Skew Creates Opportunities in Tesla and Delta Airlines

Skew Creates Opportunities in Tesla and Delta Airlines

Anxiety has created elevated put premiums, and these two stocks offer opportunities

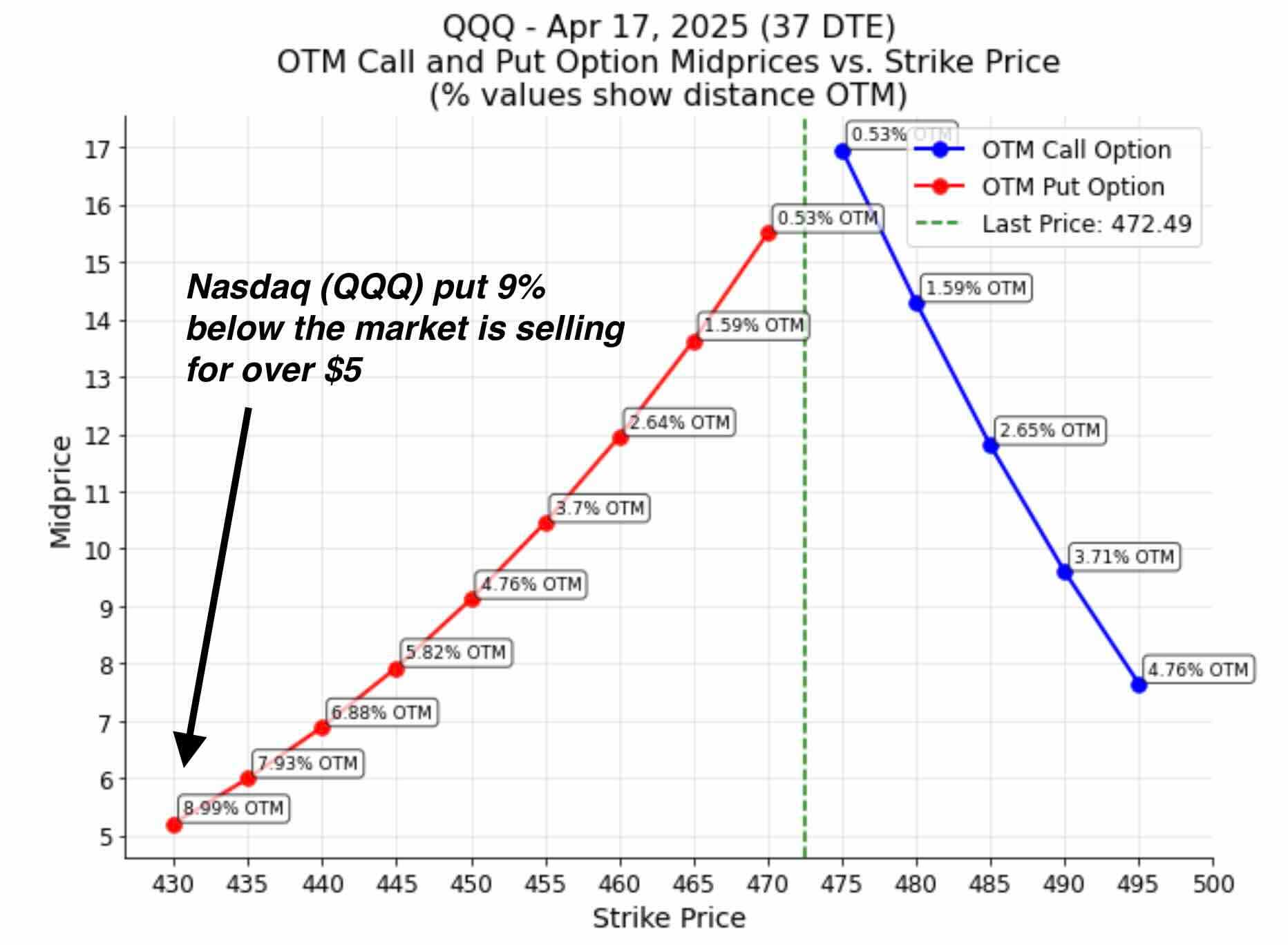

We're seeing put skew develop, and this is where downside protection commands significant premiums. This anxiety has created an opportunity: Selling puts 9% below current market levels offers unusually generous compensation for those willing to take on calculated risk.

