Salesforce Earnings Preview: Google Deal in Focus as Stock Slides

Salesforce Earnings Preview: Google Deal in Focus as Stock Slides

By:Mike Butler

The expanded partnership bring the Gemini generative AI chatbot tool to Agentforce

- Salesforce Inc. will report quarterly earnings on Wednesday, after the market closes.

- After an earnings-per-share (EPS) miss last quarter, the tech giant will look to bounce back.

- It is expected to report an EPS of $2.61 on $10.04 billion in revenue.

- Salesforce and Google recently expanded their partnership, bolstering AI efforts for Salesforce's autonomous AI agents.

Ahead of the earnings call this week, Salesforce (CRM) announced an expanded partnership with Alphabet (GOOGL), which will bring Gemini, Google's generative AI chatbot tool, to Agentforce. Agentforce is an autonomous platform that enables customers to help themselves with popular or simple queries. With Gemini, more complex queries can be handled as well.

Srini Tallapragada, Salesforce president and chief engineering and customer success officer, offered commentary in a recent press release: “Through our expanded partnership with Google Cloud and deep integrations at the platform, application and infrastructure layer, we're giving customers choice in the applications and models they want to use ... Salesforce offers a complete enterprise-grade agentic AI platform that makes it easy to deploy new capabilities easily and realize business value fast. Google Cloud is a pioneer in enterprise agentic AI, offering some of the most powerful, capable models, agents and AI development tools on the planet. Together we are creating the best place for businesses to scale with digital labor.”

An apparent win-win scenario for both parties doesn't hide the fact Salesforce failed to exceed earnings-per-share (EPS) estimates last quarter. Over the past four earnings announcements, Salesforce has had a decent earnings history, missing EPS and revenue estimates once. With that said, CRM stock has failed to maintain the recent all-time high price of $369 per share.

The stock currently sits around $310 per share, which is on the lower end of the 2025 trading range so far. It will be interesting to see if Salesforce execs can wade through the earnings storm and post a strong report in a few days.

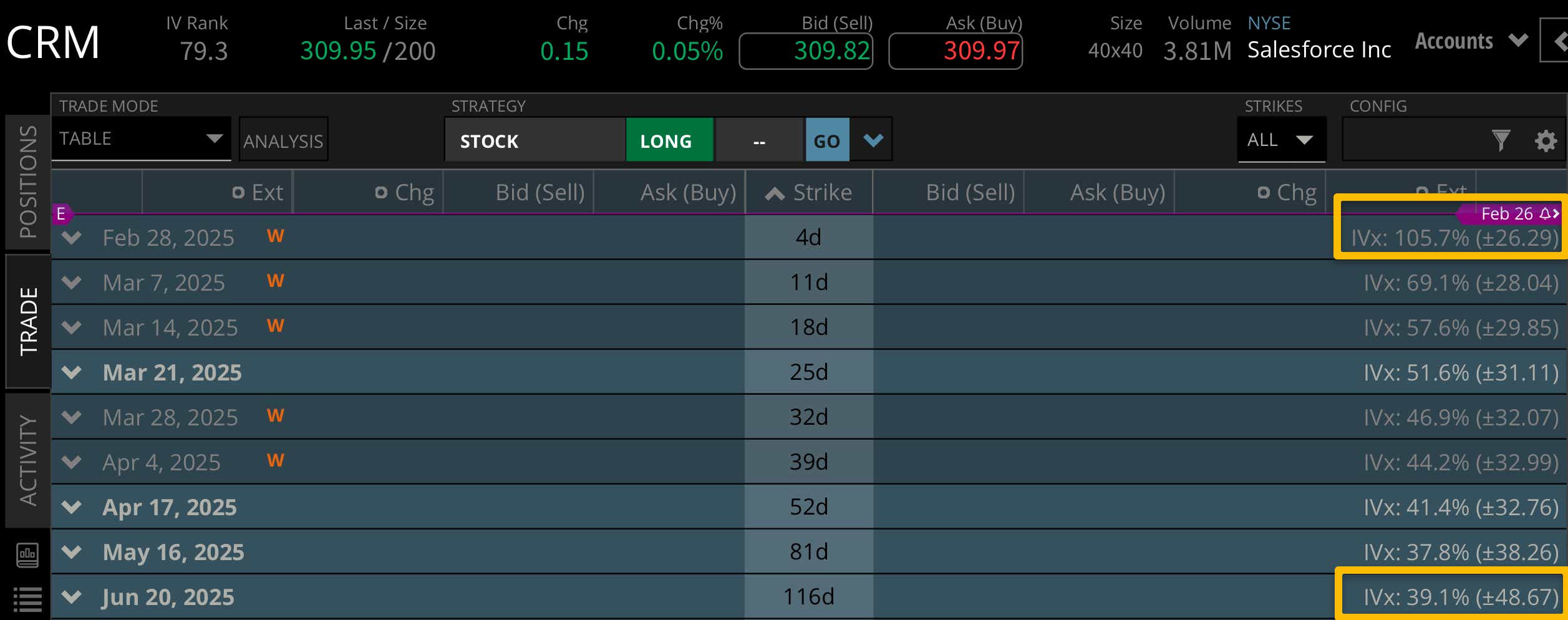

When we evaluate earnings announcements, we can also look at the implied volatility of the options market to give us context around what the market is expecting this week.

Looking at this week's option expiration cycle, we can see a +/- $26.29 expected stock price move for CRM. This is about 8% of the notional value of the stock price, which puts Salesforce on the higher end of the 5% to 10% range we typically see for stocks reporting earnings.

Looking farther into time, we see a +/- $48.67 expected stock price move through the June expiration. That means the expected move this week makes up for over 50% of the stock's expected range over the next 116 days. The market is not taking this earnings announcement lightly, and given the recent earnings history and expanded Google partnership, we could see fireworks after the close on Wednesday.

Bullish on Salesforce stock for earnings

If you're bullish on CRM stock for earnings, you want to hear a more detailed plan for the Google partnership expansion that was just released, and you want to see EPS and revenue estimates exceeded. The stock has had volatile moments over the past few months, but it's still way up from recent lows of $220 late last year. Salesforce bulls are looking for a momentum generator, and the Google partnership could be just that.

Bearish on Salesforce stock for earnings

If you're bearish on CRM stock for earnings, you may be weary of the lack of movement to the upside in the stock price after the Google news. You may also think high implied volatility in a well-known tech stock isn't necessarily a good thing. High implied volatility translates to uncertainty, and binary events are certainly unpredictable. Any sort of EPS or revenue miss may make it hard for the stock price to rally off recent lows.

Tune in to Options Trading Concepts Live on Wednesday at 11 a.m. CST for an in-depth options trading strategy overview for Salesforce (CRM), Snowflake (SNOW) and NVIDIA (NVDA) earnings.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.