The Russell 2000’s Most Promising Stocks in 2025

The Russell 2000’s Most Promising Stocks in 2025

In the world of small-cap underdogs, these stars are punching well above their weight

- Despite underperforming the S&P 500 and Nasdaq Composite, the Russell 2000 has seen standout small-cap stocks posting significant gains.

- Companies like Dave Inc., GeneDx, Root and Sezzle have leveraged growth potential in biotechnology and the financial sector to deliver impressive returns.

- While these stocks have performed well, their elevated valuations suggest investors should stay vigilant. Returns may hinge on their ability to meet or exceed earnings expectations.

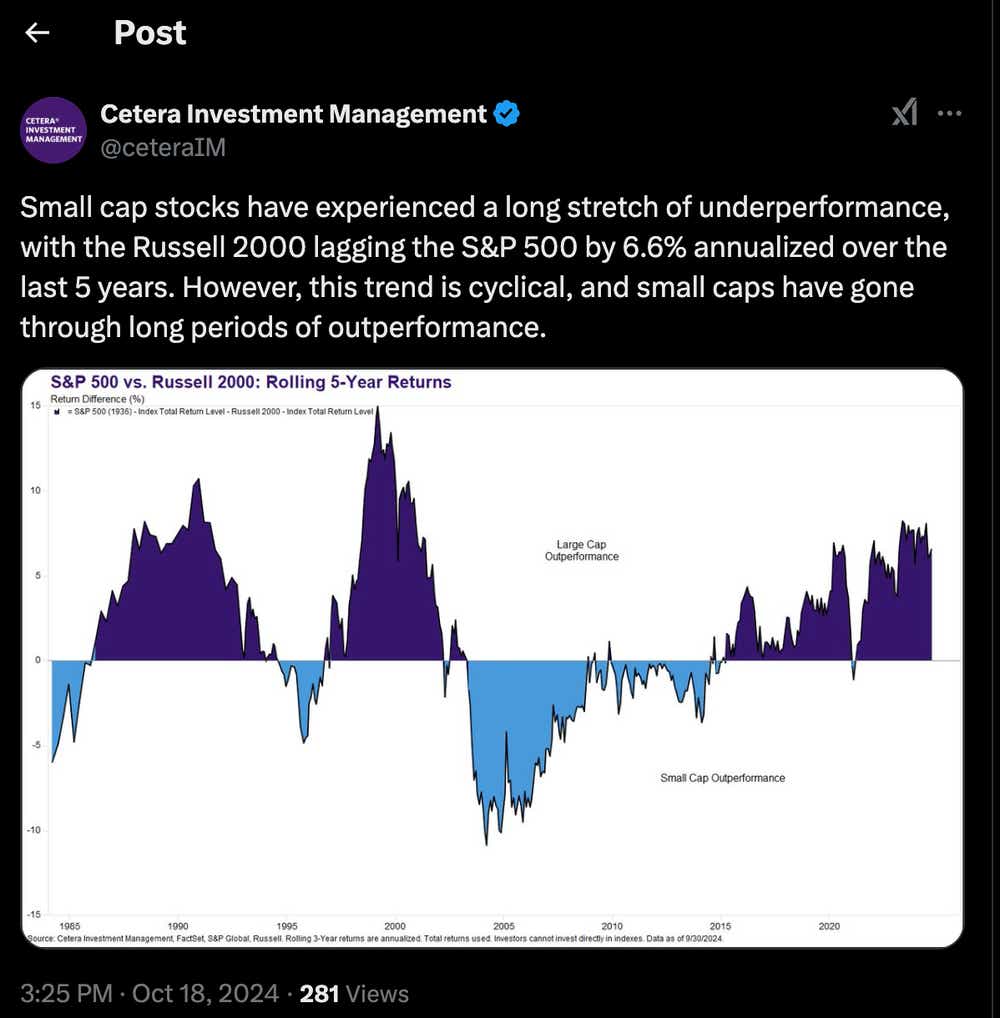

During the last 52 weeks, the Russell 2000 has underperformed both the S&P 500 and Nasdaq Composite, rising 14% compared to 22% and 24% for the latter two indices. However, beneath this broader underperformance, some compelling stories are emerging from the small-cap universe. Today, we’re focusing on several standout performers from the Russell 2000 over the last year—stocks that have achieved impressive gains, fueled by innovation, market shifts and investor sentiment.

