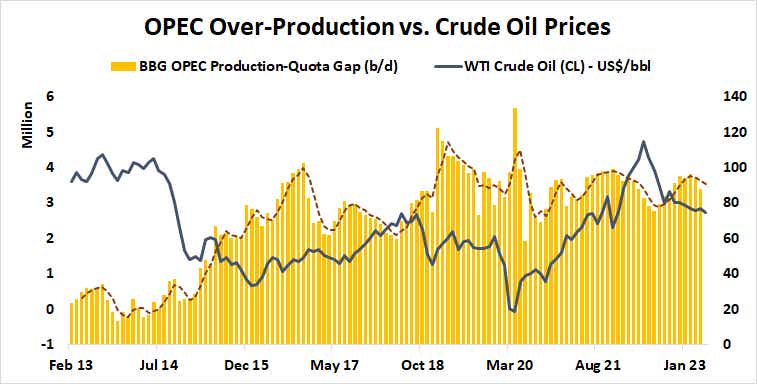

2. The size of OPEC over-production is not a reliable influence on crude oil prices.

Looking beyond strict adherence to the quota to consider OPEC’s influence in relative terms, one might expect that overshooting the target by a lot would pressure prices lower while keeping the gap small might underpin them. However, the relationship seems tenuous at best. That undermines the case for the cartel’s market-driving potency still further.

Data Source: Bloomberg

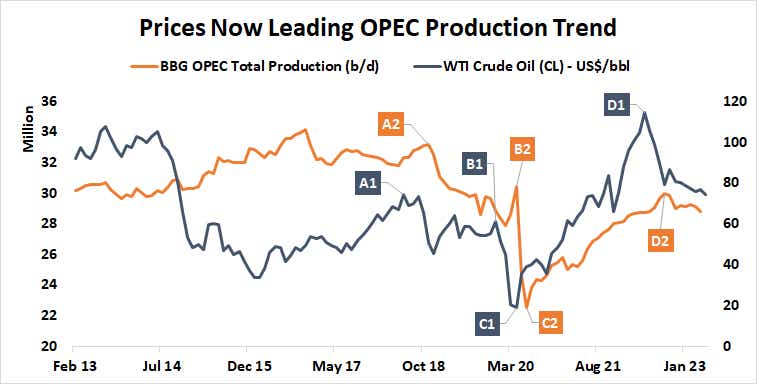

3. Crude oil prices now lead the trend in OPEC output.

Clearly, the Saudi minister’s remarks imply that this is the opposite of what cartel officials want to portray. From about mid-2018, major turning points in the crude oil price trend have preceded changes in OPEC output in the same direction. Major tops in prices have been followed by reduced output, implying producers simply found it less profitable to pump more into a falling market. The key bottom amid the Covid-19 outbreak in early 2020 occurred in prices before OPEC output started to rebuild, ostensibly to take advantage of improving margins. In all, it seems that it’s not OPEC supply that influences prices, but the other way around.

Data Source: Bloomberg

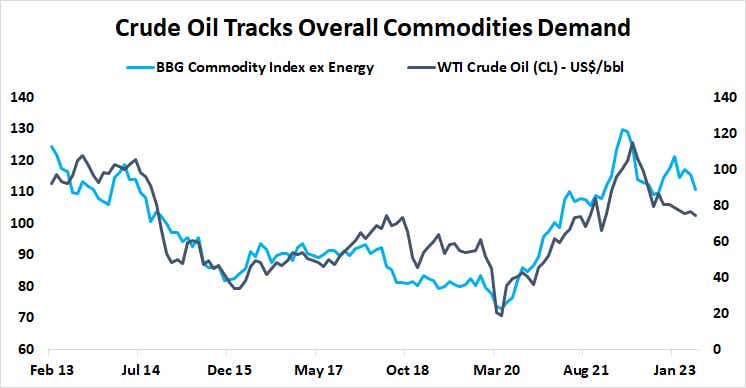

4. Crude oil prices track broad-based commodities demand.

What drives the price of crude, if not OPEC? The WTI benchmark tellingly trades in lockstep with the Bloomberg Commodity Index – a catch-all benchmark for raw materials prices – even when it is stripped of its energy component. That factors out any crosscurrents from adjacent products, putting in sharp relief that crude oil trades with broad-based demand for commodity inputs. That makes its trend a function of the global business cycle, not OPEC’s say-so.

Data Source: Bloomberg

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.