Probability of Touch (POT) in Options Trading: Puts and Calls

Probability of Touch (POT) in Options Trading: Puts and Calls

By:Kai Zeng

Our analysis of several puts reveals the actual POT amounted to only half the theoretical POT

- Puts have a lower actual probability of touch(POT) compared to calls.

- The actual POT on the put side is roughly half of the theoretical POT, whereas the actual POT on the call side aligns with the theoretical number.

- The win rate after positions are tested is higher on the put side than on the call side.

Probability of touch (POT), a key concept for premium sellers, indicates the likelihood an option will reach its strike price before expiration, helping investors choose appropriate strikes.

This measure is particularly useful for premium sellers who focus on price movements. Typically, the POT has about twice the probability of the option finishing in-the-money. For instance, if there's a 20% chance of an option ending in-the-money, the POT should be roughly 40%.

We know the Probability of profit (POP) often overstates the realized success rate. This raises the question: Is the theoretical POT similarly overestimated?

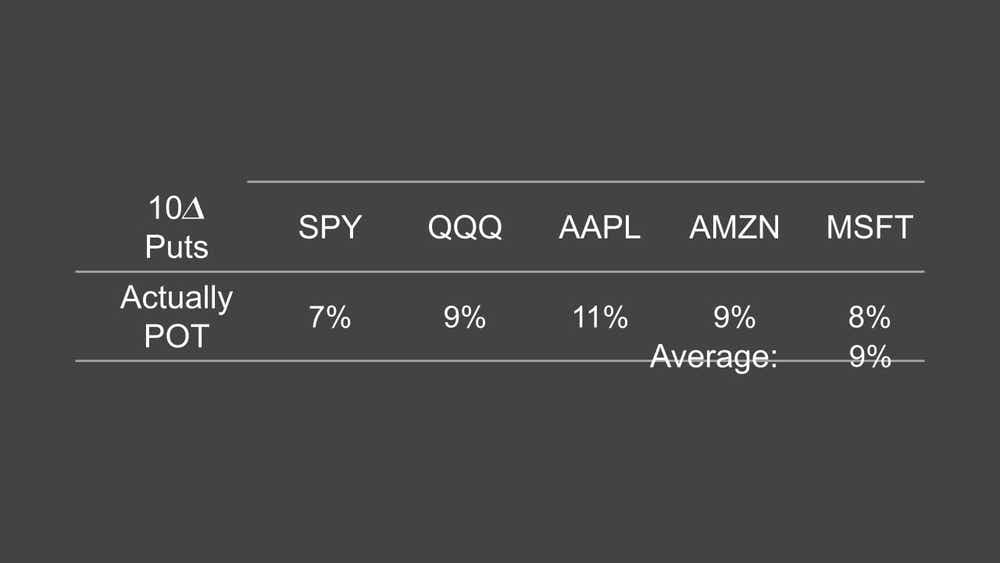

To explore this, we analyzed 45 days to expiration (DTE) 10 Delta (𝜟) Puts and 10𝜟 Calls from several popular underlyings: SPDR S&P 500 ETF Trust (SPY), Invesco QQQ Trust, Series 1 (QQQ), Apple (AAPL), Amazon (AMZN) and Microsoft (MSFT). All positions were held until expiration, and the theoretical POT for these 10𝜟 options should be around 20%.

Our analysis revealed the actual POT for these puts is significantly lower than expected, amounting to only half of the theoretical POT.

Conversely, the actual POT on the call side with the same delta was much higher—about double what we observed on the put side. This discrepancy is largely because of the strong bull market in recent years, which has made calls more likely to be breached than puts. However, the average actual POT on the call side remains consistent with the theoretical number.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

We also examined the win rate of these positions after the strikes were touched. On the put side, the variation in win rates is slightly higher than on the call side. Interestingly, win rates on the put side are significantly higher—by 21%—compared to the call side. This is attributed to the strong market and quick rebounds from market bottoms, which favor put options.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.