Let’s dive into five companies making waves in the Russell 2000: Dave Inc. (DAVE), GeneDx Holdings (WGS), Root (ROOT), Sezzle (SEZL) and SoundHound AI (SOUN).

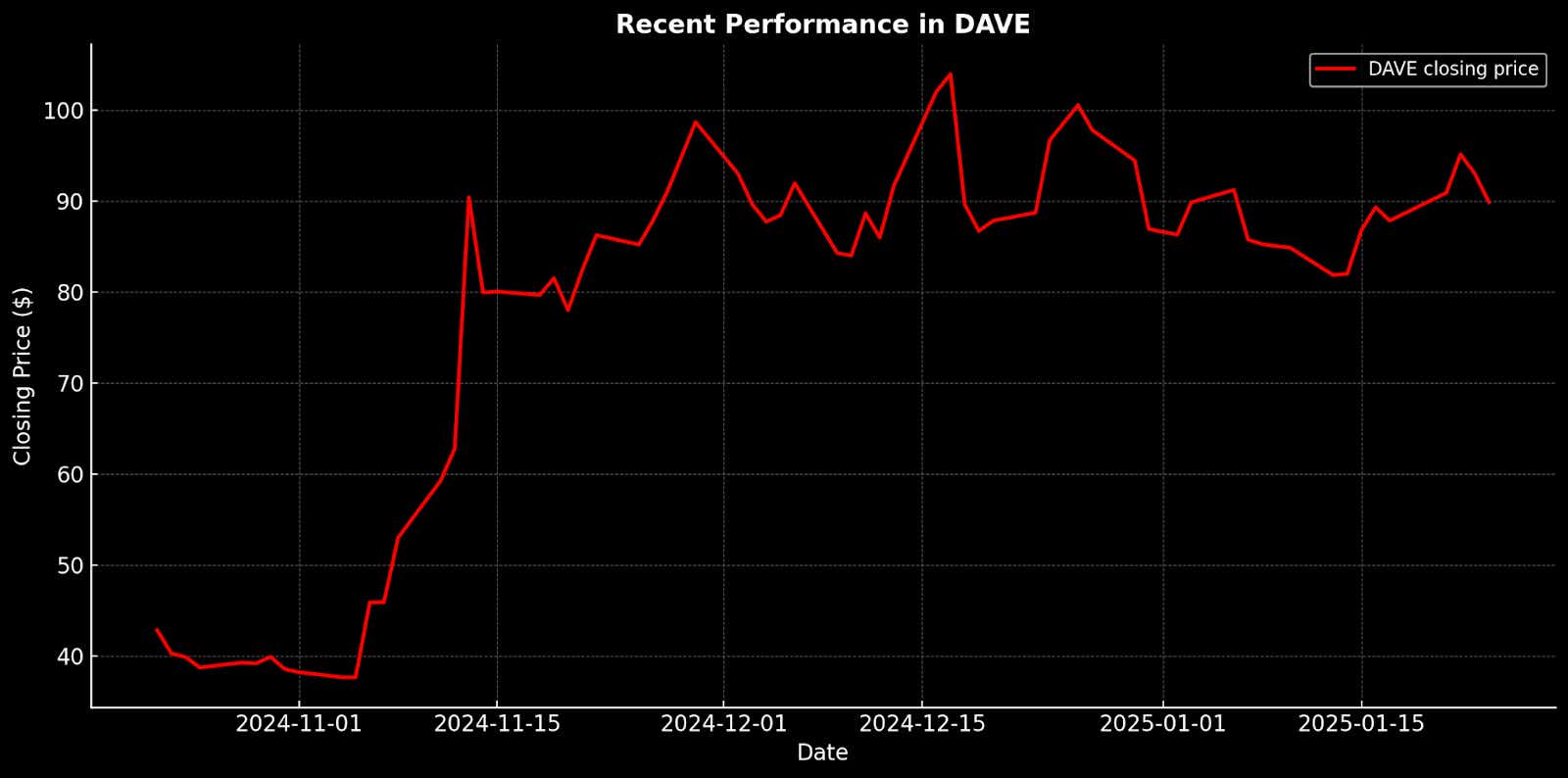

Dave Inc.

