Probability of Stock Price Reversions

Probability of Stock Price Reversions

By:Kai Zeng

The chance of a stock returning to its original price diminishes over time

- On average, SPY prices returned to their initial value twice within a 45-day period.

- Managing positions at 21 DTE offers a much greater chance of the stock price returning to its initial point compared to holding until expiration.

- Exiting a position before expiration increases the probability of the stock price remaining within a narrow range.

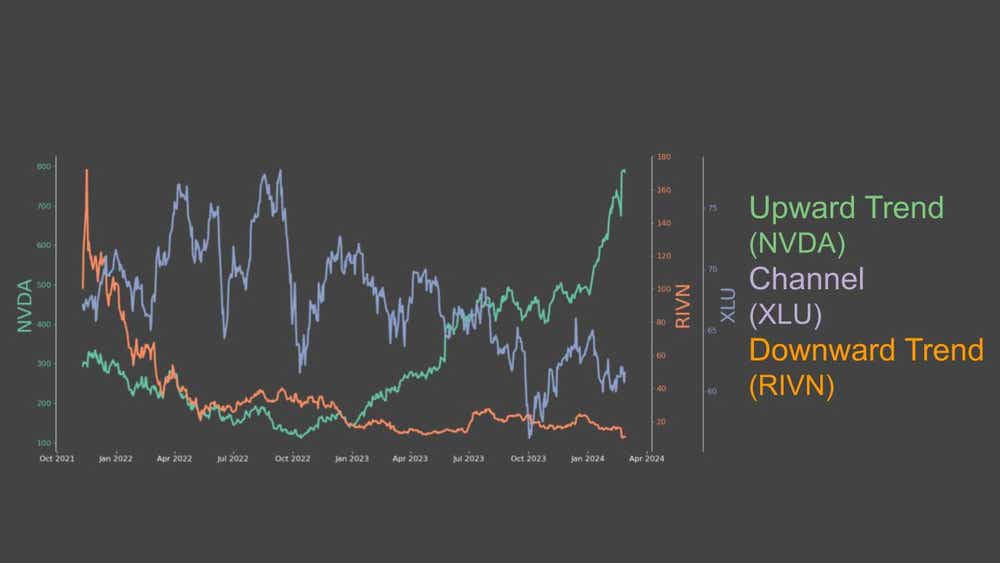

Predicting stock price movements within a specific period can be incredibly challenging because prices often exhibit random fluctuations.

Despite recent upward trends in the market, traders should always consider the possibility of price corrections and increased volatility.

For those who prefer a neutral trading strategy and aren't focused on predicting a particular direction, understanding the probability of a stock reverting to its original price or staying within a tight range is crucial.

SPY price reversion over 45 days

We analyzed the S&P 500 ETF (SPY) to determine the likelihood of price reversion within each 45-day trading cycle. The study focused on the probability of SPY returning to its initial price daily. Unsurprisingly, the probability of a stock reverting to its original price diminishes over time.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

On average, SPY prices returned to their initial value twice within a 45-day period. However, if traders manage their positions at 21 days to expiration (DTE), the probability of a price reversion doubles. This insight is particularly useful for those who seek to optimize their neutral trading strategies focused on price stability rather than directional movement.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Neutral traders often wonder about the likelihood of stock prices staying within a specific range instead of hitting the exact initial price point.

Historical data reveals interesting findings for a 45-day, one-standard-deviation (1SD) SPY strangle. The average call strike price is around 4% above the underlying price, while the put strike is about 12% below.

Closing positions at 20 DTE

To gain a deeper understanding, we analyzed the probability of SPY’s price remaining within tighter ranges—1%, 2% and 3% of the initial price—both at 21 days DTE and at expiration. The data show that closing positions at 21 DTE significantly increases the likelihood of the stock price staying within these narrow ranges, compared to holding positions until expiration.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Managing positions at 21 DTE offers a much greater chance—twice as much—of the stock price returning to its initial point, compared to holding until expiration. Additionally, exiting a position before expiration increases the probability of the stock price remaining within a narrow range. This is particularly beneficial for premium sellers who profit from limited price movement rather than volatility.

By understanding these probabilities and strategically managing positions, traders can enhance their returns while reducing risk, making neutral trading a more viable and rewarding strategy.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.