Qualcomm Earnings Preview—6% Stock Price Move Expected

_down.png?format=pjpg&quality=50&width=387&disable=upscale&auto=webp)

Qualcomm Earnings Preview—6% Stock Price Move Expected

By:Mike Butler

Continued strength ahead for the semiconductor and software company?

Qualcomm will report quarterly earnings on July 31 after the stock market closes.

Qualcomm is expected to report earnings per share (EPS) of $2.26 on $9.22 billion in revenue.

Both figures are lower than the previous earnings report.

Insight on AI initiatives will be a focal point for this earnings call.

Qualcomm earnings preview

Qualcomm (QCOM) is set to report earnings on July 31, after the stock market closes. The semiconductor and software company is expected to announce an EPS of $2.26 on $9.22 billion in revenue. Qualcomm has had a great track record for earnings recently, beating EPS and revenue estimates three quarters in a row.

QCOM stock opened the year at $142.19 and has had a strong first half, rallying to a high of $230.63 in June. But like the rest of the tech sector, it has experienced a selloff recently and currently sits at $179, still up 26% on the year.

For this quarter, both EPS and revenue figures have been reduced. Cristiano Amon, Qualcomm president and CEO, expressed positive sentiment during the last earnings call: ”We are excited about our continued growth and diversification, including achieving our third consecutive quarter of record QCT Automotive revenues, upcoming launches with our Snapdragon X platforms and enabling leading on-device AI capabilities across multiple product categories."

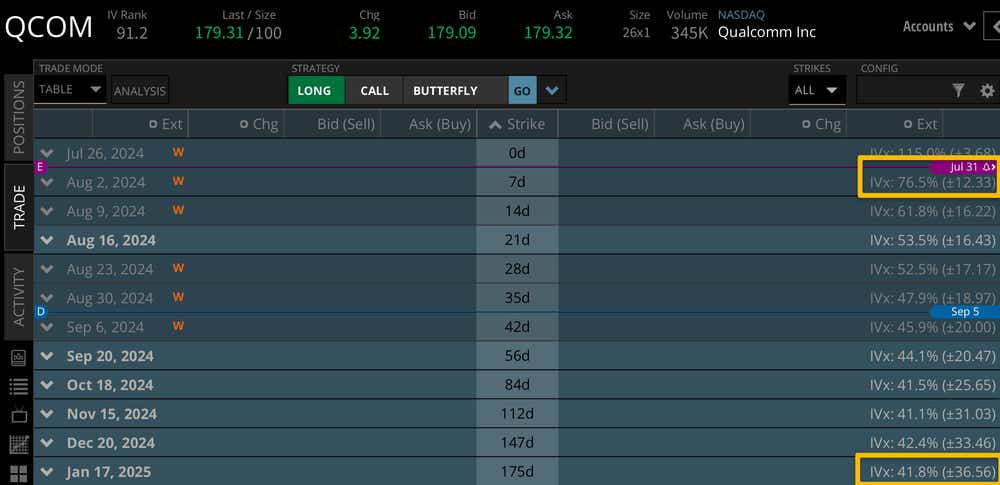

We look to the options market for context around the expectations for earnings. We can look at implied volatility to determine the expected stock price move for this earnings announcement. For Qualcomm, we're looking at an expected move of +/- $12.33 for next week. This is just over 6% of the stock price, which puts it on the lower end of the expected move range for other tech stocks in the sector. There is always the chance the stock can have a big move after earnings, but the market is not expecting anything crazy as of now.

Bullish on QCOM stock for earnings

Qualcomm bulls want to see the reduced EPS and revenue estimates blown out of the water. I have a hard time believing sentiment will be negative given the AI and tech boom we've realized recently, but anything can happen. If QCOM can continue posting strong earnings numbers, we could see the stock rise after earnings.

Bearish on QCOM stock for earnings

We've seen some tech stocks report earnings already, and while results have been pretty good, stock prices have sold off. If QCOM stock sells off after earnings, even if they post a strong number, the market may have been expecting an even stronger earnings result. If Qualcomm misses on any part of its earnings call, we could see the stock price fall, which is what bearish earnings traders are banking on.

Tune in for a full earnings preview on Options Trading Concepts Live at 11 a.m. CDT on July 31 ahead of Qualcomm's report!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.