Dave Inc. has seen remarkable growth in the last year, rallying by approximately 400%. As a neobank targeting underbanked Americans, Dave has established itself as a strong player in the fintech sector. The company reported notable third-quarter 2024 results, with revenue increasing 41% year-over-year to $92.5 million, driven by strong customer acquisition and improving credit performance. Dave's net income also turned positive at half a million dollars, and adjusted EBITDA surged 63% quarter-over-quarter. Overall, Q3 earnings showcased the company's ability to grow revenue and profitability, while effectively managing customer acquisition costs.

Currently trading at around $88 per share, Dave's valuation stands at a market cap of $1 billion, with a price/earnings (P/E) ratio of 30, which is higher than the sector median of 13. However, its price-to-sales (P/S) ratio of 3.5 is much more palatable, just above the sector median of 3.0. With analysts rating the stock a buy across the board, and an average price target of $110 per share, the outlook for Dave appears very positive. The company also raised its full-year guidance, projecting revenue growth of 31%-32% year-over-year and Adjusted EBITDA growth of 81%-84%, reflecting continued optimism.

So, Dave looks attractive at its current valuation, but investors should consider risks that could arise if the economy shifts. Focusing on lower-income Americans, Dave's business suffer in a downturn, especially if rising unemployment or economic pressures lead to higher delinquency rates. Should the economy contract, this might be a position to trim, as increased financial strain on its user base could negatively affect credit performance and growth. As long as the economy remains stable, however, Dave looks well-positioned for continued growth, particularly with its expanding user base and strategic bank partnerships.

