Roblox Q3 Earnings Preview: Can it Beat Expectations?

Roblox Q3 Earnings Preview: Can it Beat Expectations?

By:Mike Butler

Roblox ($RBLX) reports their quarterly earnings on November 9th, before the market opens. The stock has had a hard time maintaining positive traction this year, as it’s down over 60% from the annual high of $103.79 that was recorded on the first trading day of the year on January 3rd.

Roblox stock: can it beat expectations?

The stock has missed three of the last four EPS reports, although revenue is expected to increase from last quarter. The stock is currently trading at around $39, and the earnings report has massive implications on the stock price for the rest of the year:

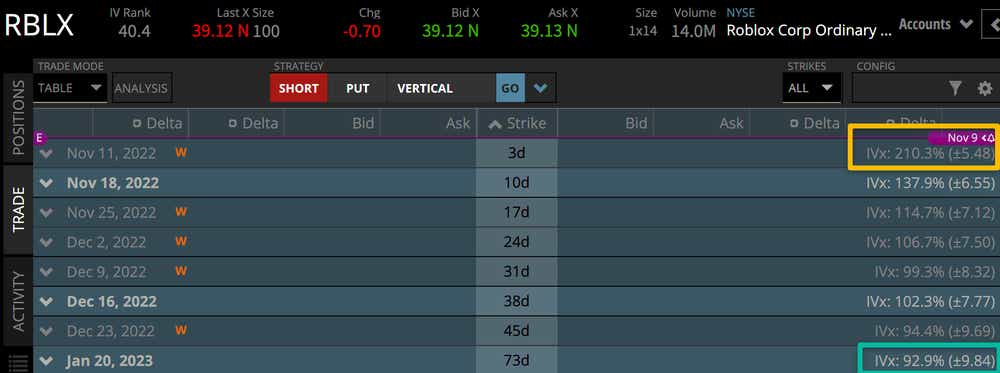

The expected move based on is +- 5.48 through the rest of the week – this is well over 10% of the notional value of the stock price, indicating that the market is projecting some real movement from the current stock price after earnings are announced.

One way to determine just how much weight the market is placing on this earnings announcement is to check out the further-dated expiration cycles’ expected moves. The 73 day cycle in January shows us an expected move of +- $9.84, which means the earnings cycle for the next three days accounts for over 50% of the expected move projected in January – when the ratio from front to back month expected move is high like we see here, more weight is placed on the earnings announcement than if we saw a much lower number in the 3 day cycle, or a much higher number in the January cycle.

By the time the stock market opens on November 9th, the numbers will be released and the stock will react – let's see what tomorrow brings!

Tune in to Options Trading Concepts Live for a full earnings review for $RBLX, only on tastylive.com

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.