For investors who believe the market may be oversold or who would welcome the chance to acquire shares at a substantial "discount," this elevated put skew presents a compelling risk/reward proposition. If the market recovers, you pocket the premium; if it continues lower, you'll acquire positions at prices you've determined represent good value.

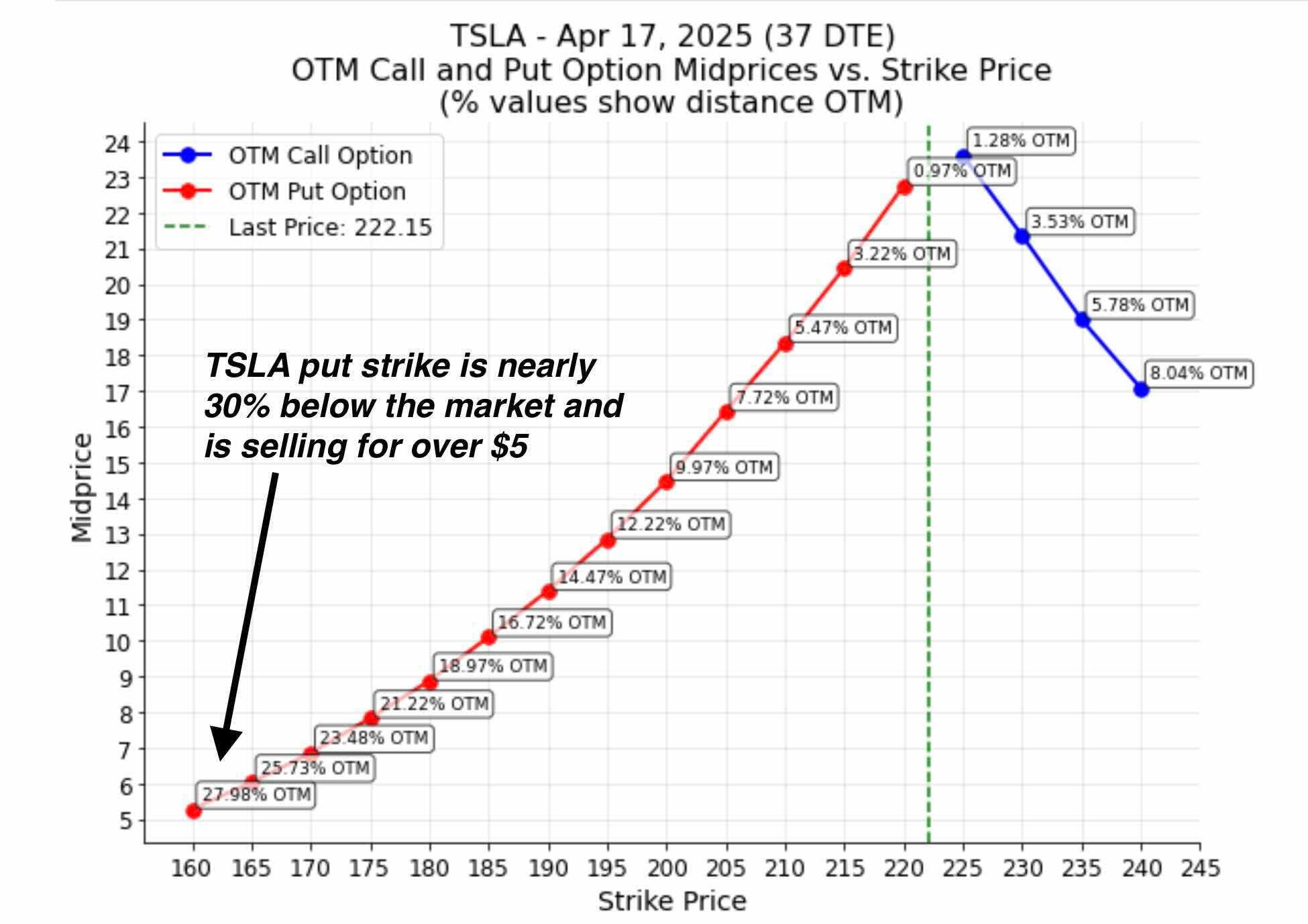

Tesla (TSLA) puts that are 30% below the current market price are trading at almost the same price as QQQ puts that are just 10% below the market. Only a couple of weeks ago, these same TSLA options would have been priced at a small fraction of their current value.