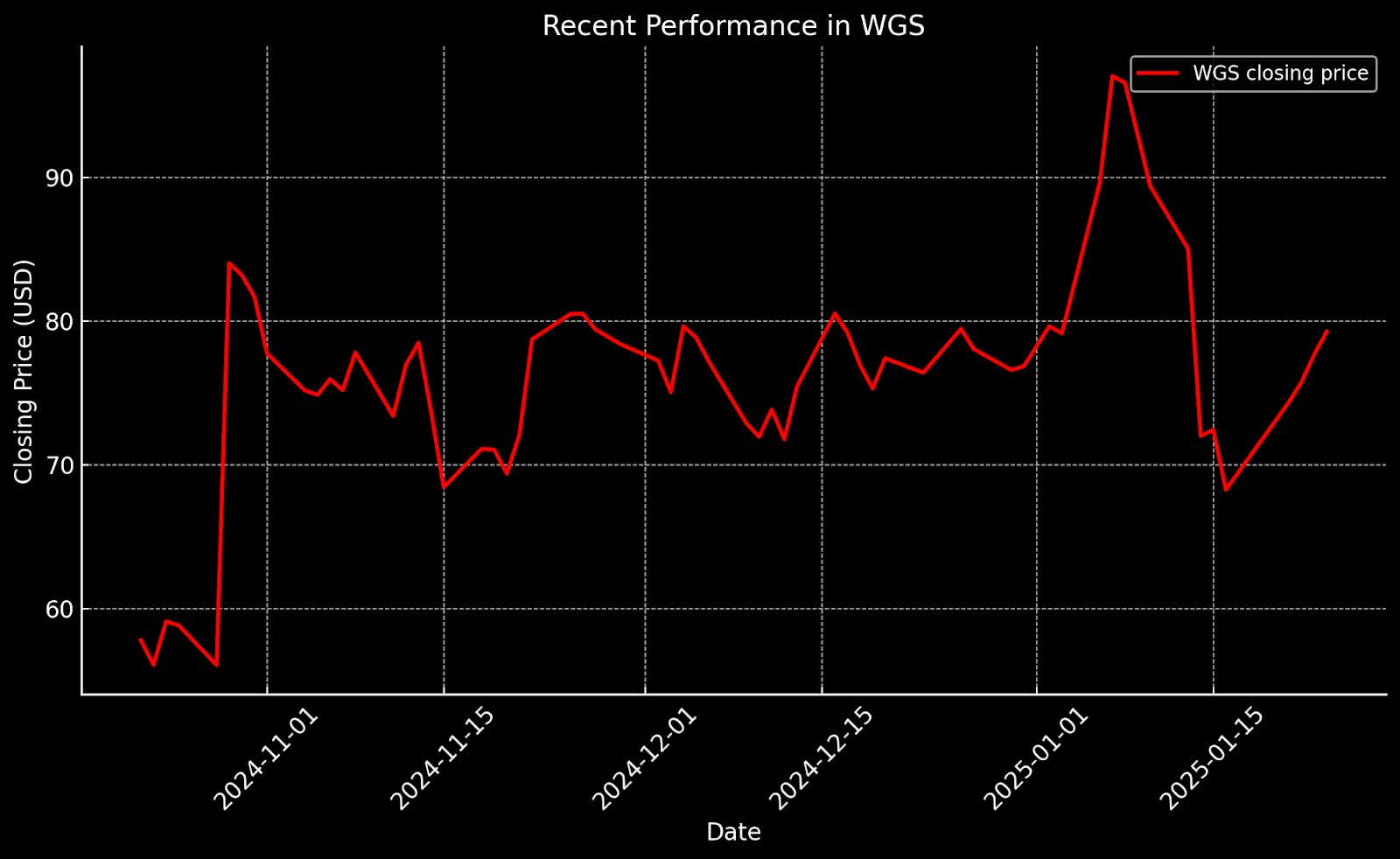

GeneDx Holdings

GeneDx Holdings, a leader in genomic diagnostics, has seen a remarkable turnaround in 2024, with its stock surging around 1,700%. Trading at approximately $75 per share with a market capitalization of $2 billion, the company has reached a notable milestone: profitability. GeneDx specializes in genomic sequencing, focusing on exome and genome testing to help diagnose genetic diseases, particularly in pediatric and rare disease populations. Their technology can detect genetic conditions that might otherwise go undiagnosed, offering earlier interventions and better health outcomes.

In Q3 2024, GeneDx reported a 52% year-over-year revenue increase to $76.6 million, driven by a 77% rise in exome and genome revenue. This performance marked the company’s first-ever positive adjusted net income ($1.2 million). The company's market leadership stems from its proprietary genomic testing, particularly its whole exome sequencing (WES) and whole genome sequencing (WGS) services, which have increasingly become recognized as essential for diagnosing complex genetic conditions, especially in children with neurological disorders.

Despite these impressive financials, the stock's valuation is a critical consideration. With a price-to-sales ratio of 8 and a price-to-book ratio of around 10.5, both significantly above sector medians, there is concern that much of the company’s growth is already priced in. The increased market enthusiasm is understandable given the company’s strong performance and the substantial potential in the genomic testing sector, especially in pediatric neurology and neonatal intensive care unit markets. Additionally, favorable regulatory tailwinds, such as Medicaid’s increasing coverage of genomic testing, are positioning GeneDx well for further expansion.

However, the company’s challenges remain. GeneDx still faces hurdles in penetrating the pediatric neurologist market, where only 12% of potential customers have been reached, and the slower adoption of genomic newborn screening presents a multi-year growth effort. The company also depends on reimbursement from third-party payers, and competition in the genomic diagnostics industry is intensifying, especially from more-established players.

The stock’s high valuation, combined with these ongoing challenges, suggests that while GeneDx’s long-term growth potential is strong, the current price may not leave much room for further upside unless the company continues to exceed expectations. Analysts remain cautious, with a consensus price target of $88 per share, implying limited upside from current levels. Given the valuation risk, we recommend a “hold” on GeneDx, keeping an eye on near-term dips for more attractive entry points.

