Recession Risk, U.S. Labor Data, CPI Release, Canadian Interest Rates and China Trade

Recession Risk, U.S. Labor Data, CPI Release, Canadian Interest Rates and China Trade

By:Ilya Spivak

Macro events that may move the markets this week

- After U.S. jobs data, markets hint recession fears may be taking center stage.

- U.S. CPI figures might spook traders, but UofM uptick could calm nerves.

- BOC rate decision eyed for Fed implications, while China’s trade woes continue.

Last week’s price action seemed to offer the markets an important insight, complicated though it was by thin liquidity around the Fourth of July holiday. June’s U.S. employment report promised traders a much-needed clue about how to interpret economic data after almost a month of hawkish posturing from the Federal Reserve.

It did not disappoint.

The economy added 209,000 jobs last month, undershooting estimates of a 230,000 increase. The preceding two months’ figures were also revised down by a cumulative 110,000. Wage growth printed at 4.4% year-on-year, higher than the expected 4.2%. May’s reading was revised higher to match after having been reported at 4.3% initially.

The bond market offered a nuanced view of the markets’ interpretation. The front and long ends of the yield curve were relatively little-changed, suggesting traders’ immediate and longer-term Fed policy views were not significantly altered. However, the belly of the curve—approximated by the 5- to 2-year yield spread—saw outsized steepening.

This seemed to imply some monetary stimulus on the sooner side of the “medium term,” ostensibly in response to a downturn that could amount to an official “recession.”

Regime change for global markets?

The bellwether S&P 500 stock index attempted to rally around the idea that softer hiring might be a “good” thing in that it might restrain the Fed, but the move failed intraday and Wall Street ended the day with a loss. The anti-risk Japanese Yen tellingly rallied, and gold popped to the top of its recent range. Growth concerns thus appeared to prevail.

Over-extrapolating one data release and the price action it inspired would be a mistake. Nevertheless, the evidence on offer so far seems to suggest that—in their current configuration—financial markets see “bad” economic data as … “bad.” If this continues, it will amount to a major regime change relative to trade patterns prevailing since mid-2021.

The coming week is loaded with opportunities to test whether the markets’ primary impetus has truly shifted from narrow bet-making on the Fed’s next move to positioning in earnest for those actions’ accumulating impact:

CPI report

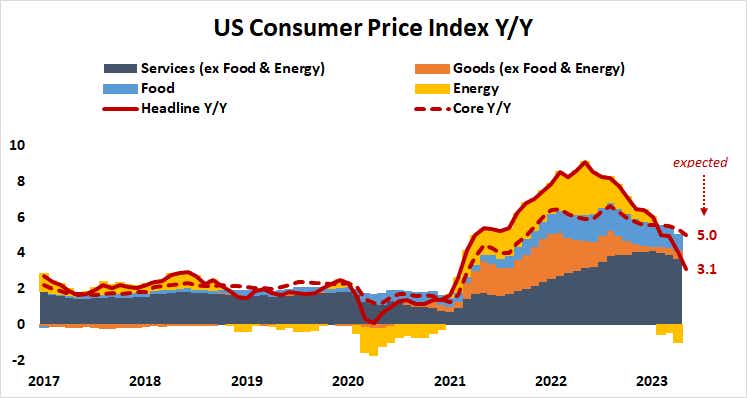

The U.S. consumer price index (CPI) measure of inflation is expected to show the headline rate decline from 4% year-on-year in May to 3.1% in June. The core reading excluding food and energy—a focal point for the Fed considering policymakers’ acute focus on the service sector—is projected to be lowest since November 2021 at 5%.

Soft numbers may stoke economic slowdown fears and hurt cycle-sensitive assets, including equities.

Canadian interest rate decision

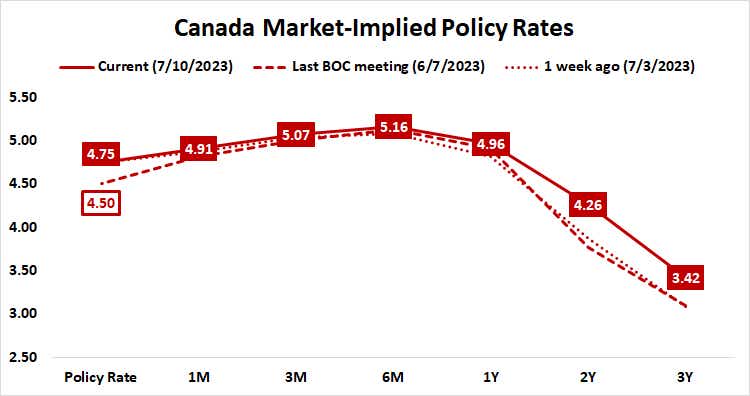

The Bank of Canada (BOC)is expected to raise its target interest rate by 25 basis points (bps) from 4.75% to 5%. Markets price in the probability of the move at 67%. It is fully baked in by September’s policy meeting, with no further hikes on the menu this year.

The markets seemed to interpret June’s unexpected BOC rate hike as telegraphing of a hawkish Fed, given the Canadian economy’s outsized sensitivity to the U.S. business cycle. Any fireworks generated this time around might have similarly extended reach beyond local assets.

China trade statistics

June’s Chinese trade figures are expected to present another sobering picture of the struggle to regain momentum in the world’s second-largest economy. Exports are seen falling 10% while imports decline 4.1%, pointing to continued trouble with demand at home and abroad.

Data from Citigroup suggests Chinese economic data has increasingly underperformed relative to baseline forecasts since mid-April. This suggests that analysts’ models are rosier than realized outcomes have endorsed, opening the door for continued disappointment.

Unexpectedly downbeat results may stoke global recession fears and punish growth-sensitive assets, like stocks and the Australian dollar.

U.S. consumer confidence

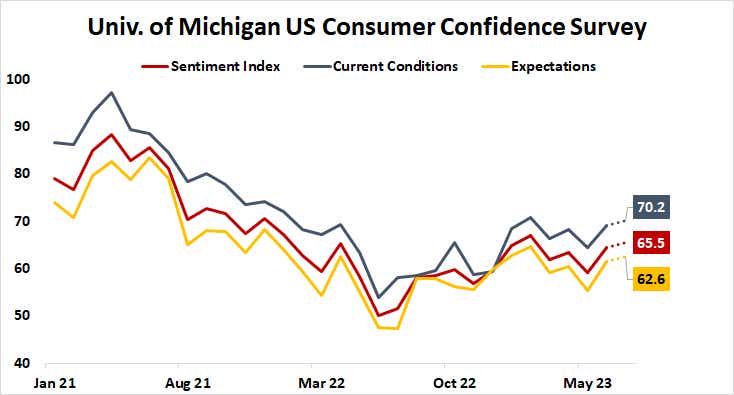

The University of Michigan will publish the July edition of its monthly survey of U.S. consumer confidence, with expectations pointing to a slight increase of 64.4 to 65.5 on the headline sentiment gauge. That would point to the most optimistic disposition in five months, implying worries about the Silicon Valley Bank-led banking crisis as well as the U.S. debt ceiling debacle have dissipated.

Household consumption is the dominant driver of U.S. economic growth by a hefty margin, so data pointing to an improving outlook may help counter growth concerns and underpin cycle-driven assets.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.