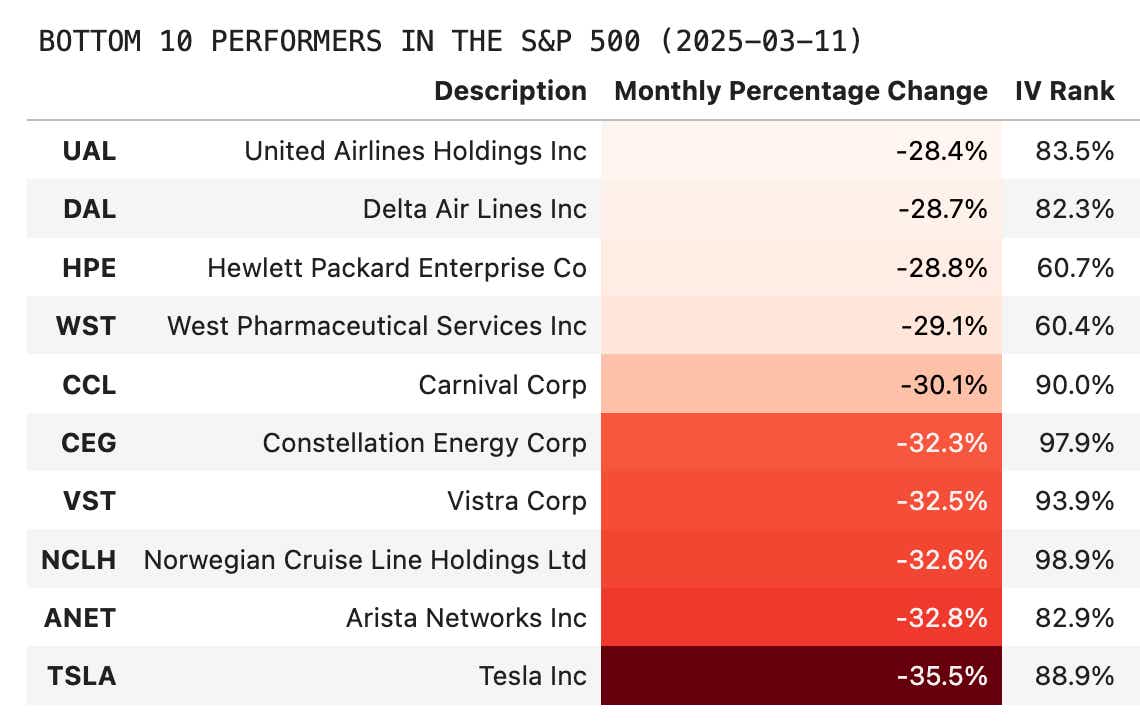

Besides TSLA, What is Getting Hit?

Below, we examine the 10 worst-performing stocks in the S&P 500 during the past month. That list is below. Nearly 60% of the stocks in the S&P 500 are down.

Count of stocks up: 203 (40.52%)

Count of stocks down: 297 (59.28%)

Two Trade Ideas

TSLA ($228) Short Put Spread (APR) $2.63 Credit

Tesla is back to early 2024 lows, down more than 50% from its highs. Premium skew is still to the upside, but the puts have been bid as well with the huge move lower. If you think maybe the worst is behind us, selling an out-of-the-money (OTM) put spread of the 200/190 provides around a 15% downside buffer and trades at almost 1/3 the width of the strikes in premium.

DAL ($47) Naked Put (APR) $2.53 Credit

Airlines stocks have been some of the hardest hit stocks in the recent market bludgeoning. Delta Air Lines (DAL) is down more than 30% in the last month with an implied volatility rank (IVR) at 82. If you think the worst might be behind us, selling the 45 strike put for $2.53 uses only around $700 in BP for a high potential ROC.

Subscribe to Cherry Picks. We are okay with grifters, but to be on our good side subscribe to our newsletter. Please share with your friends - and if you don't have friends - our condolences.

We love new subscribers! We’re OK with grifters, but to be on our good side by subscribing to our newsletter.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s known best for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker. Open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.