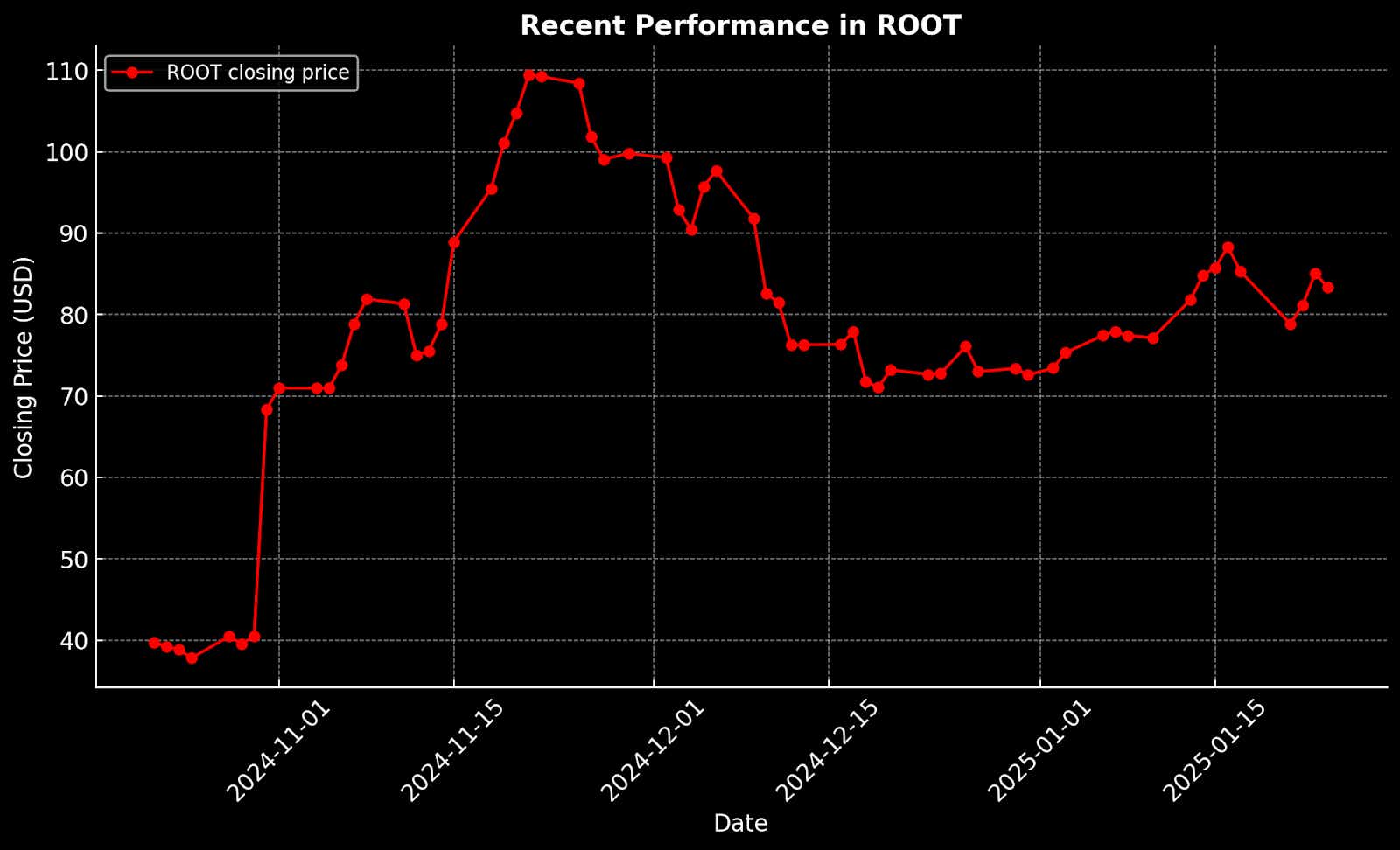

Root

Leveraging telematics, Root has emerged as an upstart player in the insurance sector. Specifically, Root uses the specific driving data of an individual to offer more precise pricing of auto insurance. The company’s stock has experienced an incredible 835% increase over the last year, trading at around $80 per share with a market capitalization of $1.2 billion.

Root's recent Q3 earnings report marked its first-ever profitable quarter. The company achieved a net income of $23 million, representing a $69 million improvement year-over-year. This profitability, alongside a 48% year-over-year increase in gross written premiums, signaled the effectiveness of its turnaround strategy. The company has also reduced its loss ratio to an impressive 57% through its strong underwriting and data science capabilities.

However, the stock's valuation has raised some concerns. Root’s price/book (P/B) ratio stands at 7, considerably higher than the sector median of 1, suggesting the stock may already be pricing in much of the recent growth. While the company’s first profitable quarter is promising, analysts remain cautious, with four of the six covering the stock rating it a hold and an average price target of $76, below its current trading price.

Despite these concerns, Root’s ongoing initiatives—including expanding its geographic footprint and scaling its partnership channel—may offer attractive potential in the insurtech sector. If the company continues to meet or exceed earnings expectations, the stock could be poised for further gains. However, given its elevated P/B ratio and the volatility inherent in its business model, investors should approach ROOT with caution, especially in an economic downturn.

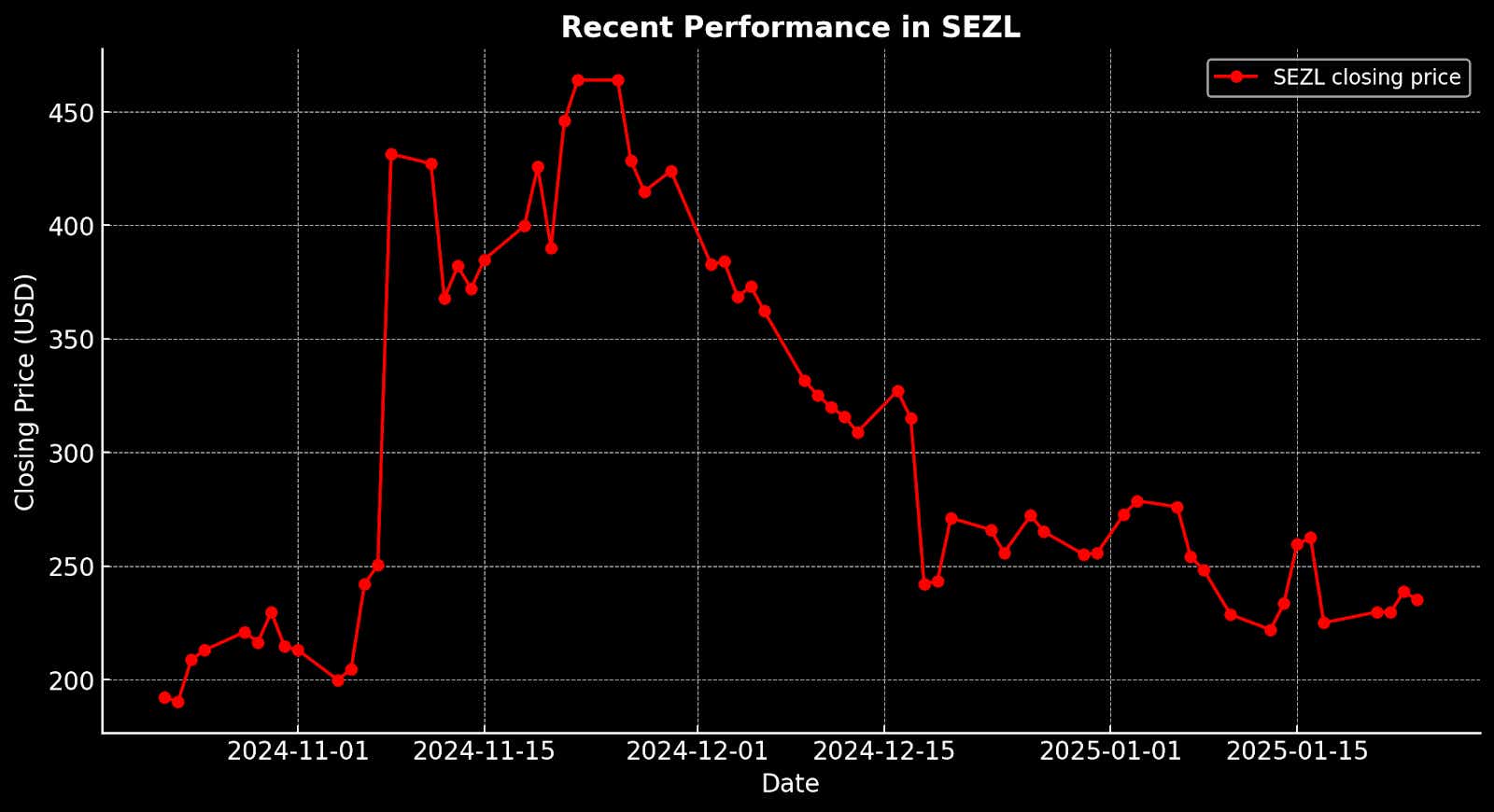

Sezzle

Sezzle has been another outperformer over the last 52 weeks, with shares surging more than 450%. As a leader in the buy now, pay later (BNPL) industry, Sezzle provides consumers a flexible option to split their purchases into four equal installments, giving shoppers an alternative to credit cards and offering greater financial flexibility. Sezzle’s most recent earnings report highlighted robust growth, with a 71% year-over-year increase in revenue, reaching $70 million—exceeding analyst expectations. This growth was driven by a surge in merchant sales and greater consumer engagement, contributing to a net income of $15.4 million, a marked improvement over previous quarters.

Besides this strong performance, Sezzle provided an encouraging update for its 2024 full-year earnings guidance, signaling the company is positioned for continued growth. The company expects to exceed its previous revenue and income forecasts, with total revenue now projected to rise more than 55% over 2023 figures, reaching roughly $247 million. Adjusted earnings per share are also expected to surpass the $9.80 target, reflecting solid profitability. As Sezzle’s CEO, Charlie Youakim, stated, “exceptional holiday demand and the effective execution of our strategic initiatives fueled our fourth-quarter outperformance, and gives us confidence that we will exceed our prior 2024 guidance.” This positive outlook illustrates the company’s ability to continue capitalizing on momentum and the growing BNPL market.

The stock, which is trading around $225 per share, remains well off its 52-week high of $477. Given this pullback, investors may find an attractive entry point at this level. While Sezzle’s P/E ratio stands at 25—above the sector median of 13.5—this is not excessively high when weighed against the company’s strong earnings growth and promising outlook. Analysts are confident in Sezzle’s future, with a consensus price target of $366 per share, indicating room for further upside if the company can maintain an aggressive trajectory.

With Sezzle posting strong earnings in 2024 and a positive outlook for 2025, the stock is well-positioned for continued growth, making it an appealing option for investors looking to capitalize on the expanding Buy Now, Pay Later (BNPL) market. However, one key factor to consider is the momentum. Despite impressive gains, Sezzle’s shares have been trending downward since their peak in late November. For some investors, this pullback may present a buying opportunity, while others may prefer to wait for signs of a bullish reversal before jumping in.

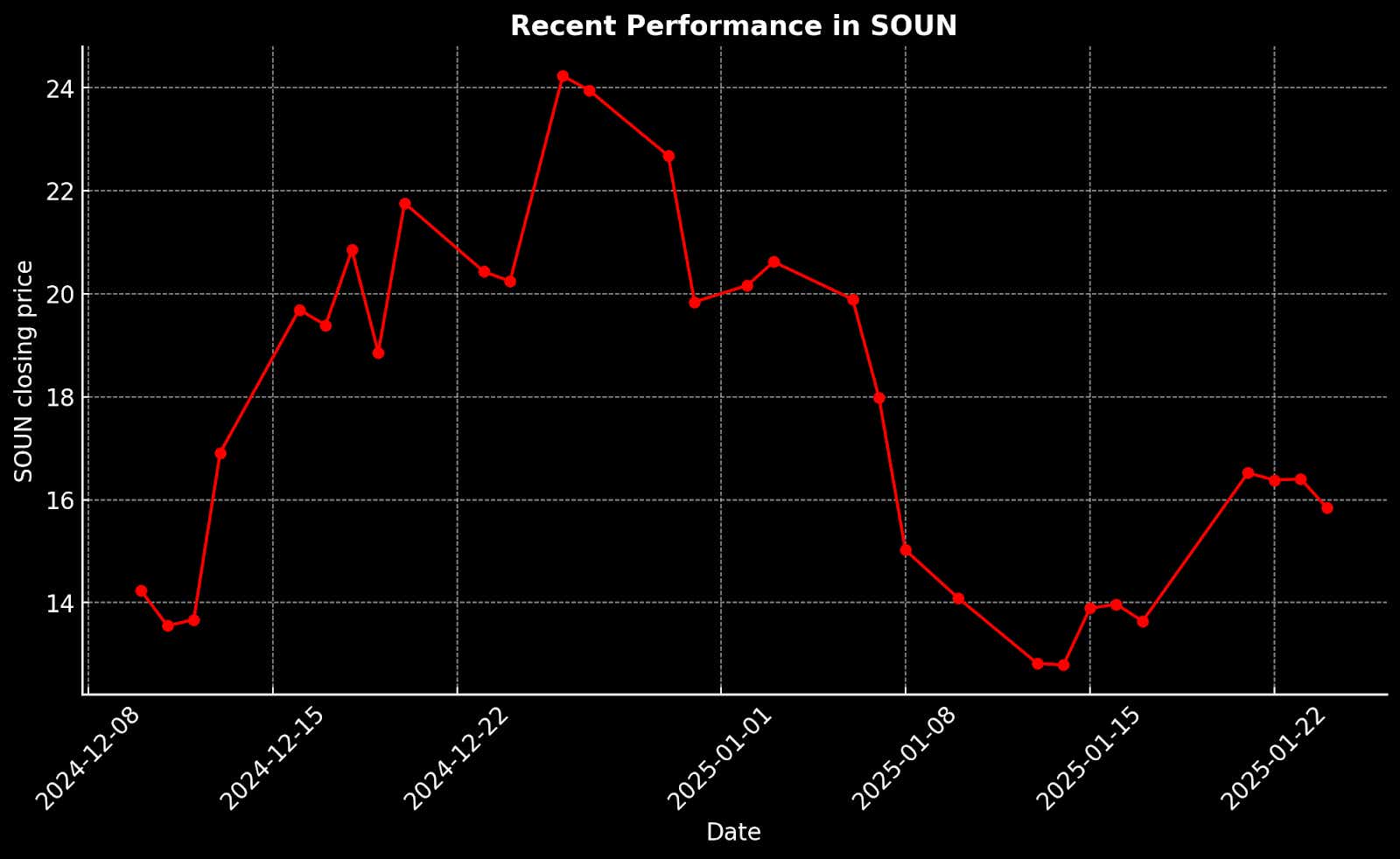

SoundHound AI

SoundHound AI is another Russell 2000 stock that has screamed higher in the last year, climbing by more than 640%. As a leader in conversational AI, SoundHound powers innovative voice recognition software across multiple industries, including automotive, finance and hospitality. In Q3, the company reported 89% year-over-year revenue growth, reaching $25 million. This performance was driven by an expanding customer base and increased diversification in its revenue mix, with contributions from key sectors like automotive and restaurants. Despite this strong growth, SoundHound is still a long way from turning a profit, reporting a net loss of $21.8 million for the quarter.

While the company's top-line growth is promising, its valuation has raised concern. Before the DeepSeek-induced sell-off on Wall Street, shares of SoundHound were trading about $16 per share with an associated market capitalization of roughly $6 billion. That put SoundHound’s price-to-sales (P/S) ratio at a staggering 75, compared to the sector median of around 3.5. The company's P/S ratio highlights a surprising premium, particularly with the company’s revenue still below $100 million annually and continuing quarterly losses.

On the bright side, SoundHound's potential for growth remains attractive, particularly as it strengthens partnerships with major companies like Nvidia (NVDA). The latter helps Soundhound bring voice generative AI to edge devices without cloud connectivity. And SoundHound’s recent acquisition of Amelia, a leader in enterprise conversational AI, has broadened its reach into new verticals, such as healthcare and finance.

Despite its growth potential, SoundHound faces ongoing challenges, such as high cash burn and low gross margins. Analysts are divided on the stock, with a consensus price target of around $15 per share. Following the recent tech-focused sell-off, shares are now trading closer to $14. Given the volatility in this sector, a further pullback could create an attractive opportunity for investors. For example, if SoundHound’s shares dip below $10, the investment case would become more compelling, potentially re-rating the stock to "buy."

Takeaways

While the Russell 2000 has lagged behind the S&P 500 and Nasdaq Composite over the past year, this broad underperformance doesn't apply to every stock. As evidenced by the above data, many small-cap stocks have been outperforming, with several delivering remarkable gains. Companies like Dave, GeneDx Holdings, Root, Sezzle and SoundHound AI have proven growth can still occur in the Russell 2000, even amid broader struggles in the small-cap universe. These outperformers have benefited from innovation, shifting market dynamics and evolving investor sentiment, resulting in some eye-popping gains.

Looking ahead, readers should not only keep an eye on the stocks highlighted in this article but also watch for new small-cap opportunities that may break out. While small-cap stocks carry inherent risks, they can also offer high growth potential, which makes this niche one to monitor continuously for emerging opportunities. As observed last year, promising narratives—whether in finance, tech or biotechnology—can quickly translate into higher valuations once the market recognizes that potential.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.